Tag: hedge against recession

-

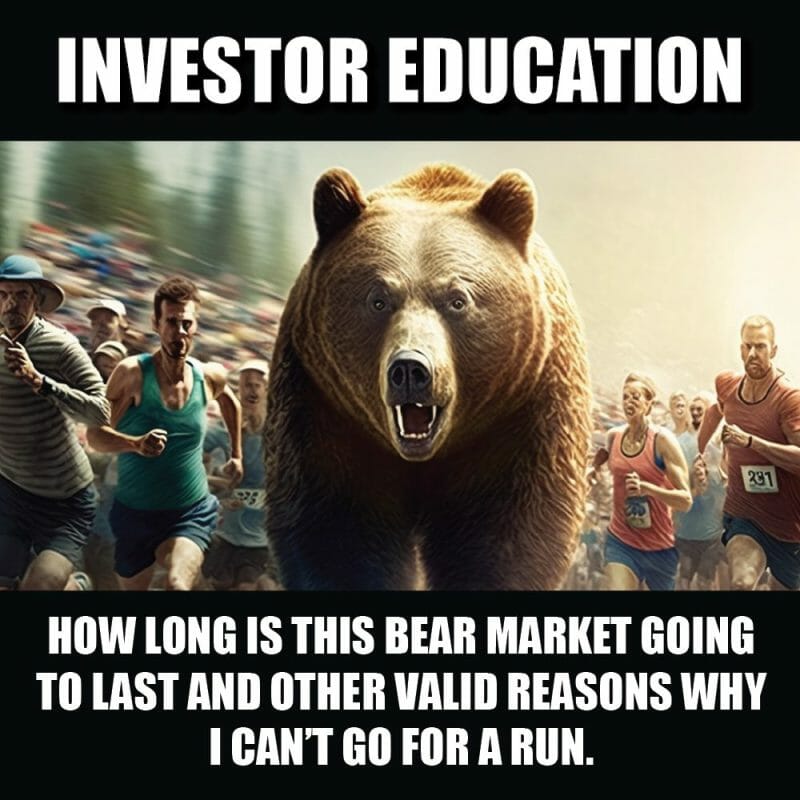

How Long is this Bear Market Going to Last and Other Valid Reasons Why I Can’t Go for A Run.

In lieu of resolutions and all things ‘bettering yourself’ (bleh), I have seen many go-getters sprinting down the seawall like their life depends on it. Good for them, I guess. My boyfriend tells me that running is a good way to ‘clear your head’ and is ‘easy once you get going’. I’d like to formally…

-

Gold (GLD.NYSE): Is the U.S. too broke to fight another war?

A $6.4 trillion price tag, means that adventures-in-the-middle east cost each U.S. tax-payer USD $42,000. The median U.S household has only $11,700 in savings. 29% of U.S. households have less than $1,000 in savings.

-

Martini-time for gold investors as the U.S. treasury yield curve inverts

This week the 3-month U.S. Treasuries are yielding more than 10-year notes. For the last 50 years, a yield curve inversion, has been an infallible predictor of recessions. The spread between 3-month bills and 10-year Treasuries has inverted before each of the past seven recessions. Bianco Research determined that historically, a recession arrives 12-18 months…