Tag: economics

-

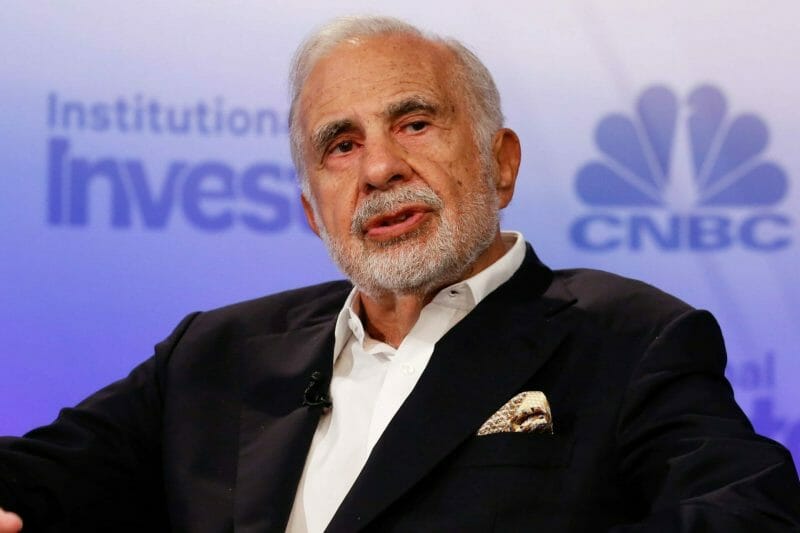

Tuesday Recap: Carl Icahn’s Big Short

Carl Icahn’s Big Short Billionaire Carl Icahn is betting against mall owners. He thinks they will be unable to service their debt. A lot many traders have made the same bet and lost millions of dollars, but it’s not something that’s stopping Icahn anytime soon. Icahn stands to gain as much as $400 million if…

-

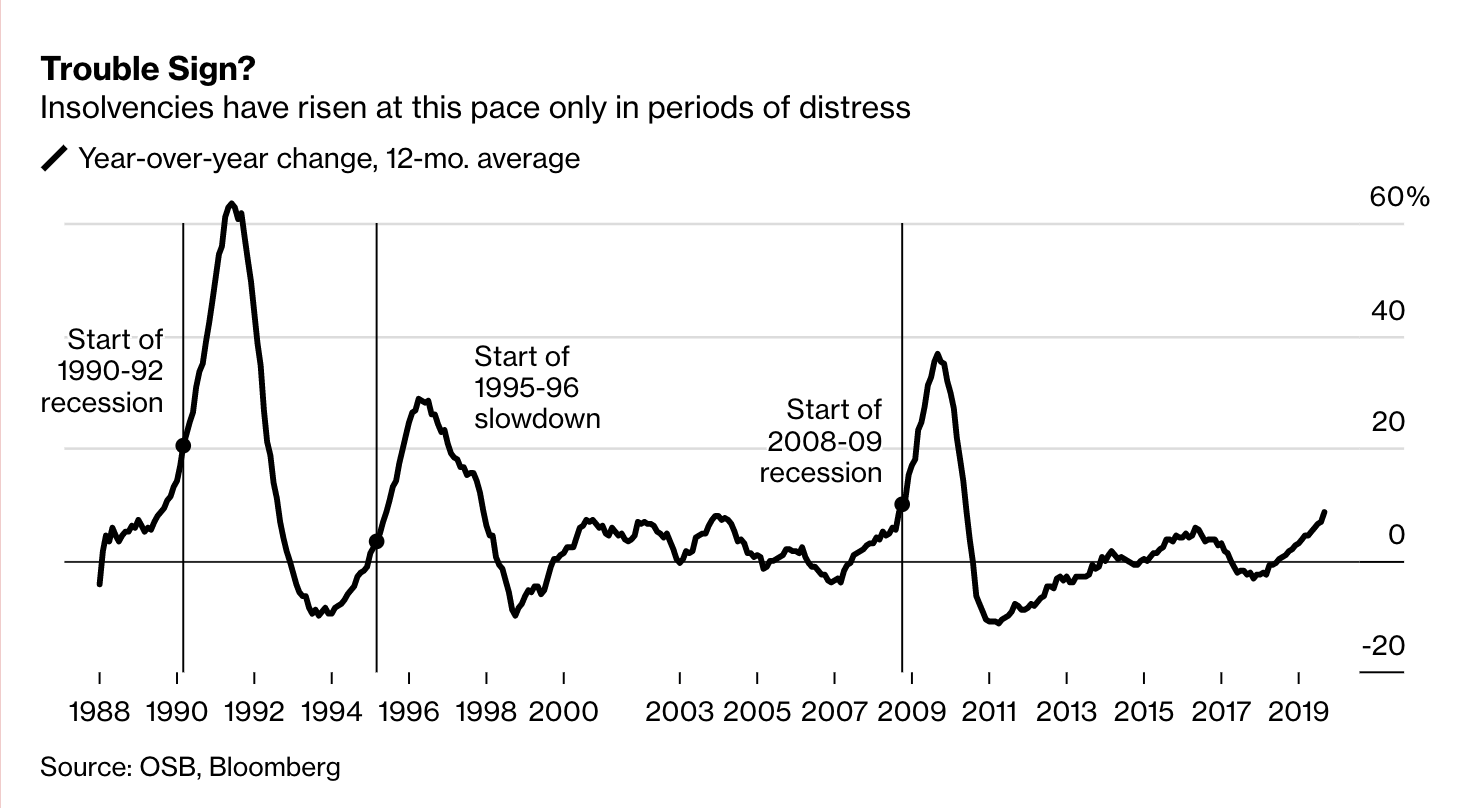

Monday Recap: Cracks in the Canadian Economy, Aramco IPO, Powell Meets Trump

Aramco IPO Oil giant Aramco is gearing up for a valuation between $1.6 – $1.7 trillion for its initial public offering. While this is short of the initial $2 trillion mark the crown prince hoped for, it still boasts the world’s largest IPO offering. The firm released a statement on Sunday aiming that it had…

-

Friday Recap: Cannapocalypse™, Dow Record, and Fed Report

Aurora CEO: “We will be profitable before others” Aurora Cannabis Inc. Chairman Michael Singer made a statement today that the firm will reach profitability before “any of its peers”, however, declined to comment by when this will happen. We spoke yesterday about the bloodbath that was Canopy and Aurora earnings. The chairman saying Aurora will…

-

Thursday Recap: Return of the Cannapocalypse, Walmart, and Powell

Cannapocalypse: Version 2 I think Canopy Growth ($CGC) and Aurora Cannabis ($ACB) should notify the makers of the Oxford English Dictionary that the word “earnings” has been redefined to mean “losses”. Both firms have been supposed “leaders” in the industry, and have let stakeholders down in the past quarter. My disappointment in these two companies…

-

Tuesday Recap: Political Economy, AbbVie, and Apple

Before it’s here, it’s in your inbox. Sign up for our daily markets newsletter here. Daily updates about what’s moving the markets. Political Economy I’m certain that Donald Trump’s legacy as President will contain many things, one of which will certainly be his impact on global markets. I think this will be iconic for two distinct reasons:…

-

Long and Short (Ep 2): The rate cut and what it means

For the first time since 2008, the Fed cut rates by 25 basis points to boost economic growth. In a perfect world, a lower cost of borrowing would’ve made the market soar. But stocks fell yesterday, and they fell today. It’s complicated. Let’s get into it: Interest rates and the economy The interest rates set…