Category: Resources

-

Azincourt Energy Corp.: Navigating Uranium and Lithium Markets

Azincourt Energy Corp., a Canadian exploration-stage mining company, is strategically positioned in the uranium and lithium markets, with projects pri…

-

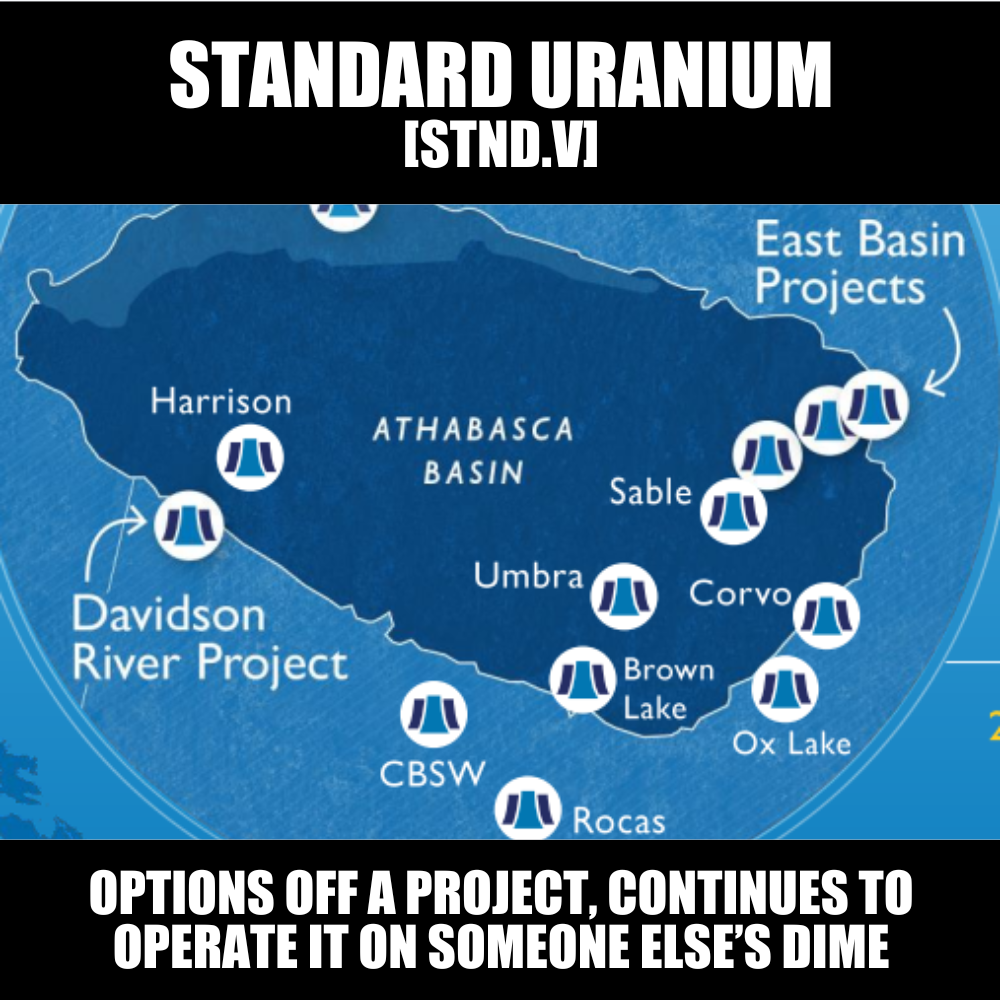

Standard Uranium (STND.V) signs LOI to option out the Rocas project, and remains the operator

Disclaimer: This article has been paid for by Standard Uranium. See disclosures at the bottom of the page. I dig the way STND runs its prospect generator business. In a nutshell, they like to get other companies to give them money for an option on a project, as well as a net smelter royalty, and…

-

Cleghorn Minerals Ltd.: Navigating the Metals Market Landscape

Cleghorn Minerals Ltd., a junior exploration company, is strategically positioned in the prolific Abitibi Greenstone Belt of Ontario, Canada. The comp…

-

Lithium Ionic (LTH.C): Walking a well-trodden path in Brazil’s big lithium region

If you’ve been around mining long enough, you know how these things work: one company makes the big discovery, proves a new region works, then suddenly the whole district lights up. A few years back, Sigma Lithium (SGML.V) did exactly that in Brazil’s Minas Gerais state. The market watched a tiny company with some sweaty…

-

Skyharbour Resources (SYH.V) & Trident Resources (ROCK.V): Turbo charged on near term potential

Long time readers know I’ve plenty of good things to say about junior mining mover/shaker Jordan Trimble. For a while, we repped his Skyharbour Resources (SYH.V), which duly climbed from the $0.25 range to $0.45 a few years back before we moved on to other things. In the years since, despite building out its project…

-

Abasca Resources: Navigating Uranium and Graphite Markets in 2025

Abasca Resources Inc., based in Saskatoon, Saskatchewan, is strategically positioned in the metals market with a focus on uranium and graphite. The co…

-

Allied Gold Corporation: Navigating Gold Market Trends and Regional Dynamics

Allied Gold Corporation is a prominent player in the gold mining sector, with operations primarily in Africa, including Ethiopia and Côte d’Ivoire. Th…

-

Prismo Metals (PRIZ.C) surrounded by Vizsla Silver, BHP, Rio Tinto, Freeport McMoran

SPONSORED GUEST POST BY PETER EPSTEIN: Word on the street is that generalist funds are looking at metals & mining companies, possibly reducing exposure to highly-valued tech names. This makes sense as many S&P500 sectors are doing poorly. Astute readers will say, sure but generalist funds will only buy the largest mining companies, not pre-production…