Tag: Equinox Gold

-

Unabated selling, dry powder, the upside of buying when you’re the only bidder in the room – a Guru roundup (Part 1)

A ‘medieval battlefield at dawn’ might best describe the current state of the junior exploration arena. Many of the stocks I track have been unseamed from the nave to the chops in recent weeks. An example of this pervasive, unabated selling pressure… The above chart depicts a well-run, cash-rich explorer on the cusp of defining…

-

Golds (potential) catalysts – the Bitcoin vs Gold debate (oh, it’s most definitely on) – a roundup including Delta (DLTA.V), Arizona Metals (AMC.V), Nomad (NSR.T), Prime (PRYM.V), Defense (DEFN.V), and Forum (FMC.V)

It would appear that Gold, after a hasty retreat in Q1 of 21, is back to riding the $1750 line, a level that has held prices in check for the past month and a half. After breaching and taking out this key resistance level last week—pushing to $1760, nearly $80 higher from the lows tagged…

-

Arizona Metals (AMC.V) upsizes significant bought-deal PP within hours of announcement – triples the size of Kay Mine Project drill program to 75,000 meters

Arizona Metals (AMC.V) has been one of the better price performers in the junior exploration arena since it began trading in the summer-of-2019. Over the past 5 months in particular, the stock has demonstrated some very decent price trajectory, heightened by a runaway gap in mid-February. Clearly, the market sees the potential in this Company’s…

-

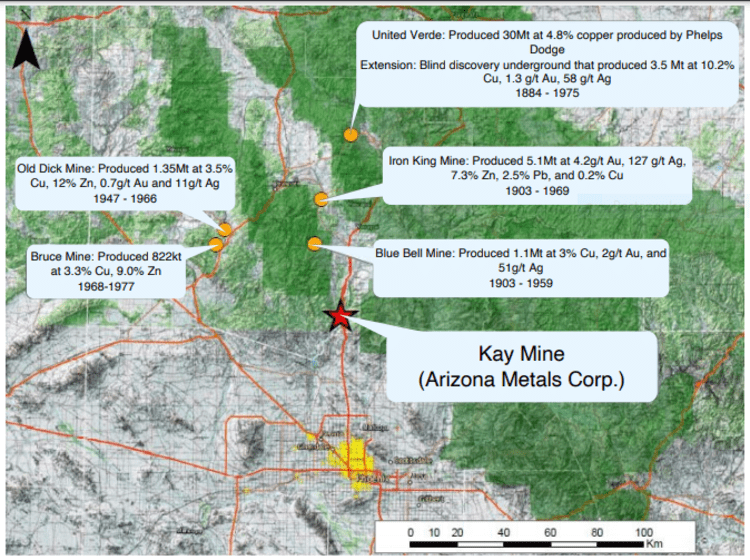

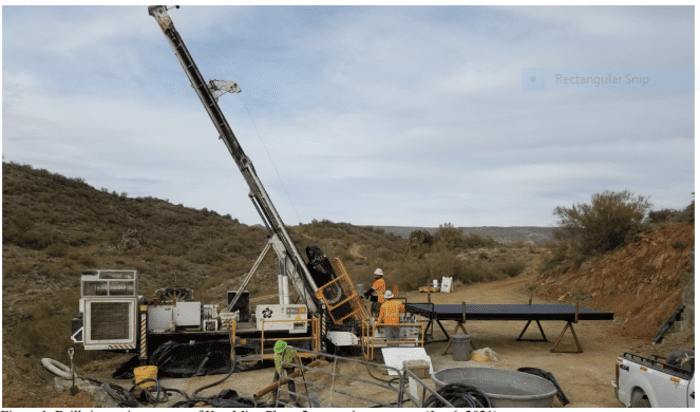

Arizona Metals (AMC.V) takes it up a notch – mobilizes 2nd drill rig to flagship VMS project in mining-friendly Arizona

One of the better volcanic massive sulphide (VMS) plays we’re aware of—Arizona Metals (AMC.V)—just accelerated a fully-funded Phase 2 drilling campaign at its flagship Kay Mine Project in mining-friendly Arizona. We like VMS settings here at Guru Central. Their ubiquitous nature being the reasoning—where there’s one deposit or lens, there’s often another, and another. These…

-

X-Terra (XTT.V) drills for gold, Arizona Metals (AMC.V) and Baru Gold (BARU.V) court U.S. investors

X-Terra (XTT.V) drills for gold, Arizona Metals (AMC.V) and Baru Gold (BARU.V) court U.S. investors

-

Arizona Metals (AMC.V) commences phase-2 drill program as share price doubles on back of rocketing copper prices

We have an impressive stable of resource clients here at Equity Guru, several of which produced significant gains in recent sessions. Defense Metals’ (DEFN.V) is a standout, having captured high ground not seen since it made its debut two years back. What’s really striking about this price trajectory is the accompanying volume. Defense is a…

-

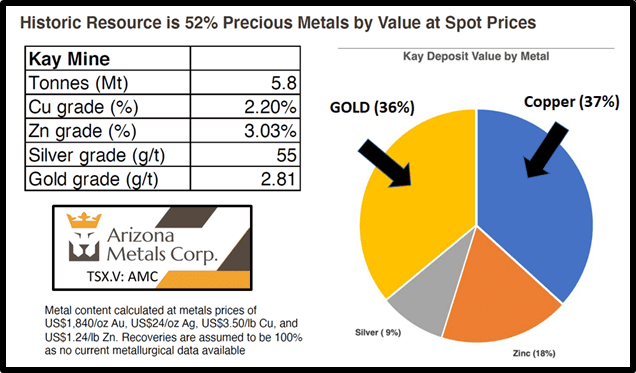

Arizona Metals (AMC.V) expands VMS land package as gold and copper come into focus

An 1982 historic estimate by Exxon Minerals reported a “proven and probable reserve of 6.4 million short tons at a grade of 3.03% zinc, 55 g/t silver and 2.8 g/t gold, 2.2% copper”.

-

Arizona Metals (AMC.V) and Delta Resources (DLTA.V) set stage for significant newsflow as 2020 draws to a close

It would appear that $1,850 is turning into a front line in the brawl between gold bulls and bears. After breaking through key support ($1,850) earlier in the week, the snap-back from the $1,767 level, anchored by a surfeit of compelling fundamentals, coincided with the U.S Dollar printing 2.5 year lows. Short term, the market…

-

Two strategic deposits, two strategic hires – Arizona Metals (AMC.V) and Defense Metals (DEFN.V)

When conducting due diligence on a prospective company in the junior exploration arena, the crew behind the enterprise needs to be examined with great rigor. I can’t stress this enough. Again, at the risk of sounding like a stuck record… you can have a great project, but without the right team in place, shareholder-value-creation is…

-

A Guru ClientCo Resource Roundup – Arizona Metals (AMC.V), Baru Gold (BARU.V), Golden Lake (GLM.C), Nomad Royalty (NSR.T), Sentinel Resources (SNL.C) and Freeport Resources (FRI.V)

Trading activity in the junior exploration arena is currently dominated by short tempers, across-the-board selling (some of it profit taking), and transient bouts of cautious buying. Should we have predicted this weakness, with the flurry of private placements from earlier this summer coming off hold? With the vorticity of economic and political uncertainty around the…