Tag: China

-

Vext Science (VEXT.C) enters California market and records a COVID-19 era loss of only $1 million

If you stop and think about it, the fact that Vext Science (VEXT.C) only lost USD$1 million in Q1 of 2020 is fantastic. Today’s news, of their joint operation with Green Goblin Inc. of San Diego, California, for extraction, distillation and kitchen operations today is only of moderate importance. Granted, it’s the next natural step…

-

Oil prices take a dive, and Equity Guru tells you what it all means

As if 2020 has not been weird and unusual already, today the world experienced another unprecedented wacky event: negative oil prices. If anyone reading this is about to rush to the nearest gas station to get paid to fill up their tank, think again. I already tried that and it didn’t work. A more in-depth…

-

Sierra Wireless (SW.T), Telus (T.T), Firan Tech (FTG.T) – 3 Canadian companies on the 5G ramp

Granted, it may not be intuitively obvious why a toaster-oven needs to converse with a rectal thermometer – but trust me IoT is a gigantic thing that will require the 5G network to run efficiently.

-

Thursday Recap: Buy the Rumour, Sell the News

There we go. It’s here. President Donald Trump agreed to a phase-one trade deal with China, averting the Dec 15 introduction of new tariffs on $160 billion worth of Chinese goods.

-

Tuesday Recap: No Deadline for Tariff Man

“No Deadline” for Tariff Man Stocks dropped and bonds rallied in global markets shortly after President Trump fired his tariff weapon to France and Latin American Countries yesterday, and announced today that there is “no deadline” for reaching a trade deal with China. He added that he liked “the idea of waiting until after the…

-

Monday Recap: The Tariff Man Returns

Return of the Tariff Man Thanksgiving is over, and tariff man strikes again! This time: the victim is France. The US proposed tariffs on some $2.4 billion in French products, a response to a tax on digital revenues in France that hits large American tech companies including Google, Apple, Amazon, and Facebook. “France’s digital services…

-

Wednesday Recap: MedMen’s Woes and Trading The Trade War

Deal or No Deal? We’ve heard major news about the “phase one” deal being finalised and markets have traded up on looming optimism. But let’s not forget that Hong Kong is in the midst of a violent pro-democracy protest. Today, President Donald Trump signed legislation that expresses US support for protestors, a move that threatens…

-

Tuesday Recap: Dell, Best Buy, and China’s Slowdown

Dell Earnings The firm reported third-quarter earnings today that beat estimates for earnings per share, but fell short of meeting the street’s revenue expectations. Here are the stats: Shares traded down in aftermarket trading as the firm cut its FY2020 sales forecast. It’s not that surprising because if a firm is reducing its own expectations…

-

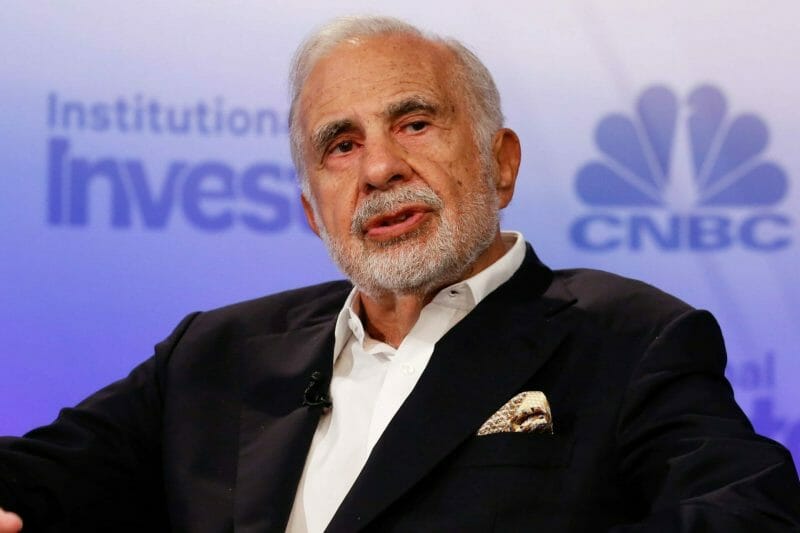

Tuesday Recap: Carl Icahn’s Big Short

Carl Icahn’s Big Short Billionaire Carl Icahn is betting against mall owners. He thinks they will be unable to service their debt. A lot many traders have made the same bet and lost millions of dollars, but it’s not something that’s stopping Icahn anytime soon. Icahn stands to gain as much as $400 million if…

-

Tuesday Recap: Political Economy, AbbVie, and Apple

Before it’s here, it’s in your inbox. Sign up for our daily markets newsletter here. Daily updates about what’s moving the markets. Political Economy I’m certain that Donald Trump’s legacy as President will contain many things, one of which will certainly be his impact on global markets. I think this will be iconic for two distinct reasons:…