Category: Macroeconomics

-

Worth Less Than Nothing: What Happened, Why It Did, What It Means, and What’s Next For Oil

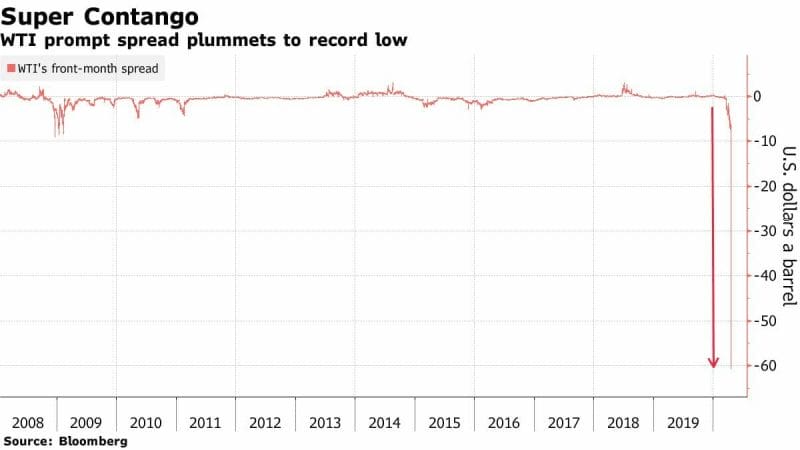

What happens when a global pandemic meets a price war on oil? Or, what happens when severe practical problems meet ineffective policymakers? Rather, what happens when an exogenous shock exposes a fragile system that fails to engage critically in its own risk assessment? Oil prices go negative. US oil futures expiring tomorrow entered negative territory…

-

The ultimate Fed Put, soaring precious metals prices – not enough gold and silver coins to go around

Though the U.S. Congress has yet to agree on a bailout package, it’s working on an unprecedented spending bill to prop up a dying economy. We’re talking somewhere in the neighborhood of 2 Trillion dollars. With interest rates at historic lows, this is shaping up to be the ultimate Fed Put. A battery of Bofors…

-

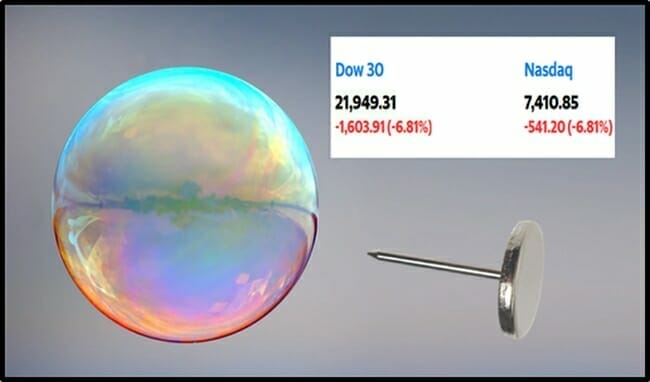

Market Meltdown: gold & housing: “It’s not the pins – it’s the bubble”.

“It’s the financials that are really getting killed,” stated Schiff, “They have made all the loans that are not going to get repaid, so this is just like 2008, only it’s not just the banks that are going to need a bailout, it’s the hotels, it’s the airlines, it’s companies like Boeing, it’s the cruise…