Tag: Athabasca Basin

-

Azincourt Energy Corp.: Navigating Uranium and Lithium Markets

Azincourt Energy Corp., a Canadian exploration-stage mining company, is strategically positioned in the uranium and lithium markets, with projects pri…

-

Abasca Resources: Navigating Uranium and Graphite Markets in 2025

Abasca Resources Inc., based in Saskatoon, Saskatchewan, is strategically positioned in the metals market with a focus on uranium and graphite. The co…

-

Standard Uranium (STND.V) coverage sees stock rise 90% in three days

In the market awareness game, it’s always difficult to honestly gauge ones effectiveness. When I write a story about a small uranium explorer with a fairly static share price and over the following three trading days it rises 90.5% in consistently outsized trading volume, how much of that is down to my getting the word…

-

Standard Uranium (STND.V) figured out how to make others pay them to work their own site

Standard Uranium (STND.V), a few years back, was all in on the Davidson River project. Uranium was hot and CEO Jon Bey had eyeballed a geo in Sean Hillacre who was young, accomplished during his time with NexGen Energy (NXE.T), and knew the ground as well as anyone. Bey’s pitch was simple; be a bigger…

-

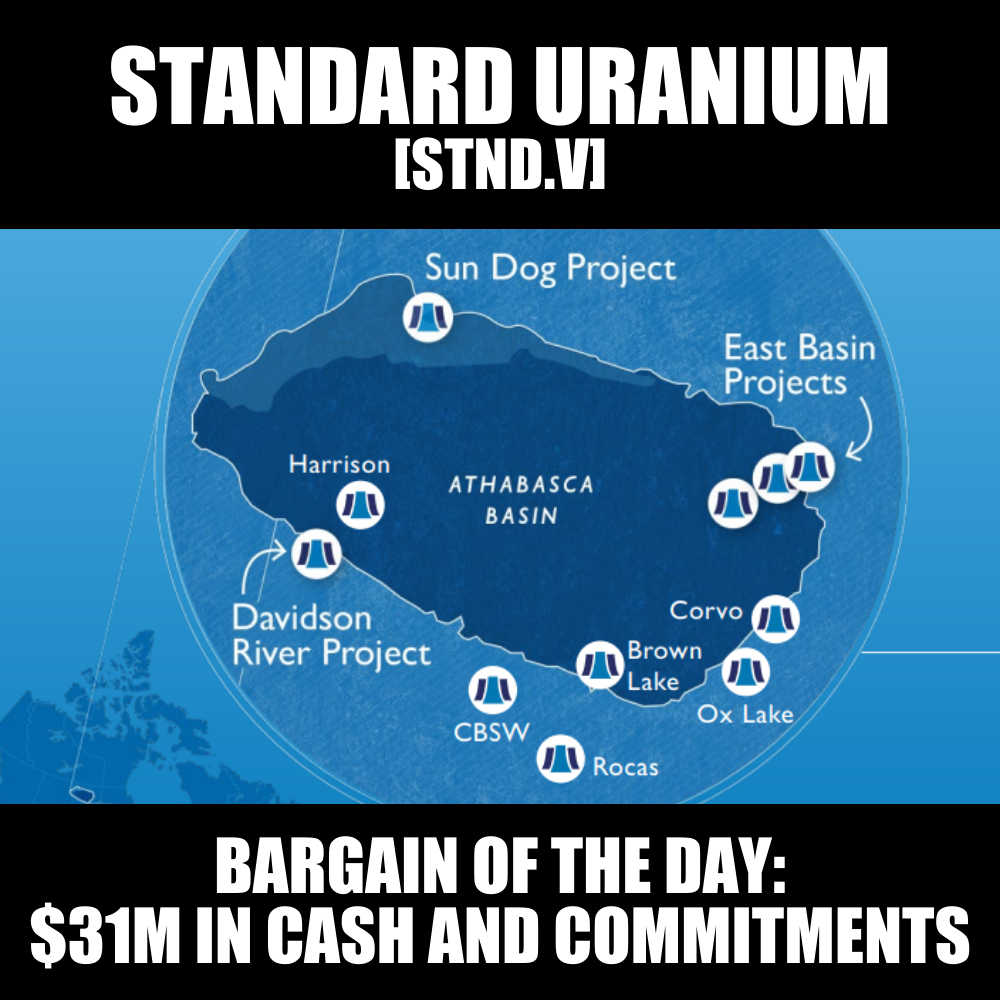

Bargain of the Day: $7m Standard Uranium (STND.V) has $31m in cash and commitments

I’m going to run through a list of assets that the $7m market cap explorer Standard Uranium (STND.V) has in its portfolio right now, and you can stop me when you think I’m making things up or it’s just too bananas to follow without laughing. Let’s go. 11 projects around the prolific Athabasca Basin, including:…

-

Fabi Lara’s uranium round-up: U prices running hard

Uranium – The Rocket Has Been Launched As we have been harping on for months HERE and HERE, pointing out the inevitability of a uranium price move upwards, we can finally say: it’s arrived. Technical analysts can pull out their crayons and draw lines to confirm the obvious: if demand is growing faster than supply,…

-

Tisdale Clean Energy (TCEC.C): A 20-yr uranium basket case until… just now

If you factor in all the rollbacks and the sell-offs and the flat years and the crashes, the downturns and boardroom battles and pivots and losses, Tisdale Clean Energy Corp (TCEC.C) has been a decades-long garbage disposal for investor dollars. But a funny thing has been happening in the last month, since Vancouver mining guy…

-

Uranium price takes out 2022 highs as bull market continues!

In July 2023, I gave a price target of $65 on spot uranium by the year end. The reason I chose $65 was because this was the 2022 highs and thus, the next major resistance zone for spot uranium. This was the chart I displayed back then: Uranium bulls did not have to wait until…

-

Uranium Market Dynamics, Nuclear Power and Global Security Concerns

In a world grappling with climate change and striving to shift towards green energy, nuclear power has emerged as a key player. This clean, efficient, and potent form of energy is increasingly needed to help us move away from fossil fuels. Central to this transformation is uranium, the fuel used in nuclear power generation. However,…

-

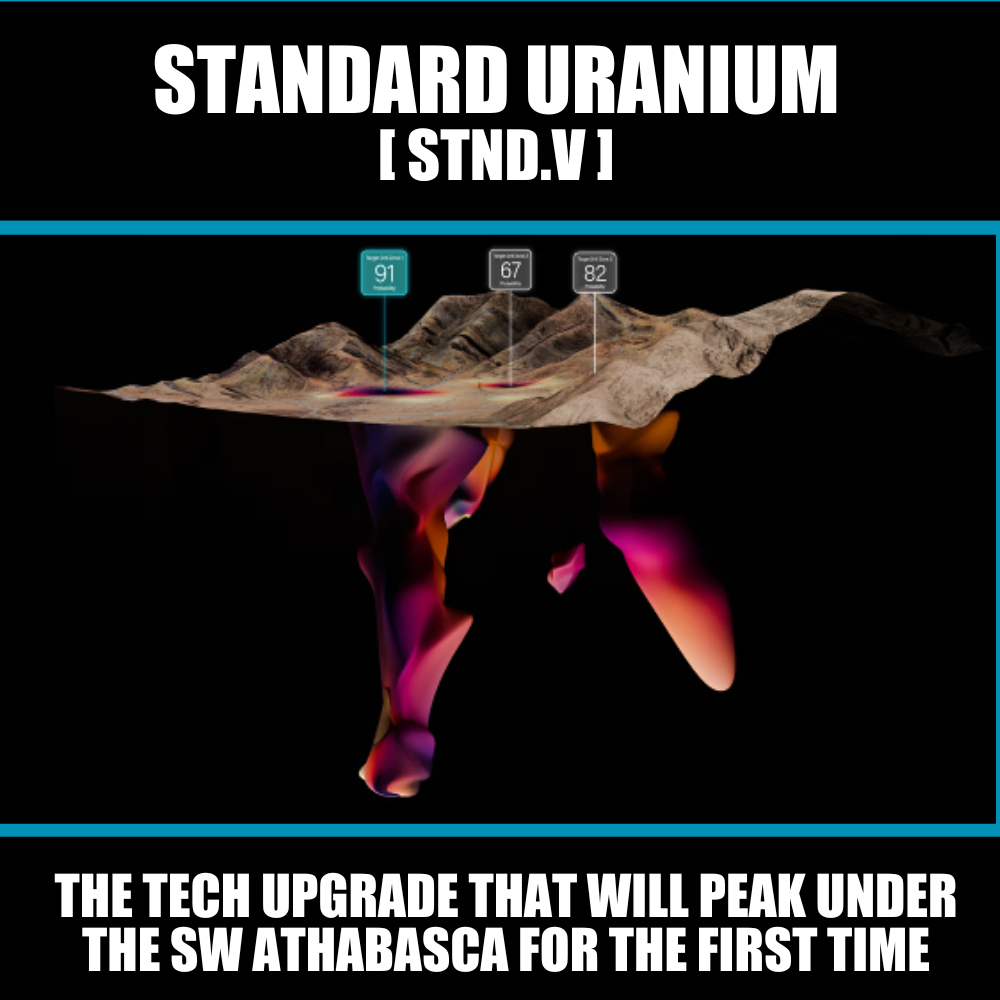

Screw you, Standard Uranium (STND.V) is on the way back

Standard Uranium (STND.V) was on the ropes, I’m not gonna lie. They went all in on a prospect in the Athabasca Basin and gathered a strong crew and fought the cold and did the work and rolled the dice, but what happened on the end of all that is what often happens in the mining…