Tag: ELY Gold Royalties

-

Unabated selling, dry powder, the upside of buying when you’re the only bidder in the room – a Guru roundup (Part 1)

A ‘medieval battlefield at dawn’ might best describe the current state of the junior exploration arena. Many of the stocks I track have been unseamed from the nave to the chops in recent weeks. An example of this pervasive, unabated selling pressure… The above chart depicts a well-run, cash-rich explorer on the cusp of defining…

-

Falcon Gold (FG.V) buys a Newfoundland gold project as CEO Karim Rayani backs his own company in the most meaningful way possible

On July 13, 2021 Falcon Gold (FG.V) announced that it has acquired a significant land position within the Hope Brook Area, Newfoundland. Falcon Gold has de-risked itself significantly by acquiring and developing multiple projects in multiple jurisdictions. That is a double-edged sword – as the messaging for the company can become fractured. “The company’s flagship…

-

Falcon Gold (FG.V) buys the Gaspard Gold Claims in British Columbia as gold price spikes USD $37/ounce

On March 9, 2021 Falcon Gold (FG.V) announced that the TSX Venture Exchange has approved the purchase of the Gaspard Gold Claims located in central BC. The Gaspard Property comprises 3 mineral claims, covering 3,955 hectares in the Clinton Mining District of central British Columbia. That’s about 10 X bigger than Stanley park. The Property…

-

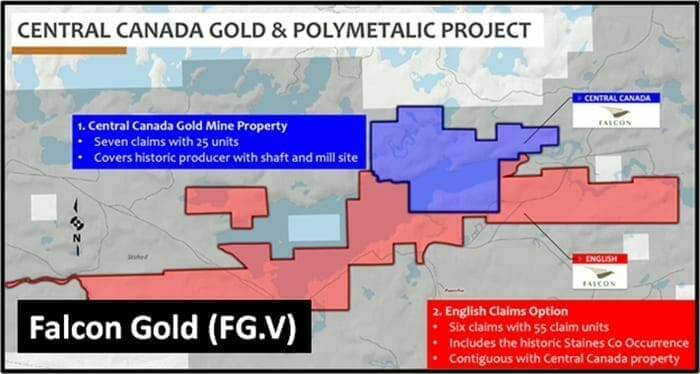

Falcon Gold (FG.V) releases strong results from 2nd drill hole in Ontario

Today, a tiny ($15 million market cap) gold company, Falcon Gold (FG.V), released strong results from its 2nd drill hole in Central Canada Gold Mine project in Ontario.

-

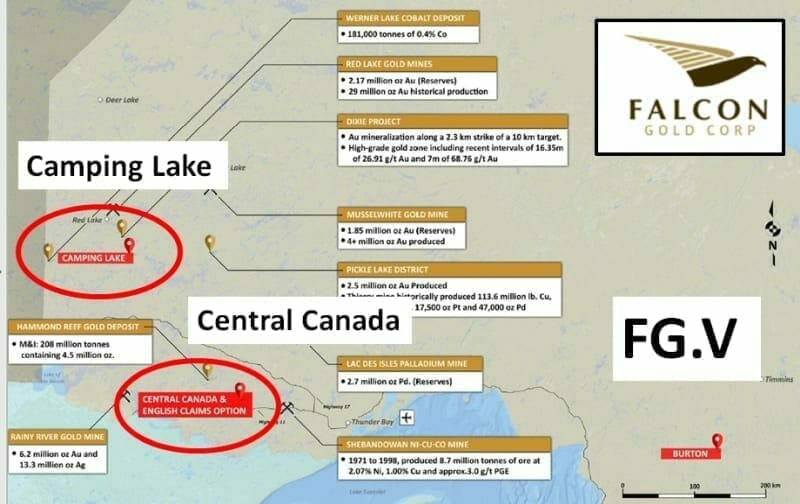

Falcon Gold (FG.V) boosts land package at Camping Lake, Ontario

The claims are contained within the Birch-Uchi-Confederation Lakes greenstone belt which host the world-renowned Red Lake gold deposits, including the Dixie project currently being drilled by Great Bear Resources (GBR.T).

-

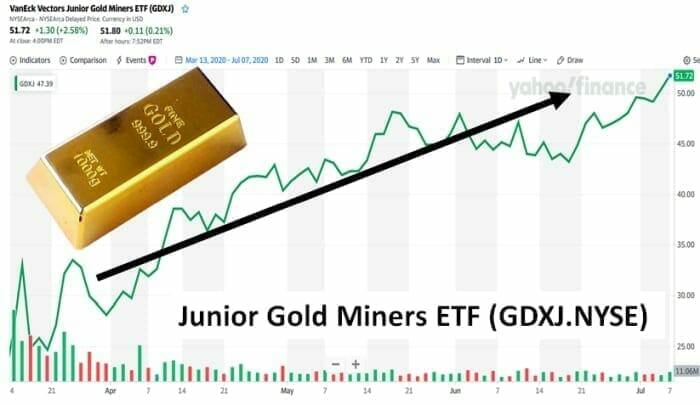

GDX.NYSE, GDXJ.NYSE: massive investment inflows into gold ETFs

H1 ETF inflows are higher than the record-setting central bank net purchases seen in 2018 and 2019, and “could absorb a comparable amount of about 45% of global gold production.”

-

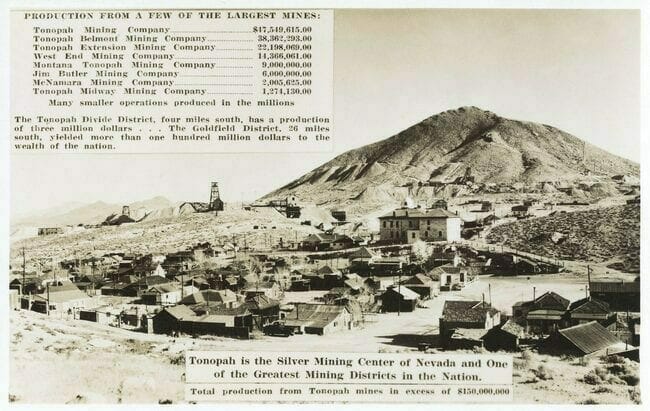

Blackrock Gold (BRC.V) drilling for high-grade in the Queen of all silver camps

We initiated Blackrock Gold (BRC.V) coverage back in April of 2018. Back then, it was a single project story, but a good one. The problem: Management was dragging its feet. Even though Blackrock held a potential world-class asset (we’ll talk about said asset—Silver Cloud—a little further down the page), management was doing the square root…

-

The IMF suddenly got very gloomy: what does that mean for the price of gold?

Today, The International Monetary Fund (IMF) released a statement predicting that the global economy will take a $12 trillion hit from the Covid-19 pandemic. $12 trillion is 60% the size of the U.S. economy – or $1,500 for every man, woman and child on the planet. The 189-country organisation says it will take a minimum…

-

Nova Gold (NG.T) Chairman invokes The Clockwork Orange in folksy clap-back to short-seller report

the answer to a metals-analyst “when-question” should never include allusions to wine, chickens or pornography (a date would be more instructive).

-

Falcon Gold (FG.V) hits 10.17 g/t Au over 3 Meters

The results have confirmed the presence of gold mineralization to a depth of 83 metres below surface of the historic Central Canada Gold Mine