Category: Silver

-

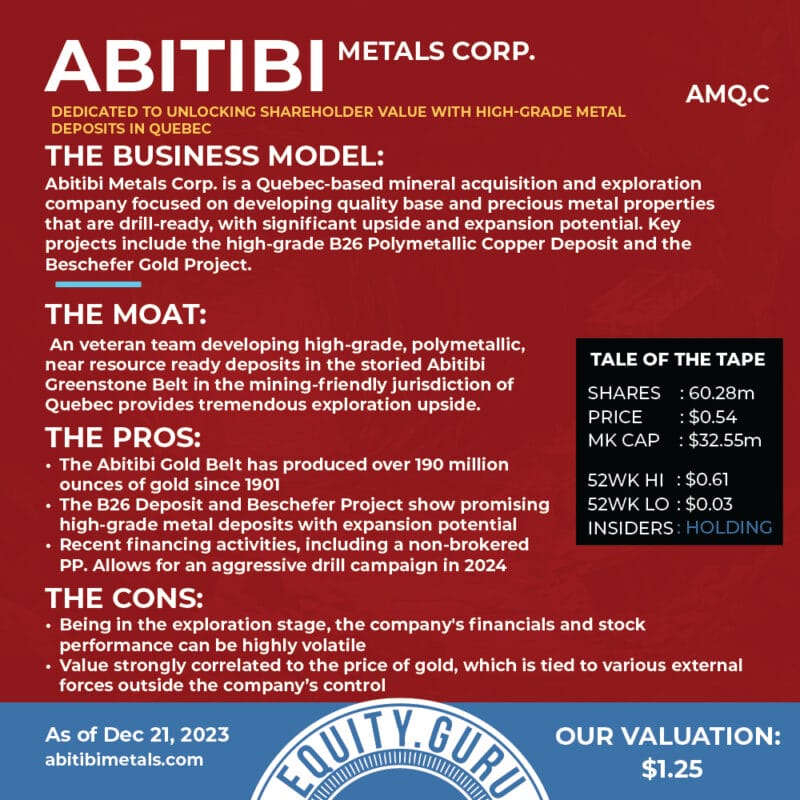

Abitibi Metals Corp (AMQ.C): Finding incredible gold exploration value in Quebec

Gold mining in the Abitibi region began in the early 1900s and has led to the establishment of more than 124 mines. At least 15 of these mines have produced over 3.5 million ounces of gold each. The total gold content in the belt, considering past production, current reserves, and resources, surpasses 300 million ounces.…

-

The Trading Desk: Commodities and the Santa Claus Rally

Ah the last two weeks of 2023. The Christmas to New Years holiday trading tends to be quiet in terms of economic data and corporate press releases. Most institutional traders are on holidays. Retail traders have nothing better to do. Because of the lower liquidity, these few weeks tend to see either range bound price…

-

Nine Mile Metals (NINE.C): Pioneering the Future of Mining with CEO Patrick Cruickshank

Mining is an industry often characterized by its robust challenges and immense rewards. Leading the charge in this dynamic sector is Nine Mile Metals (NINE.C), under the visionary leadership of CEO Patrick Cruickshank. In a recent in-depth interview, Cruickshank sheds light on the company’s innovative strategies, groundbreaking explorations, and his journey as a mining CEO.…

-

Gold rally faces a key test

On October 3rd 2023, I published an article which caused some fright among metal bulls. I outlined how the technicals indicated that silver could go below $20 and gold below $1800. I outlined key technical levels which had been breached and thus led to sellers piling in. Here are the charts which I put up…

-

The moment of truth for silver!

It is now make or break for silver. The precious metal was on fire in the second half of August seeing five days of continuous rally followed by a few more green days taking the price briefly over $25. This zone turned out to be resistance and silver prices have given up those gains. We…

-

Silver rallies five trading days in a row! Is China the catalyst?

After multiple red days in a row after breaking a key support level, silver has rallied for five trading days in a row setting up a key retest of broken support. At time of writing, silver is up over 8% since the beginning of this run-up starting August 18th 2023. And what are the catalysts…

-

Friday Forensic: Is the run on Emerita Resources (EMO.V) sustainable?

Okay, everybody shush now and pay attention, because the markets are crap and your portfolio has been hurting and we’re just bloody sick of all that. It’s time to make some money on a runner and your old pal spotted one a month ago that has been buying daddy a lot of steak.. Emerita Resources…

-

Emerita Resources (EMO.V) begins to climb as the dust settles on big financing

If there are two things that are predictable in mining exploration, it’s that a rollback will bring a short term stock price drop (it shouldn’t, but it does), and that an under-priced financing will see the stock price fall to the financing price. The reason for that second one is simple.. if the stock is…