Tag: Sangihe Gold Project

-

Baru Gold’s (BARU.V) progress in Indonesia defies Fraser Institute warnings

“BARU’s flagship asset—the Sangihe Gold Project—is being fast-tracked to production and should begin cash-flowing as early as Q2 of 2021,”

-

BARU Gold (BARU.V) gets greenlight for Sangihe Gold Project from Indonesia’s Ministry of Energy and Mineral Resources

Those of us holding shares in Baru Gold (BARU.V) have been waiting patiently for the Indonesian government to greenlight the Company’s flagship asset. The pandemic intervened causing a three-month delay. This flagship asset—the Sangihe Gold Project—is being fast-tracked to production, and after yesterday’s news, it should begin cash-flowing as early as Q2 of 2021. The…

-

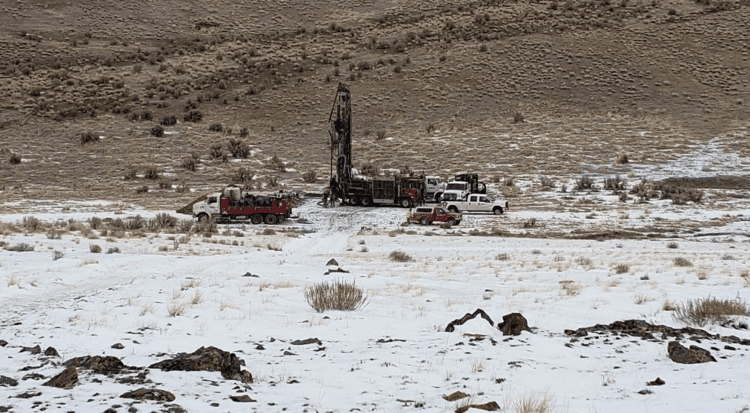

X-Terra (XTT.V) drills for gold, Arizona Metals (AMC.V) and Baru Gold (BARU.V) court U.S. investors

X-Terra (XTT.V) drills for gold, Arizona Metals (AMC.V) and Baru Gold (BARU.V) court U.S. investors

-

A Guru ClientCo Resource Roundup – Delta (DLTA.V), Nomad (NSR.T), Freeman (FMAN.C), Defense (DEFN.V), Fremont (FRE.V), and BARU.V

The battle for dominance over the $1850 front line in gold wages on. We’ve been reporting on this conflict—the brawl between bulls and bears over this key level of support (and resistance)—for a number of weeks. As I type here in the predawn light of Jan. 14th, 2021, gold bulls are attempting to regain control…

-

Baru Gold (BARU.V) checks another box on the way to Indonesia gold production

Baru is so confident in the economics of its gold resource, it’s not bothering to spend years (sometimes decades) de-risking the project using traditional geological protocols.

-

A Guru ClientCo Resource Roundup – Arizona Metals (AMC.V), Baru Gold (BARU.V), Golden Lake (GLM.C), Nomad Royalty (NSR.T), Sentinel Resources (SNL.C) and Freeport Resources (FRI.V)

Trading activity in the junior exploration arena is currently dominated by short tempers, across-the-board selling (some of it profit taking), and transient bouts of cautious buying. Should we have predicted this weakness, with the flurry of private placements from earlier this summer coming off hold? With the vorticity of economic and political uncertainty around the…

-

Yahoo Finance-Harris poll confirms that armies of newbie investors are recklessly buying options

According to the latest Yahoo-Harris poll published on Sept. 9, 2020 – an astonishing 43% of retail investors said they are “using options, margin, or both.”

-

East Asia (EAS.V) achieves major milestone, pushes Sangihe gold project one step closer to production

On a down day for the metals and the Dow 30 taking it squarely on the chin with an 800 point shellacking, East Asia (EAS.V) bucked the trend and put on a really big show (Ed Sullivan voice). This impressive price trajectory—a 50% charge to higher ground—was accompanied by huge volume. The reason for the…

-

Equity Guru ExploreCo news round up – Defense (DEFN.V), East Asia (EAS.V), Falcon (FG.V), Golden Lake (GLM.C), Nubian (NBR.V), Nexus (NXS.V), and X-Terra (XTT.V)

Back in October of 2019, I penned the following concerning gold and the companies that make the metal their business: In times of rampant currency debasement, geopolitical uncertainty (twitchy chest-puffing politicians instigating trade wars via Twitter), gold belongs in a balanced portfolio in order to reduce risk. Not only is gold a great hedge against…

-

Why did Buffett do a U-turn on gold?

“Dumping bank shares and investing in a gold miner? It certainly doesn’t sound like a Warren Buffett move, but that’s exactly what the investing guru’s company did in the second quarter,” states Bloomberg, “It’s not a good sign for markets.”