Tag: macroeconomics

-

There could be more pain before the market actually turns

Newsfeeds are clogged with “the bottom’s here!” narrative and we’re already seeing a significant bump in positivity in the public markets including risk-on assets like cryptocurrency, but are we out of the woods? This stream of social media ‘good news’ and bullish fervor comes as the yield curve inversion is in full swing. It might…

-

The U.S. Fed and market liquidity or welcome to the everything bubble

A translation of this article is available in Chinese at our partner website, NAI500 here. Before I get into the U.S. Fed and its market liquidity shenanigans, I should explain something that changed the way I view the world, kinda like the time I discovered Disney shoved lemmings off a cliff for ratings, almost making…

-

Monday Recap: Schwab + TD Ameritrade, Trade Talks, and Alibaba

Schwab buys TD Ameritrade It’s final: Schwab will buy TD Ameritrade for $26 billion to emerge as a giant with almost $5 trillion in assets. There’s no such thing as a free lunch, but at least there’s free trading. TD Ameritrade stockholders will get 1.0837 Schwab shares for each TD share, according to filings. This…

-

Thursday Recap: Price Wars Make A Good Acquisition Strategy

Nordstrom beats earnings Shares of Nordstrom surged by over 10% during extended trading Thursday after the company reported fiscal third-quarter earnings that beat analysts’ estimates. Here are the stats: Nordstorm may have beat earnings, but is still suffering the scourage that is upon the sector as a whole. However, the firm has leaned into changing…

-

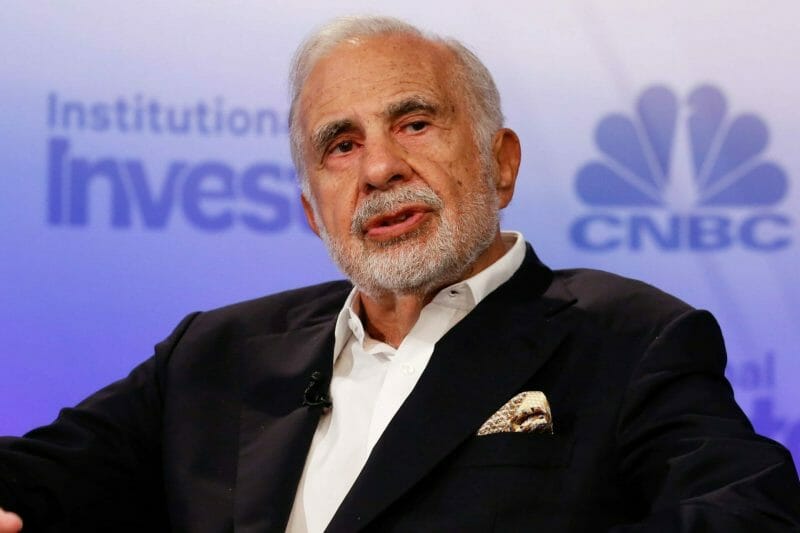

Tuesday Recap: Carl Icahn’s Big Short

Carl Icahn’s Big Short Billionaire Carl Icahn is betting against mall owners. He thinks they will be unable to service their debt. A lot many traders have made the same bet and lost millions of dollars, but it’s not something that’s stopping Icahn anytime soon. Icahn stands to gain as much as $400 million if…

-

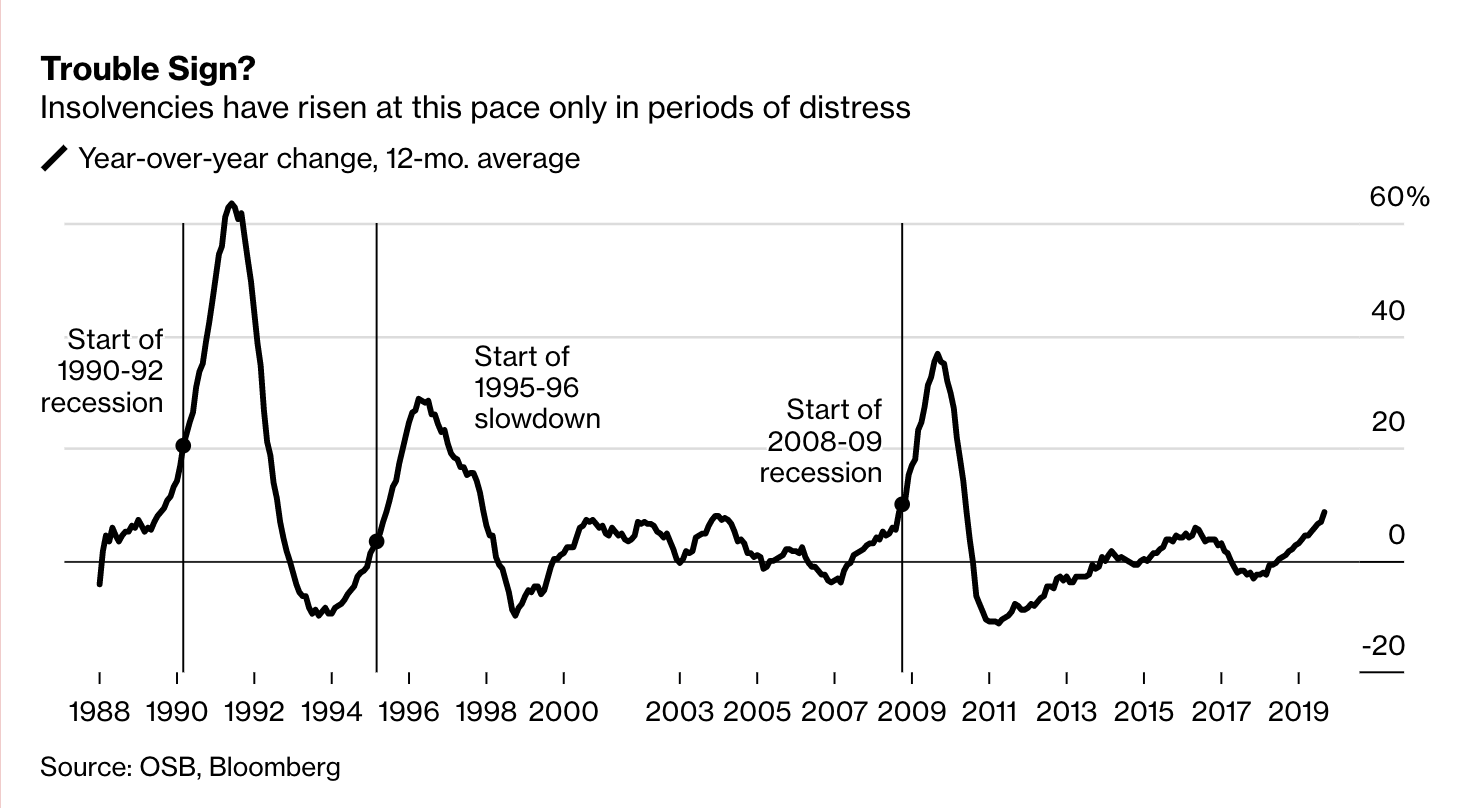

Monday Recap: Cracks in the Canadian Economy, Aramco IPO, Powell Meets Trump

Aramco IPO Oil giant Aramco is gearing up for a valuation between $1.6 – $1.7 trillion for its initial public offering. While this is short of the initial $2 trillion mark the crown prince hoped for, it still boasts the world’s largest IPO offering. The firm released a statement on Sunday aiming that it had…

-

Friday Recap: Cannapocalypse™, Dow Record, and Fed Report

Aurora CEO: “We will be profitable before others” Aurora Cannabis Inc. Chairman Michael Singer made a statement today that the firm will reach profitability before “any of its peers”, however, declined to comment by when this will happen. We spoke yesterday about the bloodbath that was Canopy and Aurora earnings. The chairman saying Aurora will…

-

Tuesday Recap: Political Economy, AbbVie, and Apple

Before it’s here, it’s in your inbox. Sign up for our daily markets newsletter here. Daily updates about what’s moving the markets. Political Economy I’m certain that Donald Trump’s legacy as President will contain many things, one of which will certainly be his impact on global markets. I think this will be iconic for two distinct reasons:…

-

India, Italy, Brazil, China and Spain or how sovereign debt smashed BRICS and deflated the EU dream

The financial crisis of 2007 wiped trillions off our global financial ledger. National economies reeled in the wake of banking’s biggest boo-boo since Reagan’s deregulation of the American Savings and Loan industry triggered the failure of almost two-thirds of the 3,234 savings and loans institutions in the United States from 1986 to 1995. Now, sovereign…