Tag: Abitibi Greenstone Belt

-

Equity.Guru’s sub-$20m ExploreCo shortlist: mining microcaps that are fit to follow (part 1 of 2)

When I was a novice investor—a kid barely in his 20’s—the junior exploration arena was a fascinating landscape. It still is. There’s something about buried treasure, and the hunt that goes along with it. Before I made my first trade, I approached the markets with lessons passed down by my old man, a very decent…

-

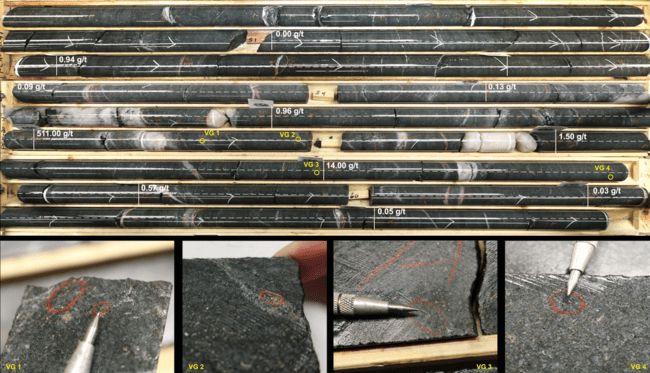

Goldseek Resources (GSK.C) pushing three highly prospective Ontario-Quebec projects aggressively along the curve

In the junior exploration arena, a tight cap structure + low G&A expenses + a technically competent management team + a disciplined approach to exploration + a geologically prospective (mining-friendly) jurisdiction = a prime candidate for an ExploreCo shortlist. The above wish list is a rare combination of elements in this era of blown-out cap…

-

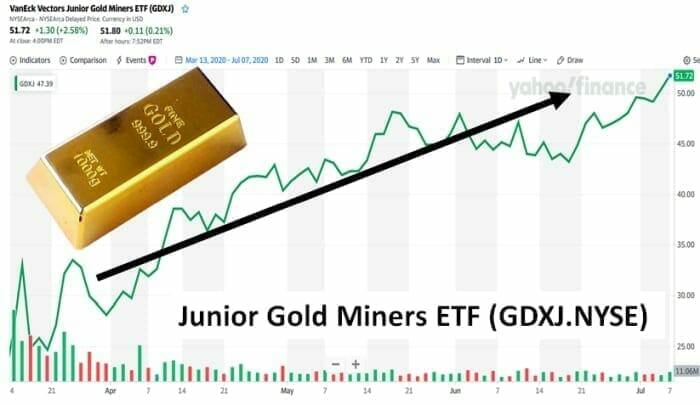

GDX.NYSE, GDXJ.NYSE: massive investment inflows into gold ETFs

H1 ETF inflows are higher than the record-setting central bank net purchases seen in 2018 and 2019, and “could absorb a comparable amount of about 45% of global gold production.”

-

Guru’s (client list) ExploreCo roundup – six goldies and a nickel

If you haven’t noticed, many of the junior ExploreCo stocks we follow here at Guru Central are popping. If it’s a gold or silver company with ounces in the ground, or a geologically prospective exploration project getting a proper probe with the drill bit, chances are it’s pushing higher. Chances are it’s already in an…

-

GFG Resources (GFG.V) doubles exploration budget for Pen Gold Project in the prolific Timmins Gold Camp of northern Ontario

Whether you’re a seasoned mining CEO or a penny ante investor, there’s a lot to be said for limiting one’s focus to only the very best mining jurisdictions in this age of political and economic uncertainty. I suppose it can be argued that even top-shelf destinations, those shortlisted by the venerable Fraser Institute in their…

-

The IMF suddenly got very gloomy: what does that mean for the price of gold?

Today, The International Monetary Fund (IMF) released a statement predicting that the global economy will take a $12 trillion hit from the Covid-19 pandemic. $12 trillion is 60% the size of the U.S. economy – or $1,500 for every man, woman and child on the planet. The 189-country organisation says it will take a minimum…

-

Guru’s $20M — $80M shortlist of gold and silver ExplorerCos (those with endgame potential)

Apologies for my tardiness. I had planned to put this article up over a week ago. But things have been pretty damn busy here at Guru Central, a clear indication that the next bull wave in mining stocks is upon us. Another indication that it’s game on in the junior arena: Nearly every private placement…

-

Nova Gold (NG.T) Chairman invokes The Clockwork Orange in folksy clap-back to short-seller report

the answer to a metals-analyst “when-question” should never include allusions to wine, chickens or pornography (a date would be more instructive).

-

2 million new investors are buying stocks on their cellphones

Stuck at home, but armed with online trading apps, individual investors helped drive the historic comeback for stocks

-

Guru’s shortlist of producing and advanced stage ExploreCos (those with endgame potential)

“Ball of confusion, that’s what the world is today”. Back in January of this year, we presented a solid case for approaching the broader markets with extreme caution in a piece titled, A “skies the limit” stock market = a house of cards? An excerpt: “Equities appear invincible. Indestructible. It would seem nothing—not a damn…