Category: Finance

-

Extreme Fear Gauge readings versus notes of optimism from the Fed and a major investment bank

The across-the-board market volatility witnessed in recent sessions has been nothing short of astounding. Example: The lifeblood of a number of nations around the globe—Oil—did one jaw-dropper of a cliff dive yesterday… Then, only 24 hours later, Oil put on a show that would’ve made even Ed Sullivan stand up and applaud (a close-up 3-month…

-

Reeling markets, helicopter cash and a sweet spot for Canadian Gold Producers

Some ask, “if gold is such a safe haven asset, why did it get sold so unrelentingly when the broader indices caught what-for?” Great question. Gold was sold because it was a source of liquidity during a liquidity event. ANYTHING even remotely liquid was sold during the panic, regardless of underlying value or safe-haven caste.…

-

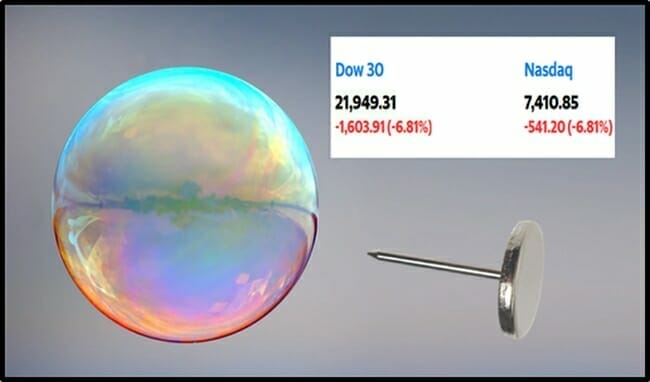

Market Meltdown: gold & housing: “It’s not the pins – it’s the bubble”.

“It’s the financials that are really getting killed,” stated Schiff, “They have made all the loans that are not going to get repaid, so this is just like 2008, only it’s not just the banks that are going to need a bailout, it’s the hotels, it’s the airlines, it’s companies like Boeing, it’s the cruise…

-

DJIA plummets: divorce lawyers shudder as poor sexless couples grope each other in the night

“The National Marriage Project dubbed the drop in divorce ‘a silver lining’ to the Great Recession,” stated The L.A. Times, “arguing that tough times were pulling many husbands and wives closer together.”

-

DJIA surges as democrats gear up to nominate a male Hilary Clinton

Investors have legitimate reason to want four more years of Trump. Ignoring the recent coronavirus-catalysed carnage, the markets have performed well during the Trump presidency.

-

The shortest correction in market history?

“This was the shortest correction in market history…” is the first thing that crossed my screen when I woke up this morning (Tuesday, March 3), pre-open for the North American markets. The broader markets, attempting to price risk into this environment of extreme volatility then went on to chop lower off the open. This, after…