Tag: BARI.V

-

The IMF suddenly got very gloomy: what does that mean for the price of gold?

Today, The International Monetary Fund (IMF) released a statement predicting that the global economy will take a $12 trillion hit from the Covid-19 pandemic. $12 trillion is 60% the size of the U.S. economy – or $1,500 for every man, woman and child on the planet. The 189-country organisation says it will take a minimum…

-

Berkshire Hathaway (BRK-A.NYSE): Warren Buffett is my hero but he got this detail wrong

“Nothing can basically stop America,” stated Buffett at Saturday’s virtual shareholder meeting. “The American miracle, the American magic has always prevailed and it will do so again.” Buffett’s opinion (about the resiliency of the U.S. economy) has been right for six decades. Why wouldn’t it continue to be right?

-

Gold Junior ETF (GDXJ.NYSE): gold offered “Hero Role” in re-make of “Apocalypse Now” – accepts gig on Hollywood Squares instead

Analysts have tied the retreat by gold in part to positioning, noting that data had shown extremely high net long speculative positions in gold futures. Still, the degree of the pullback in light of the continued selloff in equities was widely described as a surprise.

-

High-Risk/High-Reward… Guru’s sub-$20M ExplorerCo shortlist

Due to the number of companies I have in mind for this one, I’ll dispense with the usual preamble, except to say, gold is looking constructive on the charts (note the accumulation/distribution line), as is the GDX and the GDXJ. All three are holding their ground, and many of the companies I follow in the…

-

Barrian (BARI.V) eyes high-grade Nevada acquisition, consolidates its shares, contemplates PP

On Dec. 02, Barrian Mining (BARI.V) announced an interesting acquisition. The company signed a definitive purchase option agreement with Liberty Gold (LGD.T) for a 79.1% interest in the high-grade Kinsley Mountain Gold project located in northwest Nevada. Nevada Sunrise (NEV.V) owns the remaining 20.9%. The price of admission for BARI isn’t chump change: US$7,500,000 plus…

-

A handful of ExplorerCo standouts in Nevada—the mother of all mining jurisdictions

A couple weeks back we took a look at some of the more prospective (and active) exploration plays in Ontario and Quebec, particularly those along the prolific Abitibi Greenstone Belt. Today we shift our focus further to the south, to Nevada. If Nevada were a country, it would be the 4th largest gold producing nation…

-

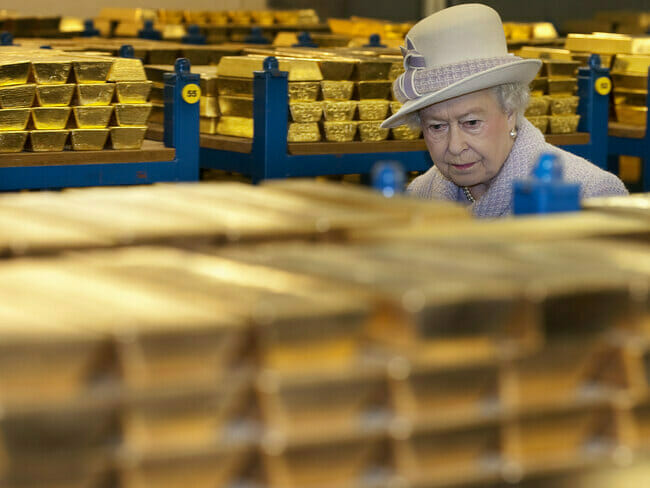

Gold: the unbearable brightness unseen

Where is gold going? Where will the gold price settle as 2019 draws to a close? And where will it trade a year from now? If some renegade time-looper handed me an envelope with the answers to these questions, I’m confident I’d be able to convert mere tip jar coinage into a retirement fund that…

-

Equity.Guru podcast: Barrian Mining (BARI.V) goes public to bring gold mining to millennials

Barrian Mining (BARI.V) announced the successful closure of its IPO a couple days ago and has a mandate to market its venture to the next generation of investors still relatively ignored by the mining sector – millennials. The company’s flagship Bolo project, located in Nevada, exhibits many geological characteristics of a potential Carlin gold deposit…

-

The overriding fundamentals underpinning the next upswing in gold

For the past few decades gold has stuck to a fairly reliable schedule – a cycle if you will – in carving out a major low every 8-years, roughly: Note that the above chart takes us only up to mid-2016. The projected gold price trajectory (green line) was a bit aggressive, but the chart illustrates…