Tag: DEFN.V

-

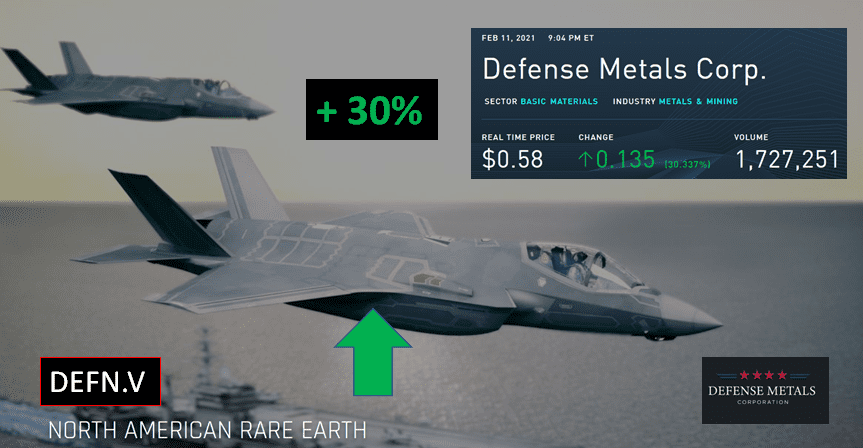

Defense Metals (DEFN.V) surges 30% as it looks to secure supply chain partners

“The engagement of Welsbach will enable Defense Metals to leverage their extensive experience and relationships in the Asia-Pacific region (Australia, Singapore, China, Japan, and South Korea), Continental Europe, and the United States towards engaging in one-on-one discussions with REE refiners and separators,” stated Craig Taylor, CEO of Defense Metals.

-

Defense Metals (DEFN.V) just mapped its 4,220-acre Rare Earth Element (REE) property in B.C.

The Wicheeda resource currently stands at 4,890,000 tonnes grading 3.02% LREO (Light Rare Earth Oxide) in the Indicated category, and 12,100,000 tonnes grading 2.90% LREO in the Inferred category.

-

Defense Metals (DEFN.V) surges as Tesla (TSLA.Q) Model 3 sales hit green energy tipping point

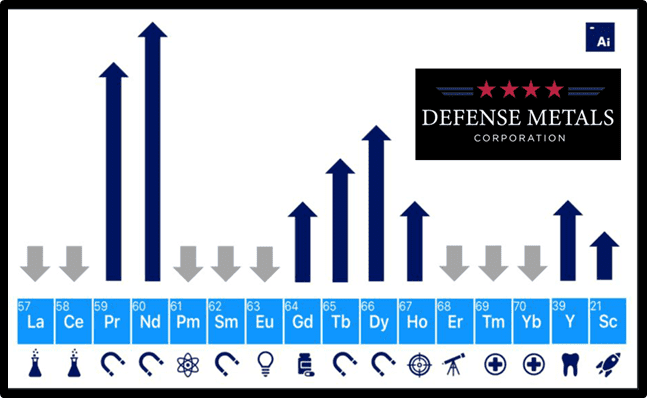

Defense Metals develops materials used in the electric power market, military, national security and the production of “GREEN” energy technologies, such as, high strength alloys and rare earth magnets.

-

Defense Metals (DEFN.V) defies ups and downs of resource sector, keeps adding to its base

If you don’t invest in resource companies because you’re concerned they do harm to the planet, I wonder where you think the metals in your Tesla are going to come from going forward. In recent years, any shift in thinking towards making other sectors more green has come with a definite up-front need for ores…

-

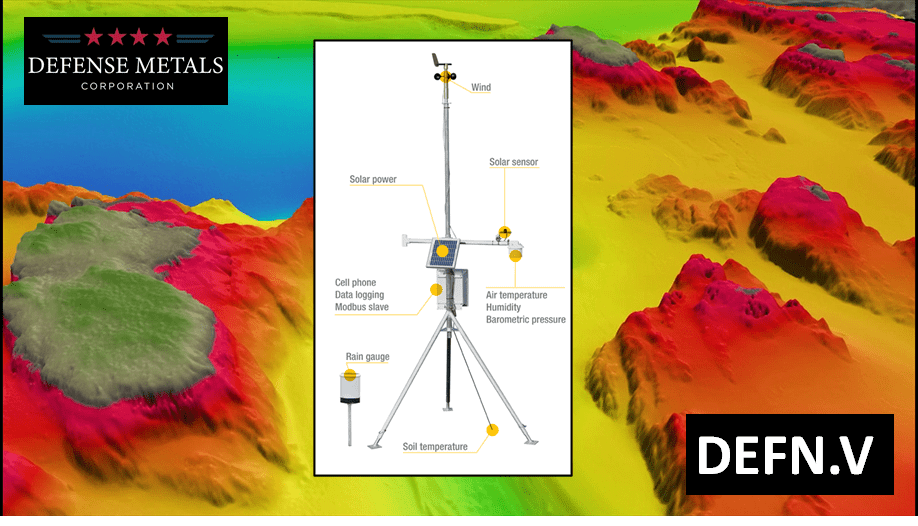

Defense Metals (DEFN.V) does base-line work to prepare for potential future Wicheeda REE mine site

The Wicheeda project has indicated mineral resources of 4,890,000 tonnes averaging 3.02% LREO (Light Rare Earth Elements) and inferred mineral resources of 12,100,000 tonnes averaging 2.90% LREO.

-

Defense Metals (DEFN.V) biz plan just got a boost from Fortress-MP Materials Merger news

The FVAC-MP Materials special meeting represents a significant milestone in the establishment of a North American critical magnet metals supply chain

-

Why did Pfizer’s (PFE.NYSE) vaccine news kick gold in the gonads? Under $20-million gold juniors in focus: BRG.V, FRE.V, GLM.C, SNL.C, TOC.C, XTT.V

“Basically, we are seeing an unwind of the trade we have been building up for the last six months,” he said. “But there is still plenty of uncertainty to support gold’s new regime. A vaccine is positive news, but it doesn’t change the narrative.”

-

An Equity Guru roundup – the sub-$20M ExplorerCos on our shortlist (1 of 4)

The junior mining sector has been mired in a holding pattern for the past two months. The metal itself is consolidating sharp gains registered since the beginning of the year. The larger stocks in the junior arena, as measured by the GDXJ… same thing (nice bit of price/volume violence surrounding the mid-March crash day lows).…

-

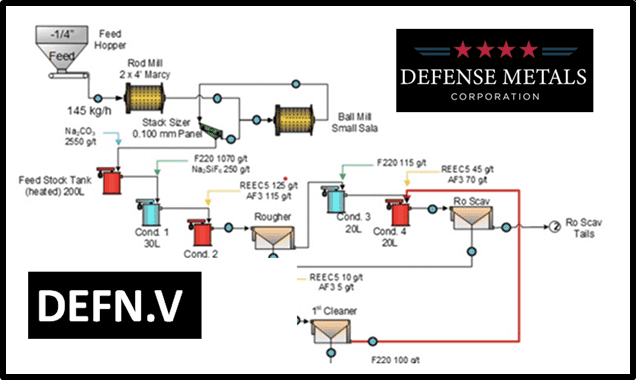

Defense Metals’ (DEFN.V) pilot plant metallurgy validates REE extraction plan

“Outside of China, the rest of the world is rapidly working to secure access to REE concentrate and processing facilities,” stated Taylor, “Given that the Wicheeda deposit is located in Canada, this gives us a strategic advantage as we continue to have discussions with various parties about this deposit.”

-

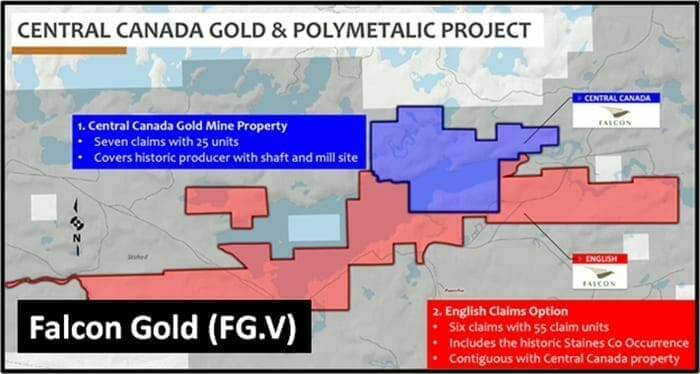

Falcon Gold (FG.V) releases strong results from 2nd drill hole in Ontario

Today, a tiny ($15 million market cap) gold company, Falcon Gold (FG.V), released strong results from its 2nd drill hole in Central Canada Gold Mine project in Ontario.