Category: Gold

-

Gold rally faces a key test

On October 3rd 2023, I published an article which caused some fright among metal bulls. I outlined how the technicals indicated that silver could go below $20 and gold below $1800. I outlined key technical levels which had been breached and thus led to sellers piling in. Here are the charts which I put up…

-

The Core Story: Rockridge Resources leveraging new tech in old mines to find what was left behind

In the world of mineral exploration and resource development, it’s not uncommon for companies to possess significant potential yet struggle to gain recognition and investment. Rockridge Resources (TSXV: ROCK) is one such company that seems to have fallen under the radar, despite holding two highly promising assets in Canada. In this article, we’ll delve into…

-

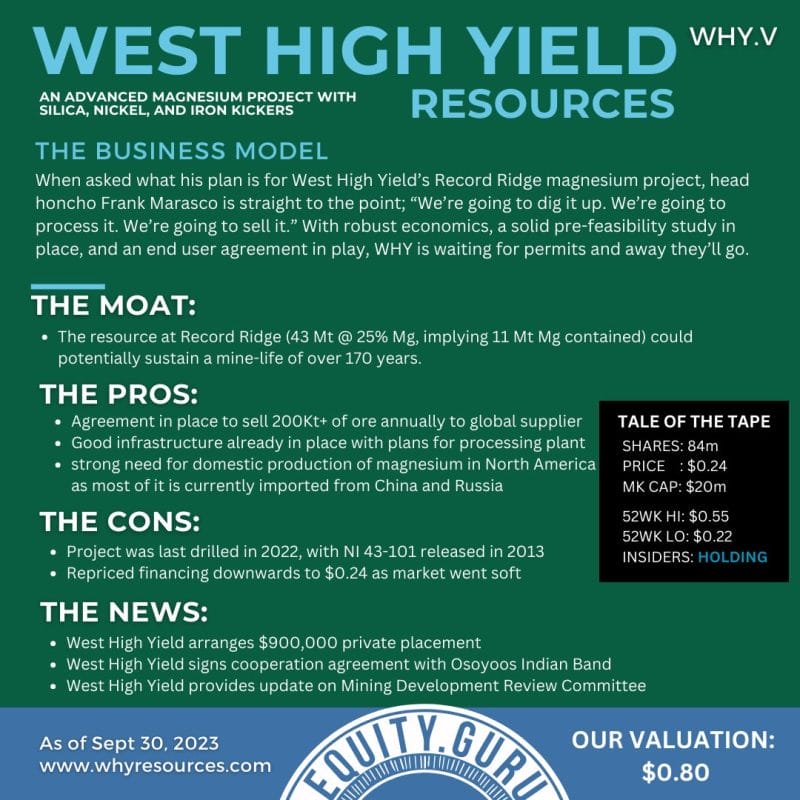

The Core Story: West High Yield Resources (WHY.V) has taken 20 years to be next in line

Part of what makes investing in mining explorers interesting is, you never know when your horse is running. You can trot down to fraser Downs and place a bet on a horse and, when the gates open, it’ll be off and running. Win or lose, at least you know there’s going to be a result.…

-

Why I bought it: Ashley Gold (ASHL.C)

This past month I participated in a financing for a gold exploration company called Ashley Gold (ASHL.C). You may be wondering why, at a time when gold explorers are throwing nooses over the rafters and writing ‘goodbye cruel world’ notes, I would commit to leaving my cash in a four-month hold on one of them,…

-

Friday Forensic: Is the run on Emerita Resources (EMO.V) sustainable?

Okay, everybody shush now and pay attention, because the markets are crap and your portfolio has been hurting and we’re just bloody sick of all that. It’s time to make some money on a runner and your old pal spotted one a month ago that has been buying daddy a lot of steak.. Emerita Resources…

-

Emerita Resources (EMO.V) begins to climb as the dust settles on big financing

If there are two things that are predictable in mining exploration, it’s that a rollback will bring a short term stock price drop (it shouldn’t, but it does), and that an under-priced financing will see the stock price fall to the financing price. The reason for that second one is simple.. if the stock is…