Tag: Aben Resources

-

Equity.Guru’s sub-$20m ExploreCo shortlist: mining microcaps that are fit to follow (part 1 of 2)

When I was a novice investor—a kid barely in his 20’s—the junior exploration arena was a fascinating landscape. It still is. There’s something about buried treasure, and the hunt that goes along with it. Before I made my first trade, I approached the markets with lessons passed down by my old man, a very decent…

-

The IMF suddenly got very gloomy: what does that mean for the price of gold?

Today, The International Monetary Fund (IMF) released a statement predicting that the global economy will take a $12 trillion hit from the Covid-19 pandemic. $12 trillion is 60% the size of the U.S. economy – or $1,500 for every man, woman and child on the planet. The 189-country organisation says it will take a minimum…

-

Berkshire Hathaway (BRK-A.NYSE): Warren Buffett is my hero but he got this detail wrong

“Nothing can basically stop America,” stated Buffett at Saturday’s virtual shareholder meeting. “The American miracle, the American magic has always prevailed and it will do so again.” Buffett’s opinion (about the resiliency of the U.S. economy) has been right for six decades. Why wouldn’t it continue to be right?

-

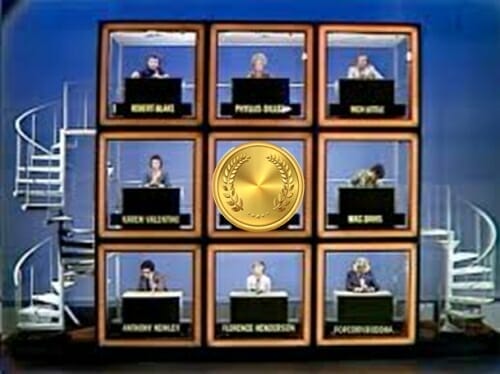

Gold Junior ETF (GDXJ.NYSE): gold offered “Hero Role” in re-make of “Apocalypse Now” – accepts gig on Hollywood Squares instead

Analysts have tied the retreat by gold in part to positioning, noting that data had shown extremely high net long speculative positions in gold futures. Still, the degree of the pullback in light of the continued selloff in equities was widely described as a surprise.

-

High-Risk/High-Reward… Guru’s sub-$20M ExplorerCo shortlist

Due to the number of companies I have in mind for this one, I’ll dispense with the usual preamble, except to say, gold is looking constructive on the charts (note the accumulation/distribution line), as is the GDX and the GDXJ. All three are holding their ground, and many of the companies I follow in the…

-

Gold: the unbearable brightness unseen

Where is gold going? Where will the gold price settle as 2019 draws to a close? And where will it trade a year from now? If some renegade time-looper handed me an envelope with the answers to these questions, I’m confident I’d be able to convert mere tip jar coinage into a retirement fund that…

-

Mining on a run: Aben (ABN.V), Blue Sky Uranium (BSK.V), E3 Metals (ETMC.V), and Cypress (CYP.V) are booming

Hey millennials. Quit obsessing over the down market your weed stocks are enduring for a moment and come with me over here. No, wrong way. Over here. Good. We’re going to talk about mining for a second. Bear with me. It’s going to be okay. You’ll like this. How many of your weed stocks have…

-

The overriding fundamentals underpinning the next upswing in gold

For the past few decades gold has stuck to a fairly reliable schedule – a cycle if you will – in carving out a major low every 8-years, roughly: Note that the above chart takes us only up to mid-2016. The projected gold price trajectory (green line) was a bit aggressive, but the chart illustrates…