Category: Rare Earths

-

Defense Metals (DEFN.V) test work advances high purity REE oxide

The Wicheeda project has indicated mineral resources of 4,890,000 tonnes averaging 3.02% LREO (Light Rare Earth Elements) and inferred mineral resources of 12,100,000 tonnes averaging 2.90% LREO2.

-

Golds (potential) catalysts – the Bitcoin vs Gold debate (oh, it’s most definitely on) – a roundup including Delta (DLTA.V), Arizona Metals (AMC.V), Nomad (NSR.T), Prime (PRYM.V), Defense (DEFN.V), and Forum (FMC.V)

It would appear that Gold, after a hasty retreat in Q1 of 21, is back to riding the $1750 line, a level that has held prices in check for the past month and a half. After breaching and taking out this key resistance level last week—pushing to $1760, nearly $80 higher from the lows tagged…

-

The plot thickens – Defense Metals (DEFN.V) draws interest from two international REE processors

Yesterday, on March 23rd, Defense Metals (DEFN.V) dropped an important headline—one I’ve been eagerly anticipating as I monitor developments from the sidelines. Leading up to this news event, in a recent interview with Defense Metals’ CEO, Craig Taylor, I asked… “Back in February, you engaged Welsbach Holdings to assist you in a number of areas.…

-

Defense Metals (DEFN.V) continues to de-risk its high-grade REE deposit in mining-friendly B.C. PLUS a Q & A with CEO Craig Taylor

Rare Earth Elements (REEs) are a major driver in the green-ride (EV) revolution. Electric motors, generators, catalytic converters, component sensors, LCD screens… REEs can even be found in the powder used to polish the windshields and mirrors. Hailed as the “vitamins of chemistry”, REEs exhibit a broad range of electronic, optical, and magnetic properties. They’re…

-

Marvel Discovery (MARV.V) is a supermarket trolley full of early resource opportunities

Confused over whether you want to invest in gold explorers or battery metals? Wondering whether it’s time to get into nickel, copper, or cobalt? Do titanium, vanadium, and chromium enter your late night thoughts? Is it time for rare earths to make a run? Maybe the recent movement in uranium is your bag? If you’re…

-

3 Guru clients making headlines in recent sessions – Defense (DEFN.V), Globex (GMX.T) and Huntsman (HMAN.V)

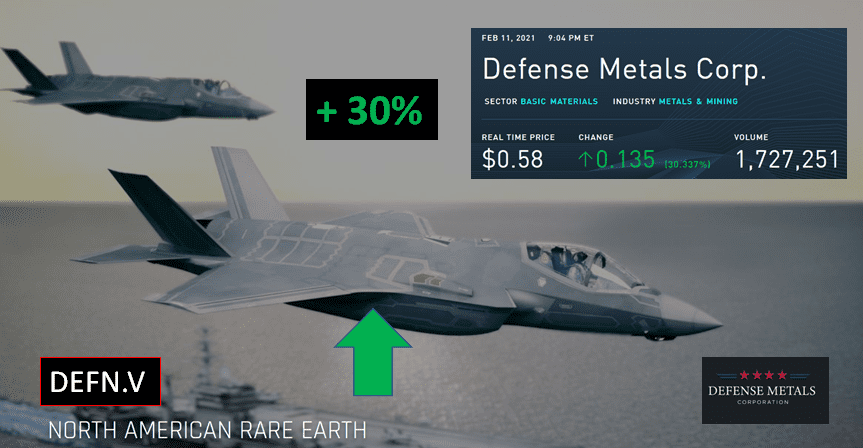

Three companies on our client list dropped headlines in recent sessions. Let’s dive right in. Defense Metals (DEFN.V) Defense has generated its fair share of joy in recent weeks. An increasingly volatile political backdrop threatening the REE supply chain and recent corporate initiatives put a spotlight on the Company’s flagship resource. Hats off to the…

-

Defense Metals (DEFN.V) surges 30% as it looks to secure supply chain partners

“The engagement of Welsbach will enable Defense Metals to leverage their extensive experience and relationships in the Asia-Pacific region (Australia, Singapore, China, Japan, and South Korea), Continental Europe, and the United States towards engaging in one-on-one discussions with REE refiners and separators,” stated Craig Taylor, CEO of Defense Metals.

-

Defense Metals (DEFN.V) just mapped its 4,220-acre Rare Earth Element (REE) property in B.C.

The Wicheeda resource currently stands at 4,890,000 tonnes grading 3.02% LREO (Light Rare Earth Oxide) in the Indicated category, and 12,100,000 tonnes grading 2.90% LREO in the Inferred category.

-

Defense Metals (DEFN.V) surges as Tesla (TSLA.Q) Model 3 sales hit green energy tipping point

Defense Metals develops materials used in the electric power market, military, national security and the production of “GREEN” energy technologies, such as, high strength alloys and rare earth magnets.

-

Two strategic deposits, two strategic hires – Arizona Metals (AMC.V) and Defense Metals (DEFN.V)

When conducting due diligence on a prospective company in the junior exploration arena, the crew behind the enterprise needs to be examined with great rigor. I can’t stress this enough. Again, at the risk of sounding like a stuck record… you can have a great project, but without the right team in place, shareholder-value-creation is…