Tag: SGS Canada

-

Golds (potential) catalysts – the Bitcoin vs Gold debate (oh, it’s most definitely on) – a roundup including Delta (DLTA.V), Arizona Metals (AMC.V), Nomad (NSR.T), Prime (PRYM.V), Defense (DEFN.V), and Forum (FMC.V)

It would appear that Gold, after a hasty retreat in Q1 of 21, is back to riding the $1750 line, a level that has held prices in check for the past month and a half. After breaching and taking out this key resistance level last week—pushing to $1760, nearly $80 higher from the lows tagged…

-

The plot thickens – Defense Metals (DEFN.V) draws interest from two international REE processors

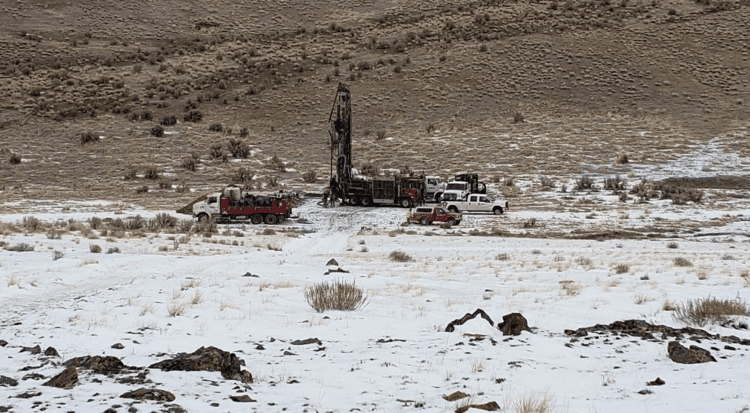

Yesterday, on March 23rd, Defense Metals (DEFN.V) dropped an important headline—one I’ve been eagerly anticipating as I monitor developments from the sidelines. Leading up to this news event, in a recent interview with Defense Metals’ CEO, Craig Taylor, I asked… “Back in February, you engaged Welsbach Holdings to assist you in a number of areas.…

-

Defense Metals (DEFN.V) continues to de-risk its high-grade REE deposit in mining-friendly B.C. PLUS a Q & A with CEO Craig Taylor

Rare Earth Elements (REEs) are a major driver in the green-ride (EV) revolution. Electric motors, generators, catalytic converters, component sensors, LCD screens… REEs can even be found in the powder used to polish the windshields and mirrors. Hailed as the “vitamins of chemistry”, REEs exhibit a broad range of electronic, optical, and magnetic properties. They’re…

-

3 Guru clients making headlines in recent sessions – Defense (DEFN.V), Globex (GMX.T) and Huntsman (HMAN.V)

Three companies on our client list dropped headlines in recent sessions. Let’s dive right in. Defense Metals (DEFN.V) Defense has generated its fair share of joy in recent weeks. An increasingly volatile political backdrop threatening the REE supply chain and recent corporate initiatives put a spotlight on the Company’s flagship resource. Hats off to the…

-

A Guru ClientCo Resource Roundup – Delta (DLTA.V), Nomad (NSR.T), Freeman (FMAN.C), Defense (DEFN.V), Fremont (FRE.V), and BARU.V

The battle for dominance over the $1850 front line in gold wages on. We’ve been reporting on this conflict—the brawl between bulls and bears over this key level of support (and resistance)—for a number of weeks. As I type here in the predawn light of Jan. 14th, 2021, gold bulls are attempting to regain control…

-

Two strategic deposits, two strategic hires – Arizona Metals (AMC.V) and Defense Metals (DEFN.V)

When conducting due diligence on a prospective company in the junior exploration arena, the crew behind the enterprise needs to be examined with great rigor. I can’t stress this enough. Again, at the risk of sounding like a stuck record… you can have a great project, but without the right team in place, shareholder-value-creation is…

-

Why did Pfizer’s (PFE.NYSE) vaccine news kick gold in the gonads? Under $20-million gold juniors in focus: BRG.V, FRE.V, GLM.C, SNL.C, TOC.C, XTT.V

“Basically, we are seeing an unwind of the trade we have been building up for the last six months,” he said. “But there is still plenty of uncertainty to support gold’s new regime. A vaccine is positive news, but it doesn’t change the narrative.”

-

An Equity Guru roundup – the sub-$20M ExplorerCos on our shortlist (1 of 4)

The junior mining sector has been mired in a holding pattern for the past two months. The metal itself is consolidating sharp gains registered since the beginning of the year. The larger stocks in the junior arena, as measured by the GDXJ… same thing (nice bit of price/volume violence surrounding the mid-March crash day lows).…

-

Yahoo Finance-Harris poll confirms that armies of newbie investors are recklessly buying options

According to the latest Yahoo-Harris poll published on Sept. 9, 2020 – an astonishing 43% of retail investors said they are “using options, margin, or both.”

-

Why did Buffett do a U-turn on gold?

“Dumping bank shares and investing in a gold miner? It certainly doesn’t sound like a Warren Buffett move, but that’s exactly what the investing guru’s company did in the second quarter,” states Bloomberg, “It’s not a good sign for markets.”