Category: Silver

-

Tocvan’s (TOC.C) step-out holes at Mexican property indicate a larger gold zone

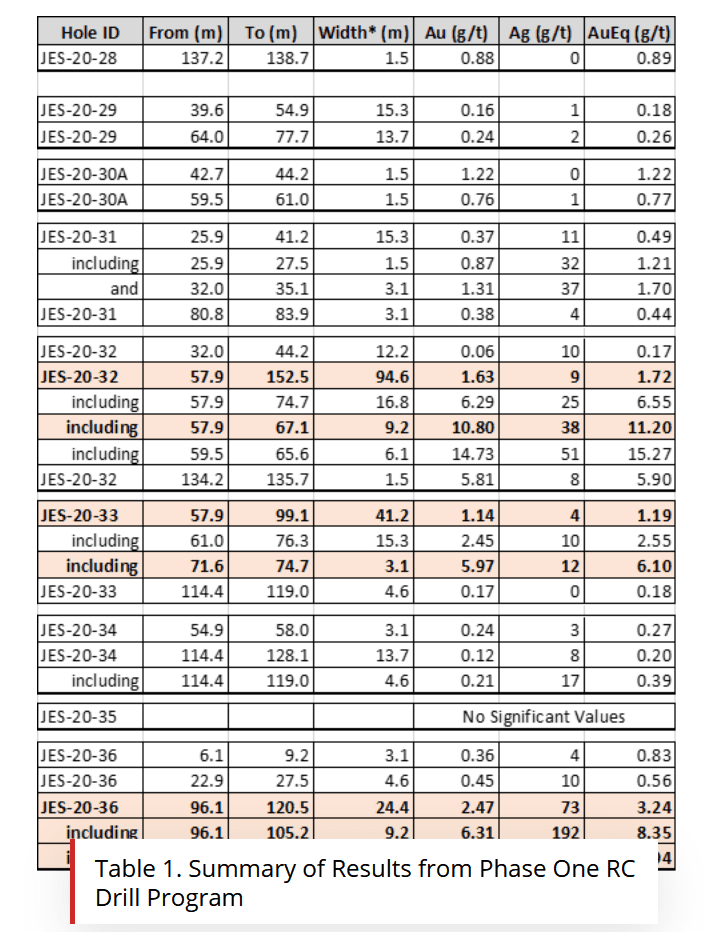

Results for all nine drill holes are included in the Feb 9, 2021 release; all drill targets were step-outs of historic drill holes within the Main zone.

-

Sentinel Resources (SNL.C) advances Australian gold project; Golden Lake Exploration (GLM.C) reports anomalous silver and gold values

On Thursday, February 4, 2021 gold fell into a funk as April gold futures traded at USD $1,788 an ounce, down 2.5% on the day. Meanwhile, the World Gold Council (WGC) reported that gold-back ETFs increased by 13.8 tonnes in January, 2020 although the price of gold dropped 1.3% that month. “We believe investment demand…

-

BARU Gold (BARU.V) gets greenlight for Sangihe Gold Project from Indonesia’s Ministry of Energy and Mineral Resources

Those of us holding shares in Baru Gold (BARU.V) have been waiting patiently for the Indonesian government to greenlight the Company’s flagship asset. The pandemic intervened causing a three-month delay. This flagship asset—the Sangihe Gold Project—is being fast-tracked to production, and after yesterday’s news, it should begin cash-flowing as early as Q2 of 2021. The…

-

A chat with Prime Mining’s (PRYM.V) Exec VP Andrew Bowering – Pierre Lassonde increases stake in the company to 11.85%

Since its debut on the TSX Venture Exchange back in September of 2019, Prime Mining (PRYM.V) has created significant shareholder value. The stock has never traded higher… The Company’s flagship project—Los Reyes—captures 6,300 hectares of highly prospective terra firma in mining-friendly Sinaloa, Mexico. I had the pleasure of catching up with Andrew Bowering, Prime’s Executive…

-

Arizona Metals (AMC.V) commences phase-2 drill program as share price doubles on back of rocketing copper prices

We have an impressive stable of resource clients here at Equity Guru, several of which produced significant gains in recent sessions. Defense Metals’ (DEFN.V) is a standout, having captured high ground not seen since it made its debut two years back. What’s really striking about this price trajectory is the accompanying volume. Defense is a…

-

Blue Moon Zinc (MOON.V) looks to drill flagship VMS project in Mariposa County, California

In a recent Guru offering, we noted how the $1850 level in gold—a level we suspected of being surveilled by a whole universe of traders—had turned into a front line in the brawl between bulls and bears. The above chart shows a bear trap (the late November-early December dip) and subsequent charge through $1850 resistance.…

-

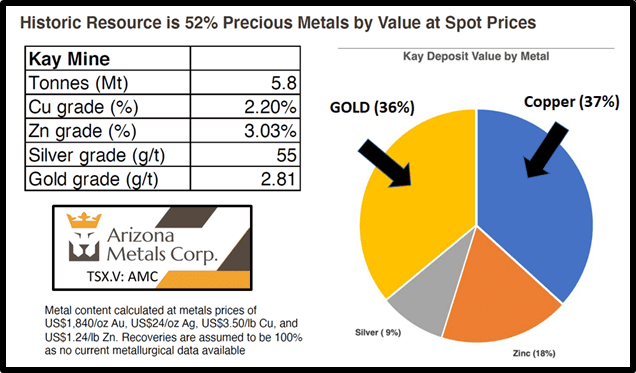

Arizona Metals (AMC.V) expands VMS land package as gold and copper come into focus

An 1982 historic estimate by Exxon Minerals reported a “proven and probable reserve of 6.4 million short tons at a grade of 3.03% zinc, 55 g/t silver and 2.8 g/t gold, 2.2% copper”.

-

Tocvan (TOC.C) starts drilling in Mexico: 5 reasons the share-price surged 19%

On December 1, 2020, Tocvan Ventures (TOC.C) told the markets that its previously-announced maiden drill program at the Pilar Gold-Silver Project in Sonora, Mexico has begun.

-

Prime Mining (PRYM.V) – the drills turn at highly prospective Los Reyes Project, Sinaloa, Mexico

Prime Mining (PRYM.V) is helmed by a top-shelf crew, a combination of successful capital markets mining executives and experienced local operators. This team has multiple wealth-creating exits under their collective belts. You can peruse their resumes here. The Company is targeting near term gold production at its 6,300-hectare Los Reyes Project located 43 kilometers southeast…

-

A Guru ClientCo Resource Roundup – Arizona Metals (AMC.V), Baru Gold (BARU.V), Golden Lake (GLM.C), Nomad Royalty (NSR.T), Sentinel Resources (SNL.C) and Freeport Resources (FRI.V)

Trading activity in the junior exploration arena is currently dominated by short tempers, across-the-board selling (some of it profit taking), and transient bouts of cautious buying. Should we have predicted this weakness, with the flurry of private placements from earlier this summer coming off hold? With the vorticity of economic and political uncertainty around the…