Category: Rare Earths

-

Defense Metals (DEFN.V) defies ups and downs of resource sector, keeps adding to its base

If you don’t invest in resource companies because you’re concerned they do harm to the planet, I wonder where you think the metals in your Tesla are going to come from going forward. In recent years, any shift in thinking towards making other sectors more green has come with a definite up-front need for ores…

-

Defense Metals (DEFN.V) does base-line work to prepare for potential future Wicheeda REE mine site

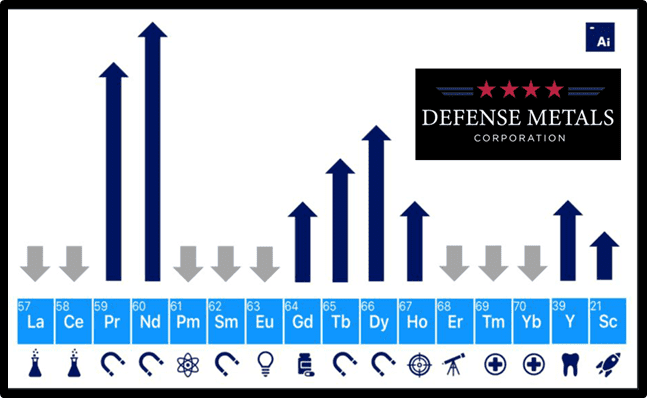

The Wicheeda project has indicated mineral resources of 4,890,000 tonnes averaging 3.02% LREO (Light Rare Earth Elements) and inferred mineral resources of 12,100,000 tonnes averaging 2.90% LREO.

-

Defense Metals (DEFN.V) biz plan just got a boost from Fortress-MP Materials Merger news

The FVAC-MP Materials special meeting represents a significant milestone in the establishment of a North American critical magnet metals supply chain

-

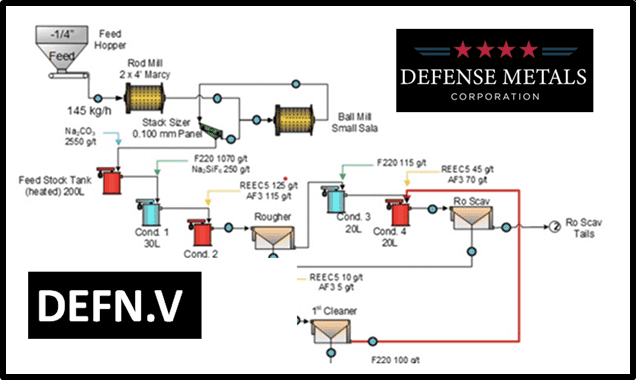

Defense Metals’ (DEFN.V) pilot plant metallurgy validates REE extraction plan

“Outside of China, the rest of the world is rapidly working to secure access to REE concentrate and processing facilities,” stated Taylor, “Given that the Wicheeda deposit is located in Canada, this gives us a strategic advantage as we continue to have discussions with various parties about this deposit.”

-

Equity Guru ExploreCo news round up – Defense (DEFN.V), East Asia (EAS.V), Falcon (FG.V), Golden Lake (GLM.C), Nubian (NBR.V), Nexus (NXS.V), and X-Terra (XTT.V)

Back in October of 2019, I penned the following concerning gold and the companies that make the metal their business: In times of rampant currency debasement, geopolitical uncertainty (twitchy chest-puffing politicians instigating trade wars via Twitter), gold belongs in a balanced portfolio in order to reduce risk. Not only is gold a great hedge against…

-

An REE supply crunch and an undervalued development play—Defense Metals (DEFN.V)

Defense Metals (DEFN.V) is our go-to Rare Earth Element (REE) development play. It’s a strategic wager on an ever-looming supply crunch, one precipitated by Chinese domination of the REE refining market. Defense is flying so low, so far below the market’s radar… … its current sub-$10M market cap might best be looked upon as laughable.…

-

A Guru (client-list) ExplorerCo round-up – DEFN.V, EAS.V, FG.V, FRE.V, GLM.C, GSK.C, NSR.T

Gold has performed exceedingly well in recent sessions, taking out the US $2,000 level as if it was just a minor speed bump. We’ve been calling for a major breakout in the metal for well over a year now. As 2019 was drawing to a close, when the metal was consolidating in the $1,500 range,…

-

Defense Metals (DEFN.V) in focus as U.S. de-couples from China REE supply chain

“A lot of mining explorers don’t actually do much exploring, for fear that they may ruin a good story or get to the end of their CEO salary budget before they have to,” states Equity Guru’s Parry, “Defense Metals has been doing the work, finding the good stuff, and doing so at a time when…

-

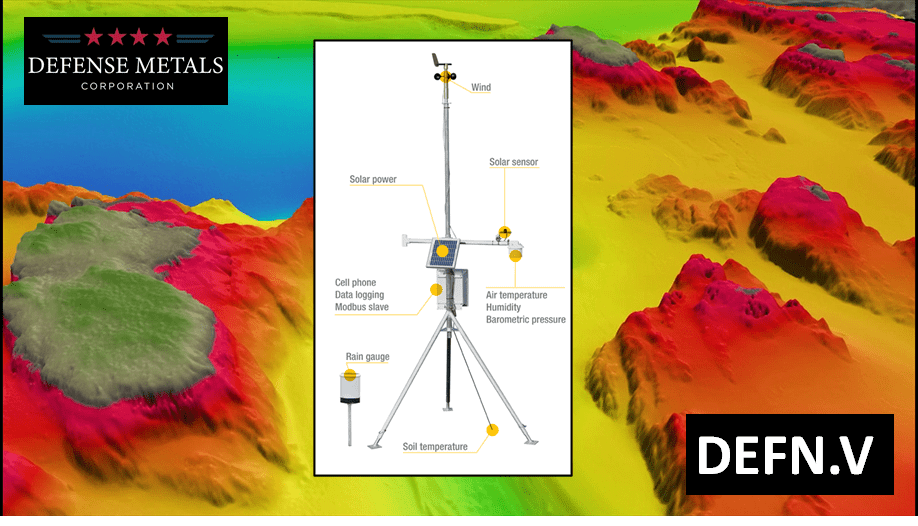

Defense (DEFN.V) commences baseline studies at Wicheeda REE deposit in mining-friendly B.C.

Defense Metals (DEFN.V) is doing everything right, and at a hurried pace, in advancing its 1,708-hectare Wicheeda Rare Earth Element (REE) Project further along the curve. In previous write-ups, we suggested that the market might acquire a real taste for this rich, highly strategic REE deposit as 2020 progressed. The stock did make a very…

-

Defense Metals (DEFN.V) resource estimate up 49% as US/China tensions put spotlight on REEs

Mining jurisdiction, geology, metallurgy – all good.