Tag: oil

-

Stock markets fall under pressure as oil prices hit their highest levels in 2023

I have been updating my readers on the technical pattern on oil. The energy sector is bullish and the technicals are indicating more upside. The stock markets are falling on fears of an inflation surprise uptick. Oil is the lifeblood of the economy and higher oil prices means higher transportation costs. Costs which will be…

-

Here’s why natural gas is going to be critical!

I was going to title this article “why millennials should pay attention to natural gas”. But it doesn’t matter what your age is. Moves in the natural gas markets will (and are already!) affecting you. If you are a regular reader of Equity Guru then none of this comes as a surprise. Not only have…

-

Oil price to resume uptrend on EU embargo on Russian oil. $185 a barrel oil?

Rising oil prices have been the talk on the street. Both Wall and Main street. Investors and traders are betting on higher prices due to geopolitics, while main street is worried higher fuel costs will eat into their monthly income as the inflation and rising interest rates hit the middle class. I am here to…

-

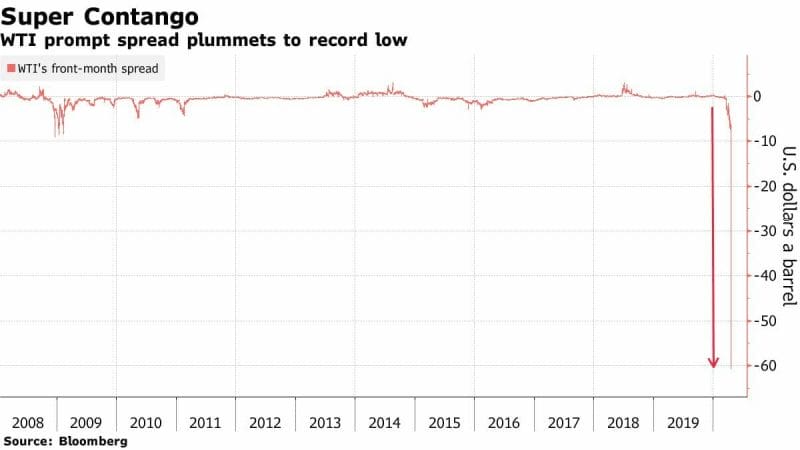

Worth Less Than Nothing: What Happened, Why It Did, What It Means, and What’s Next For Oil

What happens when a global pandemic meets a price war on oil? Or, what happens when severe practical problems meet ineffective policymakers? Rather, what happens when an exogenous shock exposes a fragile system that fails to engage critically in its own risk assessment? Oil prices go negative. US oil futures expiring tomorrow entered negative territory…

-

Oil prices take a dive, and Equity Guru tells you what it all means

As if 2020 has not been weird and unusual already, today the world experienced another unprecedented wacky event: negative oil prices. If anyone reading this is about to rush to the nearest gas station to get paid to fill up their tank, think again. I already tried that and it didn’t work. A more in-depth…

-

Extreme Fear Gauge readings versus notes of optimism from the Fed and a major investment bank

The across-the-board market volatility witnessed in recent sessions has been nothing short of astounding. Example: The lifeblood of a number of nations around the globe—Oil—did one jaw-dropper of a cliff dive yesterday… Then, only 24 hours later, Oil put on a show that would’ve made even Ed Sullivan stand up and applaud (a close-up 3-month…

-

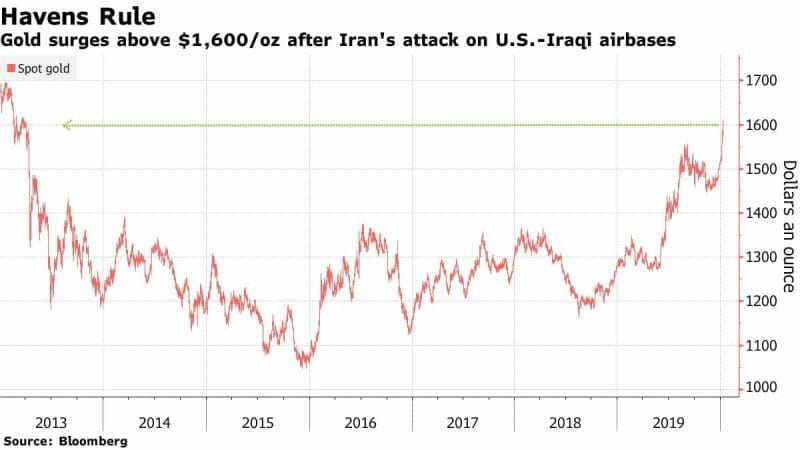

Reeling markets, helicopter cash and a sweet spot for Canadian Gold Producers

Some ask, “if gold is such a safe haven asset, why did it get sold so unrelentingly when the broader indices caught what-for?” Great question. Gold was sold because it was a source of liquidity during a liquidity event. ANYTHING even remotely liquid was sold during the panic, regardless of underlying value or safe-haven caste.…

-

Fortunes won and lost in Oil’s recent volatility

NYMEX (WTI) Light Sweet Crude Oil is the world’s most liquid and actively traded crude oil futures contract. If you think you know oil, and you fancy yourself a nimble trader (and are looking for some pick-your-jaw-off-the-floor price action), the “Texas light sweet” WTI contract—ticker symbol CL—is the most efficient way to trade this madhouse…

-

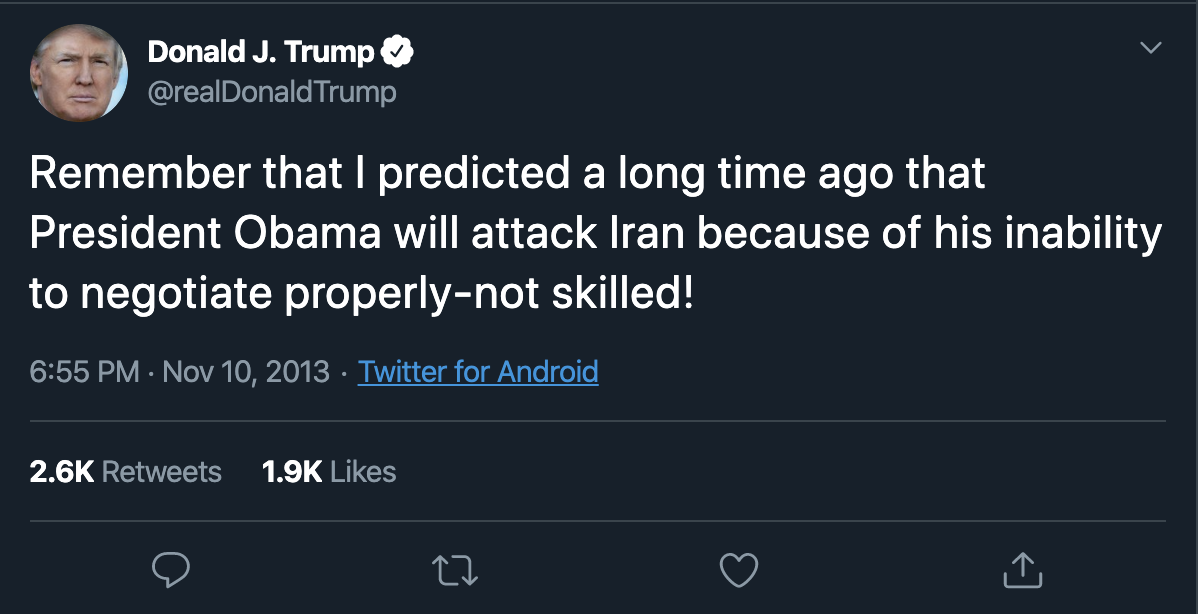

Markets and the Middle East: A look at Gold, Oil, and Student Debt

BREAKING: Boeing 737 Jet Crashes in Iran due to technical issues after takeoff. Source (ISNA) Oil Stuff & The Middle East At least two airbases housing US troops in Iraq have been hit by more than a dozen ballistic missiles. Iranian state TV says the attack is a direct retaliation to the US killing top…

-

Friday Recap: Don’t Price in WW3, Fed Minutes, and Tesla “Deliveries”

Fed Minutes The Federal Reserve released its minutes for the December meeting, and here are the key takeaways: The overarching tone of Fed minutes is that members are on the same page regarding policy. However, futures market data seems to have already priced in optimism for one more rate cut by the end of the…