Category: Silver

-

To Invest or Not: Globex Mining Enterprises (GMX.T)

In this episode, we take a look at Globex Mining (GMX.T). They explore for all sorts of things from precious metals, base metals, as well as specialty and industrial metals and minerals. But with more than 200 projects and royalties under it’s belt, is this an explorations company worth investing in?

-

Nomad Royalty (NSR.T) increases royalty stake in Caserones, gets approval for NYSE trade

Here’s a question for you (economic) analyst types out there: Inflation, is it here to stay, or is it merely a transitory phenomenon? Federal Reserve Chair Jerome Powell will have you believe it’s the latter, sighting temporary supply chain bottlenecks and price pressure in only a few categories (flights, hotels, services). Others, perhaps those with…

-

Marvel Discovery (MARV.V) , a run of the mill commodities business, run by a serial entrepreneur with a thirst for discounted purchases

Since 2020 the stock for marvel discovery is up almost 200%, and this is coming from doing nothing for almost three to four years. It started the year off at 0.04 dollars per share and is now trading at 0.16 dollars per share. Normally when we see such a meteoric rise when the business hasn’t…

-

Biting the silver bullet: (CCW.V) (CLZ.V) (SM.V) (IPT.V) (EXN.V) (ASM.V) (BCM.V) (EDR.T) (FVI.V) (FR.T)

17 months ago, silver couldn’t get a date on tinder ($12/ounce) Suddenly – a year ago – it was an object of mass desire ($29/ounce) These days, fewer investors are swiping right – but the old girl still has legs. Silver is currently trading at $23/ounce, up from $12 in March, 2020 on safe-haven and…

-

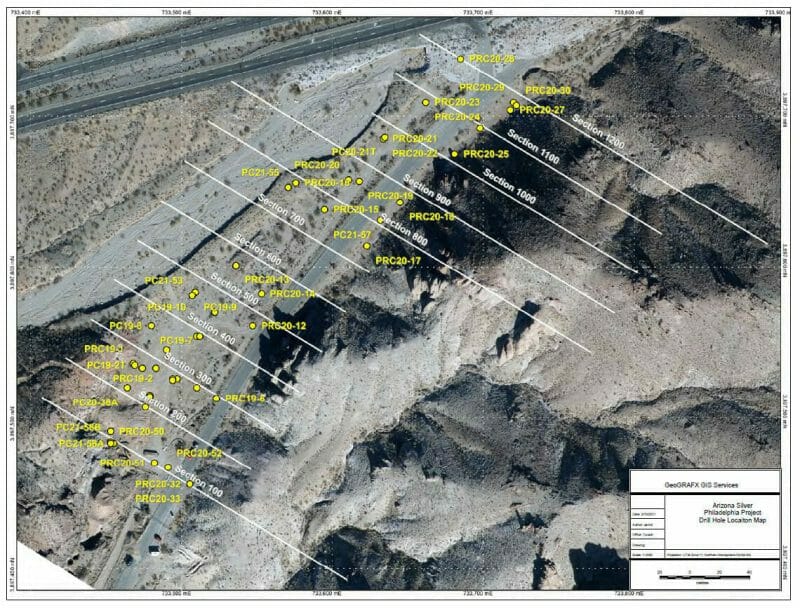

Arizona Silver Exploration (AZS.V) drops monster drill results on a day every resource stock got killed

They say timing is everything in comedy, but the same goes for resource stocks. Mining explorers spend years raising money and kicking rocks, eventually sending drills out into the wilderness, and then they wait months for the results to come back. Over time they hope two things will happen next: That they get great numbers…

-

X-Terra (XTT.V) probes the subsurface stratum at Troilus East Project in mining-friendly Québec – assays are pending

It’s difficult to overstate the importance of a project’s zip code when shortlisting stocks in the junior exploration arena. High-risk jurisdictions—those with twitchy governments at the helm—have been known to put the kibosh on mining claims, development projects, and even operating mines once all of the heavy-lifting is done. Venezuela, Kyrgyzstan, Zambia, Zimbabwe, Bolivia… the…

-

An Equity Guru ClientCo roundup – Arizona Metals (AMC.V), Defense (DEFN.V), DELTA (DLTA.V), Globex (GMX.T), Gold Mountain (GMTN.V), Nomad (NSR.T), Rockridge (ROCK.V), Skyharbour (SYH.V)

I’ll waive the standard preamble and get right to it—rounding up a few of the companies on our client list that dropped weighty headlines in recent sessions. Arizona Metals (AMC.V) We take great pride in having recognized the potential in Arizona Metals early in the going, engaging the Company and initiating coverage last fall when…