Tag: Standard Uranium

-

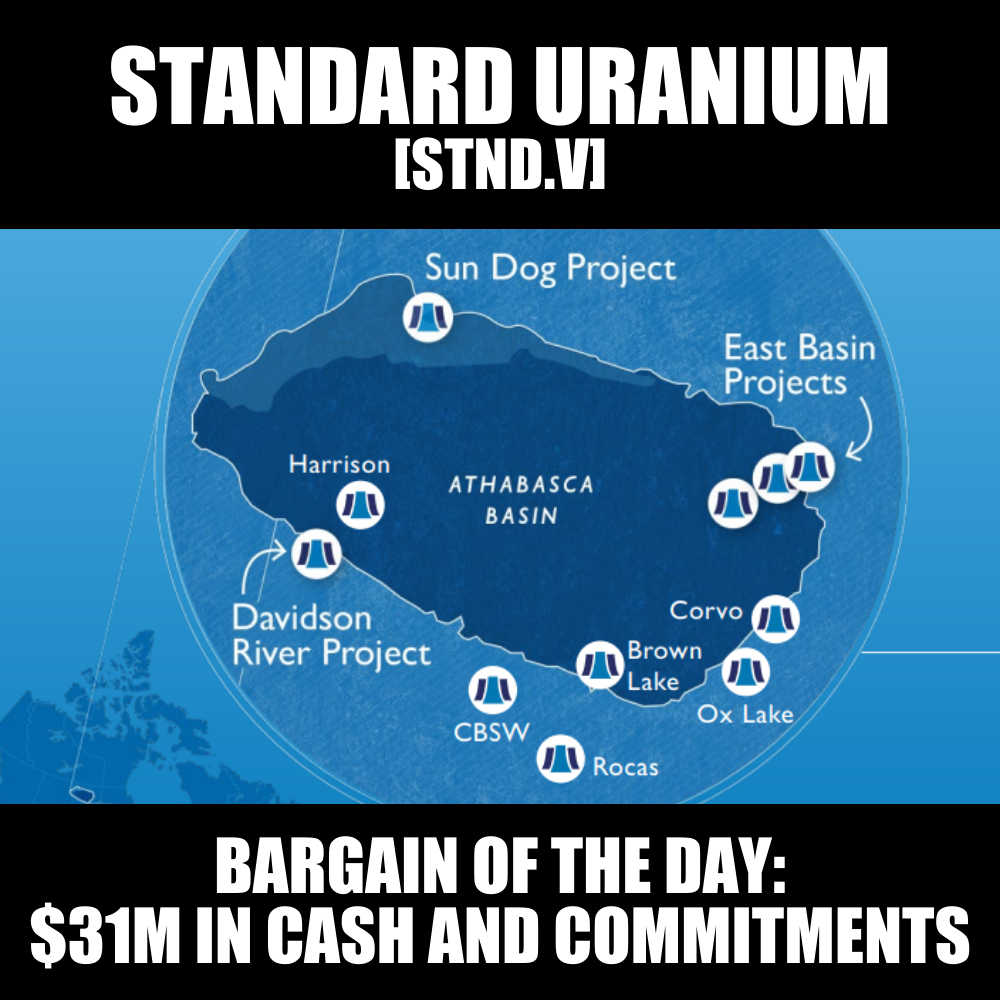

Bargain of the Day: $7m Standard Uranium (STND.V) has $31m in cash and commitments

I’m going to run through a list of assets that the $7m market cap explorer Standard Uranium (STND.V) has in its portfolio right now, and you can stop me when you think I’m making things up or it’s just too bananas to follow without laughing. Let’s go. 11 projects around the prolific Athabasca Basin, including:…

-

Standard Uranium (STND.V) looks to add to Sun Dog’s uranium history

They call it Sun Dog, which is a misnomer in two parts. It’s colder than heck out there for a lot of the year, and it;s definitely no dog of a project. Standard Uranium’s (STND.V) recent adventure at the Sun Dog Project, where they’ve joined forces with Aero Energy Ltd. to explore the atomic depths…

-

Atco Mining and Standard Uranium show promising early uranium drill results

In the remote stretches of northern Saskatchewan’s Athabasca Basin, Atco Mining Inc. (ATCM.C) and Standard Uranium (STND.V) have completed their inaugural drilling program at the Atlantic Project, a 3,061-hectare area promising in uranium potential. The project, which Standard is doing the work on and holds the option on, while Atco raises dough to pay for…

-

Standard Uranium (STND.V) is the engine making a lot of projects move forward

Had a conversation yesterday with someone I trust who has made his money in the mining space, about uranium explorers. “There’s just so many that are junk,” I exclaimed, asking, “how does a well run explorer stick its head out in this sector and get noticed?” My friend asked who I liked, and I said…

-

Fabi Lara’s uranium round-up: U prices running hard

Uranium – The Rocket Has Been Launched As we have been harping on for months HERE and HERE, pointing out the inevitability of a uranium price move upwards, we can finally say: it’s arrived. Technical analysts can pull out their crayons and draw lines to confirm the obvious: if demand is growing faster than supply,…

-

Multi-Company Wrap: Watching the watchlist so you don’t have to

We have some 29 companies on our watchlist, all in a variety of sectors, that we’re covering at any one time. Some are clients, some not, some are on deaths door, some are skyrocketing, so we’ve decided to wrap them all up into one monthly wrap so you can keep track of everything at once.…

-

Uranium price takes out 2022 highs as bull market continues!

In July 2023, I gave a price target of $65 on spot uranium by the year end. The reason I chose $65 was because this was the 2022 highs and thus, the next major resistance zone for spot uranium. This was the chart I displayed back then: Uranium bulls did not have to wait until…

-

Uranium Market Dynamics, Nuclear Power and Global Security Concerns

In a world grappling with climate change and striving to shift towards green energy, nuclear power has emerged as a key player. This clean, efficient, and potent form of energy is increasingly needed to help us move away from fossil fuels. Central to this transformation is uranium, the fuel used in nuclear power generation. However,…

-

Screw you, Standard Uranium (STND.V) is on the way back

Standard Uranium (STND.V) was on the ropes, I’m not gonna lie. They went all in on a prospect in the Athabasca Basin and gathered a strong crew and fought the cold and did the work and rolled the dice, but what happened on the end of all that is what often happens in the mining…

-

Spotlight on the Uranium Market: Emerging Opportunities Amidst Price Spikes and Underperforming Stocks

So this is it, we’ve finally started to see what’s been brewing in the long-term uranium market for a while, finally reaching the spot market, as the price is breaking out and reached $57.65 USD/lb very recently, and it looks like it’s stabilizing around the $56-57 range. As previously mentioned here, the Swiss vehicle, Zuri-invest…