Category: Uranium

-

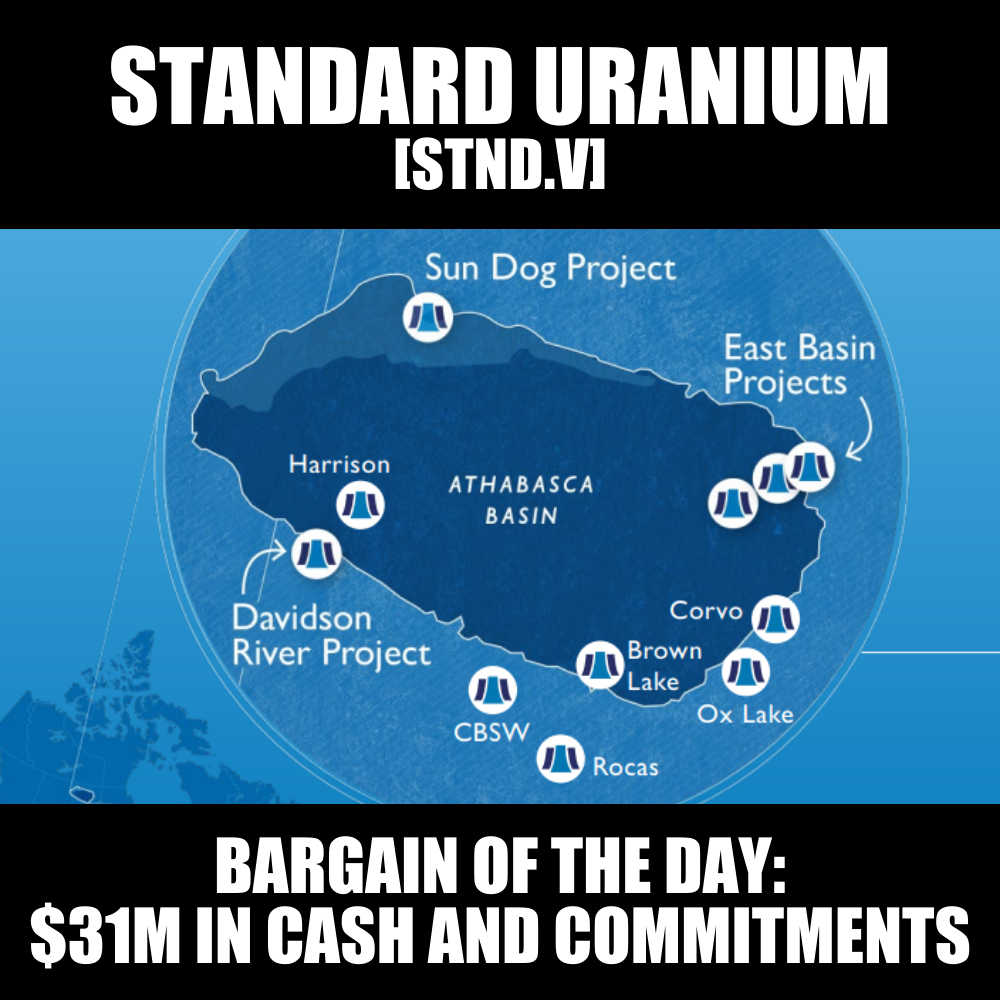

Bargain of the Day: $7m Standard Uranium (STND.V) has $31m in cash and commitments

I’m going to run through a list of assets that the $7m market cap explorer Standard Uranium (STND.V) has in its portfolio right now, and you can stop me when you think I’m making things up or it’s just too bananas to follow without laughing. Let’s go. 11 projects around the prolific Athabasca Basin, including:…

-

Ashley Gold (ASHL.C) doing a lot with a little – 31.9 gram p/t gold sample

As a marketing provider to public companies, I see a wide variety of deals of all shapes and sizes and intents. Some are monsters, with massive acreage, million of dollars in the ground, big staff rosters, and NI 43-101’s and PEA’s and financings stacked to the ceiling. Others are just straight promotes, with little intention…

-

Ashley Gold (ASHL.C) hits paydirt with 82.3 g/t Sakoose gold sample

Ashley Gold (ASHL.C) CEO Darcy Christian was out in the mountains again this past month, and when he wasn’t fighting off bears and mosquitoes, he was taking gold samples. His company recently attached itself to a uranium play that can quickly advance if all goes well, but while that’s coming together, the geo-ceo decided to…

-

Tisdale Clean Energy (TCEC.C) is getting shittered by marketing guys but it’s ok

I’m going to start this by saying Tisdale Clean Energy is not a client. I only mention this because that means I can say whatever the hell I want and if there’s anyone to sue, it’s me alone. Let’s fucking go. Tisdale, right now, is a bit screwed. But it’s going to be okay. I’m…

-

Standard Uranium (STND.V) looks to add to Sun Dog’s uranium history

They call it Sun Dog, which is a misnomer in two parts. It’s colder than heck out there for a lot of the year, and it;s definitely no dog of a project. Standard Uranium’s (STND.V) recent adventure at the Sun Dog Project, where they’ve joined forces with Aero Energy Ltd. to explore the atomic depths…

-

Atco Mining and Standard Uranium show promising early uranium drill results

In the remote stretches of northern Saskatchewan’s Athabasca Basin, Atco Mining Inc. (ATCM.C) and Standard Uranium (STND.V) have completed their inaugural drilling program at the Atlantic Project, a 3,061-hectare area promising in uranium potential. The project, which Standard is doing the work on and holds the option on, while Atco raises dough to pay for…

-

Standard Uranium (STND.V) is the engine making a lot of projects move forward

Had a conversation yesterday with someone I trust who has made his money in the mining space, about uranium explorers. “There’s just so many that are junk,” I exclaimed, asking, “how does a well run explorer stick its head out in this sector and get noticed?” My friend asked who I liked, and I said…

-

Ashely Gold (ASHL.C) brings in free government money for new drilling

Ashley Gold Corp. (ASHL.C) is the quintessential junior mining explorer, being a small early stage operation run on the smell of an oily rag. Where Ashley differs from many other junior explorers is what they get done in that scenario, with a geology-focused CEO who barely pays himself, flies coach, lifts rocks, and pitches tents,…

-

Searchlight Resources (SCLT.V) sold a property, but have loads to go

Searchlight Resources Inc. (SCLT.V), a mineral exploration company, has announced a significant business move by selling its Hanson Lake project in Saskatchewan. This decision marks a shift in focus for the company, paving the way for it to concentrate on new opportunities and projects. Located about 65 kilometers west of Creighton, Saskatchewan, the Hanson Lake…

-

Ashley Gold Corp’s (ASHL.C) Bold Leap into Uranium: Transforming Strategy for Market Leadership

The spot price for uranium was quoted at $81.32 USD per pound in February 2024, representing a nearly 97% Y0Y increase from $41.31 a year ago. The World Nuclear Association’s Nuclear Fuel Report anticipates a 27% increase in uranium demand over the 2021-2030 period, driven by a 16% increase in reactor capacity alongside a recovery…