Tag: streaming and royalty

-

Globex Mining (GMX.T) sells Tarmac Gold Property to Wesdome (WDO.T) after 41.2 grams/tonne gold over 51.1 metres hit at the Kiena Mine Complex

On July 12, 2021 Globex Mining (GMX.T) agreed to sell its Tarmac Gold Property in Quebec to Wesdome Gold Mines (WDO.T) for a million dollars plus a 1% Gross Metal Royalty. “With a total of 192 properties in the Globex project pipeline, 96 of which are prospective for precious metals, 60 for base and polymetallic…

-

Globex Mining’s (GMX.T) optioned German silver project advances

Identifying Globex Mining’s (GMX.T) “lead asset” is like trying determine Dave Chapelle’s “funniest joke”. There’s an ocean of material to wade through, and likely no consensus at the end of the process. “With a total of 192 properties in the Globex project pipeline, 96 of which are prospective for precious metals, 60 for base and…

-

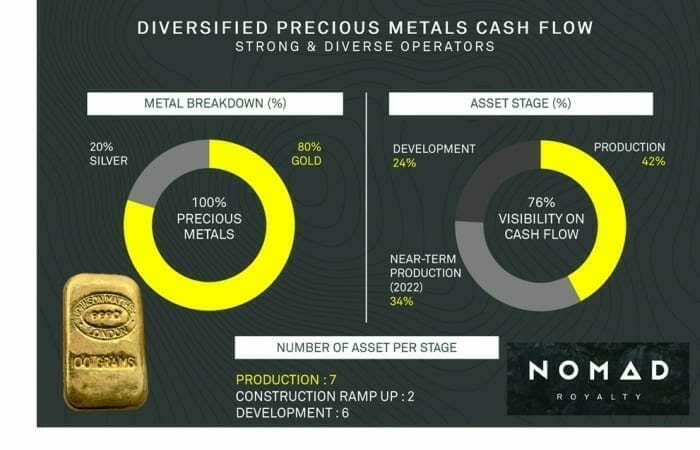

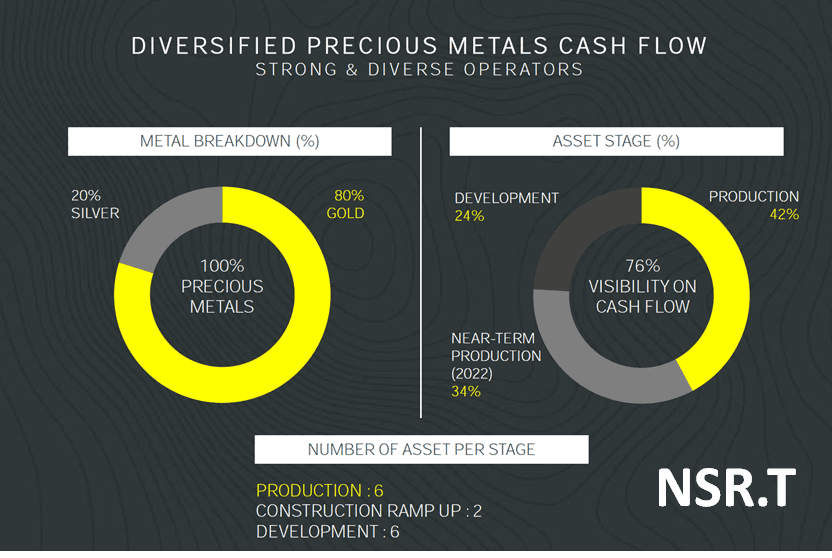

Nomad Royalty (NSR.T) acquires stake in Chilean copper mine, now eligible for the NYSE

On June 1, 2021, Nomad Royalty (NSR.T) announced that it has acquired a 0.28% net smelter return royalty on the producing Caserones mine in the Atacama region of Chile. In the same press release Nomad announced that it will be consolidating shares on a 10:1 basis. Nomad owns a portfolio of 14 royalty, and stream,…

-

How Jack Stoch CEO of Globex Mining (GMX.T) is absolutely crushing it

Globex Mining (GMX.T) has invested in a matrix of mineral properties. Over the last 12 months, many of them have appreciated sharply in value. Globex’s CEO is a man named Jack Stoch. As Tom Cruise is to action movies – Stoch is to mineral resources. A consummate pro, Stoch reliably avoids duds – while generating…

-

Nomad Royalty (NSR.T) delivers 5,575 Gold equivalent ounces in Q1, 2021, with revenues of $9.7 million

By Greg Nolan and Lukas Kane In the past week, the Bitcoin price has dropped $10,000 (from USD $65,000 to $55,000), while gold has risen a modest $30/ounce ($1,742 to $1.750). “The most popular way to describe bitcoin is ‘digital gold’” states Oliver Renick in an excellent Forbes article. “But there’s a problem, “continued Renick,…

-

Globex Mining (GMX.T) monetizes assets adding to its cash horde + Giustra challenges Saylor to a Gold vs Bitcoin debate + Gold’s repeated attempts to put resistance in its rear view

Recent volatility has many questioning the validity of holding gold in one’s portfolio in this era of global economic uncertainty and unbridled currency debasement. After carving out historic highs last summer in spectacular form (top blue line, chart below)… … the precious metal, failing to sustain the momentum required to decare GAME ON in this…

-

Nomad Royalty (NSR.T) earns USD $20.11-million in 2020 as global money-printing accelerates

“Nomad had a strong fourth quarter with revenue of $6.8-million as the portfolio continued to demonstrate its strength and reliability,” stated Vincent Metcalfe, CEO of Nomad Royalty.

-

3 Guru clients making headlines in recent sessions – Defense (DEFN.V), Globex (GMX.T) and Huntsman (HMAN.V)

Three companies on our client list dropped headlines in recent sessions. Let’s dive right in. Defense Metals (DEFN.V) Defense has generated its fair share of joy in recent weeks. An increasingly volatile political backdrop threatening the REE supply chain and recent corporate initiatives put a spotlight on the Company’s flagship resource. Hats off to the…

-

Sentinel Resources (SNL.C) advances Australian gold project; Golden Lake Exploration (GLM.C) reports anomalous silver and gold values

On Thursday, February 4, 2021 gold fell into a funk as April gold futures traded at USD $1,788 an ounce, down 2.5% on the day. Meanwhile, the World Gold Council (WGC) reported that gold-back ETFs increased by 13.8 tonnes in January, 2020 although the price of gold dropped 1.3% that month. “We believe investment demand…

-

Globex (GMX.T) poised for a re-rating—offers shareholder update on its extensive project portfolio

Globex Mining Enterprises Inc. (GMX.T) is an anomaly in the junior exploration arena. It’s been around for ages—decades. It has a mere 55 million shares outstanding (57.69 fully diluted) and there’s never been a roll back. That’s a remarkable feat in this capital intensive sector where PPs rain down like hailstones amid a high-summer prairie…