If you’ve been around mining long enough, you know how these things work: one company makes the big discovery, proves a new region works, then suddenly the whole district lights up.

A few years back, Sigma Lithium (SGML.V) did exactly that in Brazil’s Minas Gerais state. The market watched a tiny company with some sweaty jungle claims turn into a multi-billion-dollar lithium producer. That playbook is now set in stone.

Enter Lithium Ionic (TSXV: LTH). They’re running with the Sigma model; same state, same geology, same rock type, but with one key advantage: they’re arriving after the trail’s been blazed. Investors don’t have to wonder if Brazil’s lithium works. They’ve seen it. The question is: At 1/10 of the SGML market cap, can LTH be the sequel?

The Flagship: Bandeira Project

Lithium Ionic’s main asset is the Bandeira Project, right in the heart of Minas Gerais’ “Lithium Valley.” Their latest feasibility study just landed, and it’s the kind of thing that makes investors sit up.

-

Mine Life: 18.5 years. Almost two decades of steady production.

-

Annual Output: ~177,000 tonnes of lithium concentrate.

-

Capex: US$191M — nearly 30% lower than earlier estimates.

-

Opex: US$378/t — firmly at the low end of the global cost curve.

-

IRR: 61%. In mining terms, that’s ridiculous.

-

Payback: Just over two years.

Put simply: the project got longer, cheaper, and more profitable all at once. That’s not easy to pull off. Usually, when companies optimize, they get better on one metric but worse on another. Ionic managed to tighten the screws across the board.

And they didn’t do this alone — their feasibility study was run with R-TEK International, a firm founded by Sigma’s former COO.

That’s like hiring the Derby-winning jockey to ride your horse.

Why Brazil?

There’s always risk when you operate outside the safe mining havens like Canada or Australia. But Brazil, specifically Minas Gerais, is proving to be worth the gamble. Sigma showed that you can not only build a mine there, but also sell your product into the global EV supply chain.

Here’s the kicker: Brazil’s got the rocks, the infrastructure, and the political will to make lithium work. It’s already a mining powerhouse (iron ore, gold, bauxite), so this isn’t a “frontier market” story. And with the world scrambling to secure supply chains outside of China, Brazilian lithium suddenly looks very strategic.

Three Pros That Stand Out

-

The Neighbour Effect: Sigma’s success didn’t just prove Brazil works, it put Minas Gerais on the map as lithium’s next hot district. Ionic gets to ride those coattails, pitching itself as “the next Sigma” every time they meet an investor.

-

Killer Numbers: The DFS isn’t pie-in-the-sky. It’s concrete math: lower build cost, longer mine life, faster payback. These numbers work at conservative lithium prices, never mind if the market heats up again.

-

Financing Path: Most juniors struggle to raise the money to build a mine. Ionic already has an LOI with a major bank that could cover the full cost. That’s the kind of credibility that takes a lot of risk off the table.

The One Big Risk

Permitting. It always comes down to permitting. To move Bandeira from paper to reality, Ionic needs a key license called the LAC — a combination environmental, installation, and operating permit. Without it, construction doesn’t start.

Brazil is mining-friendly, but it’s still Brazil. Red tape, politics, and local pushback can slow things down. If there’s one thing that could trip this story up, it’s a permitting delay. Until that’s secured, everything else is still “potential.”

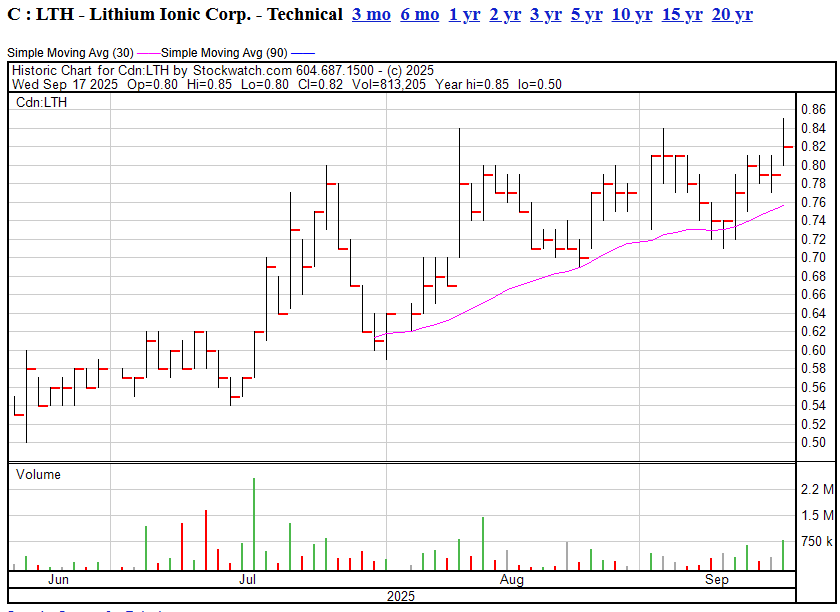

Why the Stock’s Heating Up

So why is Lithium Ionic’s stock moving now? Two main reasons:

-

Macro Tailwind: Lithium’s had its ups and downs, but the bigger picture hasn’t changed — EV makers need more of it, and the world doesn’t have enough. Despite all the “lithium crash” headlines, demand keeps outpacing new supply. Any project that’s low-cost and close to production is going to attract capital.

-

Company-Specific Catalyst: The DFS was a clear win. Longer mine life, cheaper build, higher returns. Investors love when a junior can point to hard numbers that make the story stronger. Add in the likelihood of offtake deals and project financing in the near term, and you’ve got momentum.

The Bigger Picture

Lithium went through a hype cycle — prices spiked to insane levels, crashed back down, and now everyone’s asking what’s real. The truth is somewhere in the middle. EV adoption isn’t slowing down, supply growth is lagging, and long-term prices are still high enough to support projects like Bandeira.

Investors are smarter now. They don’t want pie-in-the-sky explorers with no path to production. They want juniors that have real economics, real financing options, and clear timelines. Ionic ticks those boxes.

The Hook

Here’s the hook in simple terms: be the next Sigma.

Investors don’t have to dream this one up. Sigma went from an unknown explorer to a multi-billion-dollar producer by building a lithium mine in Minas Gerais. Ionic is literally running the same play, but with lower costs and the benefit of hindsight. If Sigma could do it, why not them? That’s the story retail understands, and that’s why the stock is catching fire.

My Take:

Lithium Ionic is no longer just a “maybe.” The feasibility study put them in the “almost real” category and showed there’s life outside of Sigma’s fenceline. They’ve got the numbers, they’ve got the financing path, and they’ve got the jurisdiction that’s already proven itself. That’s why you’re seeing money pile in.

But don’t kid yourself: this isn’t a producing mine yet. They still need permits, and Brazil isn’t known for moving fast. Until shovels hit the dirt, it’s all about belief. If they nail the licensing, this thing becomes a real contender.

— Chris Parry

FULL DISCLOSURE: No commercial arrangement

Leave a Reply