Tag: markets

-

Stock Markets and Gold shaky as bond yields rise

Besides Nvidia carrying the Nasdaq, the other major US indices have been a bit shaky. We will jump into the charts below. And as usual, the prime suspect is the action in the bond markets. Of course this has a lot to do with the Federal Reserve and interest rate cuts. At time of writing,…

-

US Senate Passes $1.9 Trillion Relief Stimulus Bill; How will the Stock Markets React?

A $1.9 Trillion Dollar Stimulus Bill was approved by the US Senate over the weekend, and is now expected to pass the House tomorrow. How will Stocks react? Stocks have recovered overnight and into this mornings trading session from Friday’s lows, but certain markets display different signs.

-

Medexus Pharmaceuticals (MDP.V), poised for flight on the Nasdaq (coming soon)

If you are like me and health sciences is your sector of choice when it comes to investing in the markets, you’d better be very patient, love doing research – and a willingness to see it through!!! A sector famous for its high-risk-high-reward characteristics is definitely not recommended for the faint of heart. Lucky for…

-

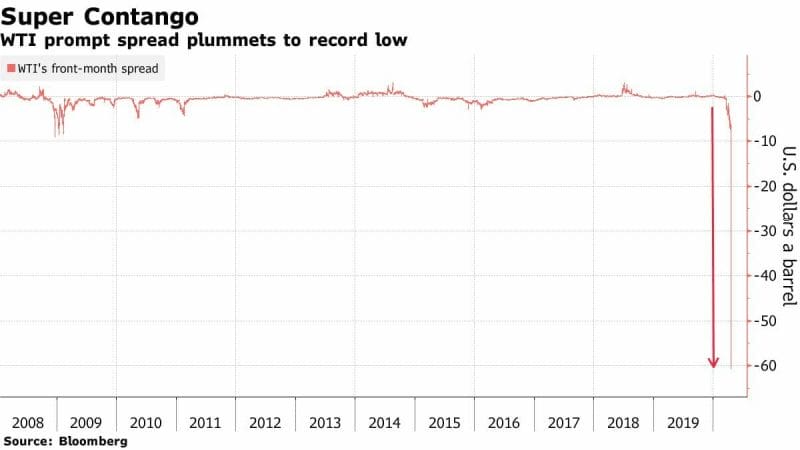

Worth Less Than Nothing: What Happened, Why It Did, What It Means, and What’s Next For Oil

What happens when a global pandemic meets a price war on oil? Or, what happens when severe practical problems meet ineffective policymakers? Rather, what happens when an exogenous shock exposes a fragile system that fails to engage critically in its own risk assessment? Oil prices go negative. US oil futures expiring tomorrow entered negative territory…

-

Friday Recap: Don’t Price in WW3, Fed Minutes, and Tesla “Deliveries”

Fed Minutes The Federal Reserve released its minutes for the December meeting, and here are the key takeaways: The overarching tone of Fed minutes is that members are on the same page regarding policy. However, futures market data seems to have already priced in optimism for one more rate cut by the end of the…

-

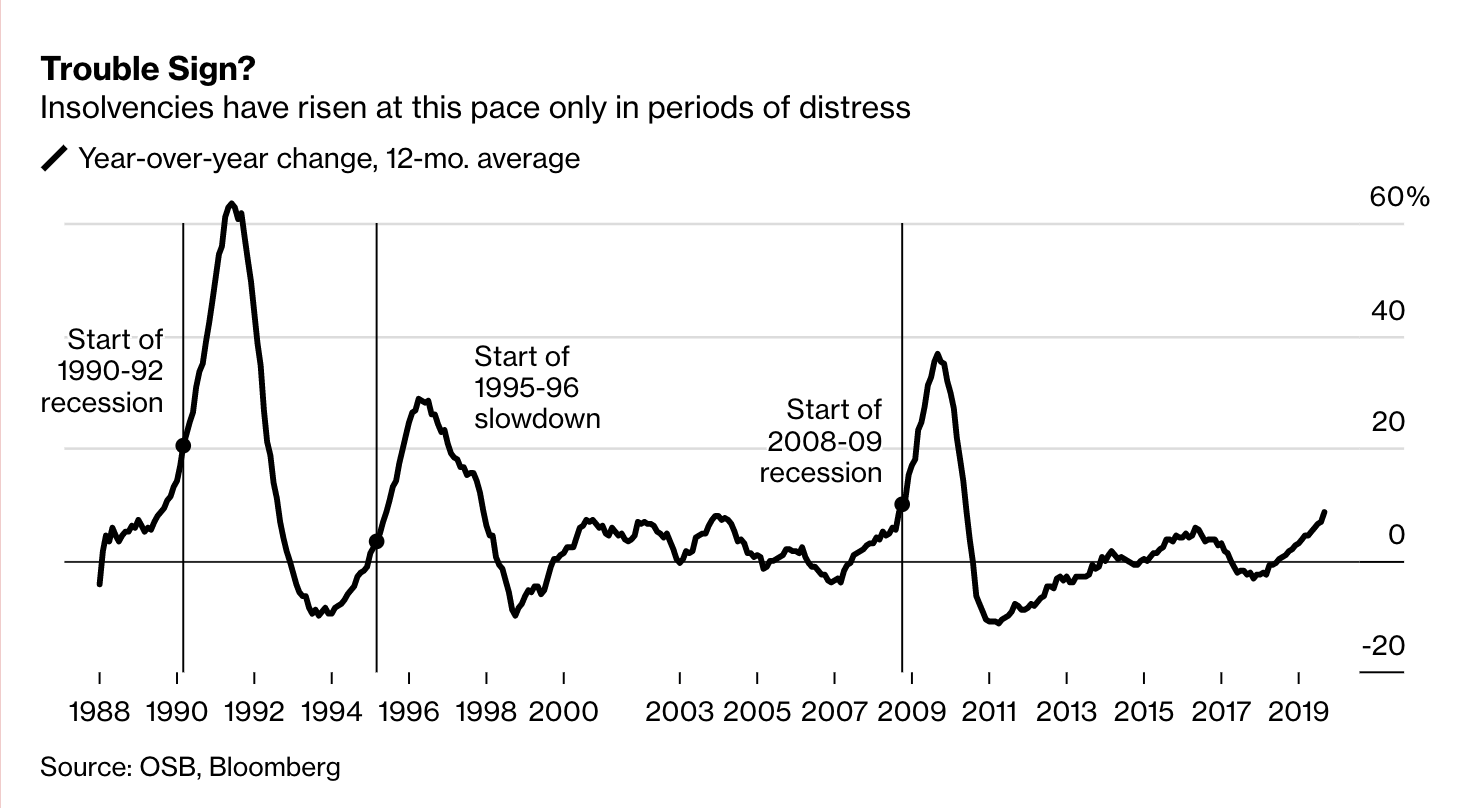

Friday Recap: Canada’s Economic Slowdown

Bond Sales Reach Record Highs With central banks cutting rates and yields dropping, investors have fled to other alternatives, primarily corporate bonds to get returns. Over $2.43 trillion worth of bonds have been sold this year so far, and many have scored double-digit returns on bond sales. For instance, here’s a story about a UBS…

-

Monday Recap: Cracks in the Canadian Economy, Aramco IPO, Powell Meets Trump

Aramco IPO Oil giant Aramco is gearing up for a valuation between $1.6 – $1.7 trillion for its initial public offering. While this is short of the initial $2 trillion mark the crown prince hoped for, it still boasts the world’s largest IPO offering. The firm released a statement on Sunday aiming that it had…

-

Thursday Recap: Return of the Cannapocalypse, Walmart, and Powell

Cannapocalypse: Version 2 I think Canopy Growth ($CGC) and Aurora Cannabis ($ACB) should notify the makers of the Oxford English Dictionary that the word “earnings” has been redefined to mean “losses”. Both firms have been supposed “leaders” in the industry, and have let stakeholders down in the past quarter. My disappointment in these two companies…

-

Tuesday Recap: Political Economy, AbbVie, and Apple

Before it’s here, it’s in your inbox. Sign up for our daily markets newsletter here. Daily updates about what’s moving the markets. Political Economy I’m certain that Donald Trump’s legacy as President will contain many things, one of which will certainly be his impact on global markets. I think this will be iconic for two distinct reasons:…

-

China: Markets, Media & Mayhem

Markets: From Monday to Thursday this week, stock markets in China got hammered as the pending trade deal between the U.S. and China fell apart. On Friday the Shanghai Composite gained 3.1% and the smaller cap Shenzhen Composite rose 3.8% – erasing most of the week’s losses. There are rumours the Chinese government ordered market-makers…