Category: Today’s Idea

-

Brazil Potash (GRO.NYSE-Am) nails big offtake agreement, resumes lift-off

See disclosures at bottom of the page. A few weeks ago, Brazil Potash (GRO.NYSE-Am), which we’ve written about a fair deal, announced an off-take agreement. The deal was a big one and gets GRO a big step closer to production, just the latest of a series of big deals that are moving them forward. Now,…

-

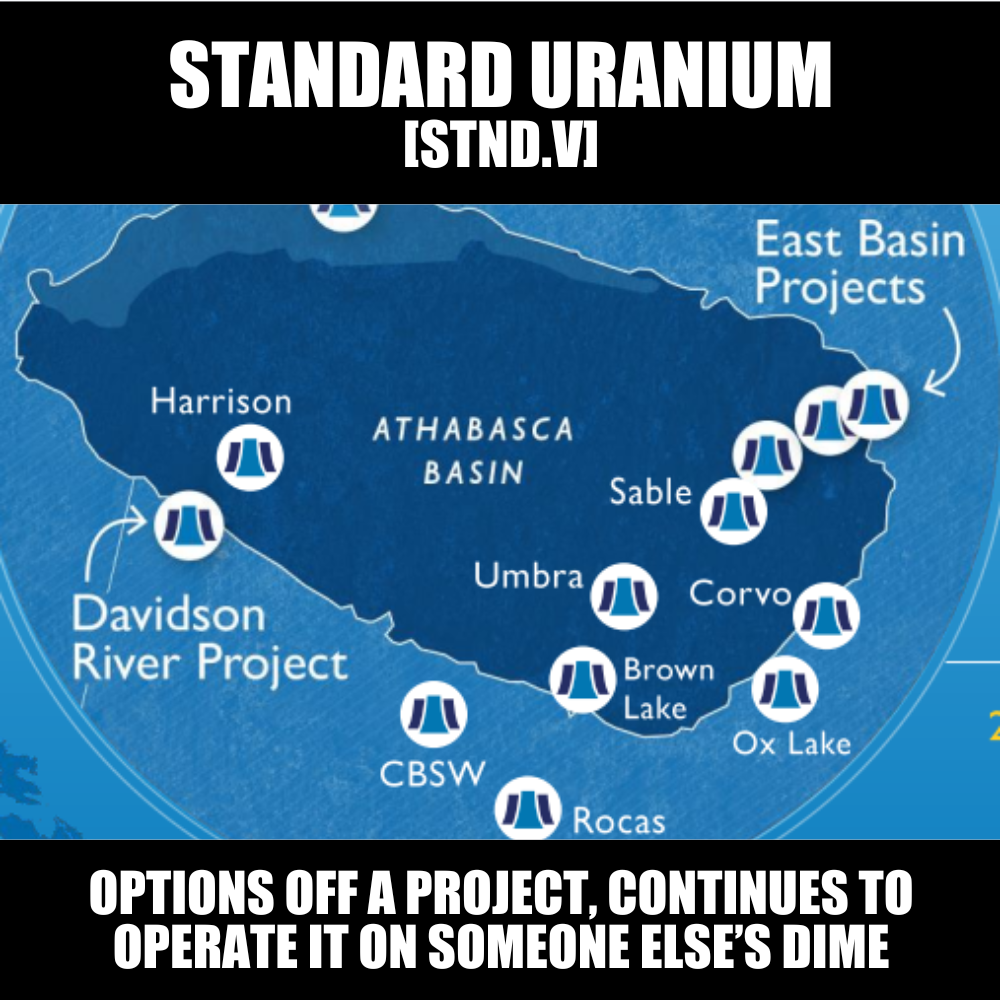

Standard Uranium (STND.V) signs LOI to option out the Rocas project, and remains the operator

Disclaimer: This article has been paid for by Standard Uranium. See disclosures at the bottom of the page. I dig the way STND runs its prospect generator business. In a nutshell, they like to get other companies to give them money for an option on a project, as well as a net smelter royalty, and…

-

Lithium Ionic (LTH.C): Walking a well-trodden path in Brazil’s big lithium region

If you’ve been around mining long enough, you know how these things work: one company makes the big discovery, proves a new region works, then suddenly the whole district lights up. A few years back, Sigma Lithium (SGML.V) did exactly that in Brazil’s Minas Gerais state. The market watched a tiny company with some sweaty…

-

Skyharbour Resources (SYH.V) & Trident Resources (ROCK.V): Turbo charged on near term potential

Long time readers know I’ve plenty of good things to say about junior mining mover/shaker Jordan Trimble. For a while, we repped his Skyharbour Resources (SYH.V), which duly climbed from the $0.25 range to $0.45 a few years back before we moved on to other things. In the years since, despite building out its project…

-

Prismo Metals (PRIZ.C) surrounded by Vizsla Silver, BHP, Rio Tinto, Freeport McMoran

SPONSORED GUEST POST BY PETER EPSTEIN: Word on the street is that generalist funds are looking at metals & mining companies, possibly reducing exposure to highly-valued tech names. This makes sense as many S&P500 sectors are doing poorly. Astute readers will say, sure but generalist funds will only buy the largest mining companies, not pre-production…

-

The Hot Hand: Mo Elsaghir’s long list of winners – EMO, SOMA, IPO, LTH, and more

After a decade-plus talking about public companies, one of the hardest things for me to do on an ongoing basis has been to steer clear of easy short term wins that leave a bad taste over the long haul. The public markets rise and fall, and some companies on the markets are both winners AND…

-

Equity Round-Up: Stuff we talk about sometimes – AIAI, SOMA, EMO, BNXT, ARGO, AIAI, NOM

Emerita Resources Corp. (TSXV: EMO) — Eric Sprott, through 2176423 Ontario Ltd., has acquired 4.76 million units of Emerita Resources in a private placement at $1.05 per unit, totaling just under $5 million. With this move, Sprott’s position increases to 25.2 million shares and 2.38 million warrants, representing 8.7% ownership on a non-diluted basis and…

-

Geo Translation: What Standard Uranium (STND.V) just announced, in layman’s terms

Disclaimer: This article has been paid for by Standard Uranium. See disclosures at the bottom of the page. Mining exploration terminology is often completely incomprehnsible to the layman investor. Sure, you know uranium is hot and you want to figure out which explorer is doing what so you can put some money in, but then…