Tag: trade war

-

Thursday Recap: Buy the Rumour, Sell the News

There we go. It’s here. President Donald Trump agreed to a phase-one trade deal with China, averting the Dec 15 introduction of new tariffs on $160 billion worth of Chinese goods.

-

Tuesday Recap: No Deadline for Tariff Man

“No Deadline” for Tariff Man Stocks dropped and bonds rallied in global markets shortly after President Trump fired his tariff weapon to France and Latin American Countries yesterday, and announced today that there is “no deadline” for reaching a trade deal with China. He added that he liked “the idea of waiting until after the…

-

Monday Recap: The Tariff Man Returns

Return of the Tariff Man Thanksgiving is over, and tariff man strikes again! This time: the victim is France. The US proposed tariffs on some $2.4 billion in French products, a response to a tax on digital revenues in France that hits large American tech companies including Google, Apple, Amazon, and Facebook. “France’s digital services…

-

Wednesday Recap: MedMen’s Woes and Trading The Trade War

Deal or No Deal? We’ve heard major news about the “phase one” deal being finalised and markets have traded up on looming optimism. But let’s not forget that Hong Kong is in the midst of a violent pro-democracy protest. Today, President Donald Trump signed legislation that expresses US support for protestors, a move that threatens…

-

Tuesday Recap: Dell, Best Buy, and China’s Slowdown

Dell Earnings The firm reported third-quarter earnings today that beat estimates for earnings per share, but fell short of meeting the street’s revenue expectations. Here are the stats: Shares traded down in aftermarket trading as the firm cut its FY2020 sales forecast. It’s not that surprising because if a firm is reducing its own expectations…

-

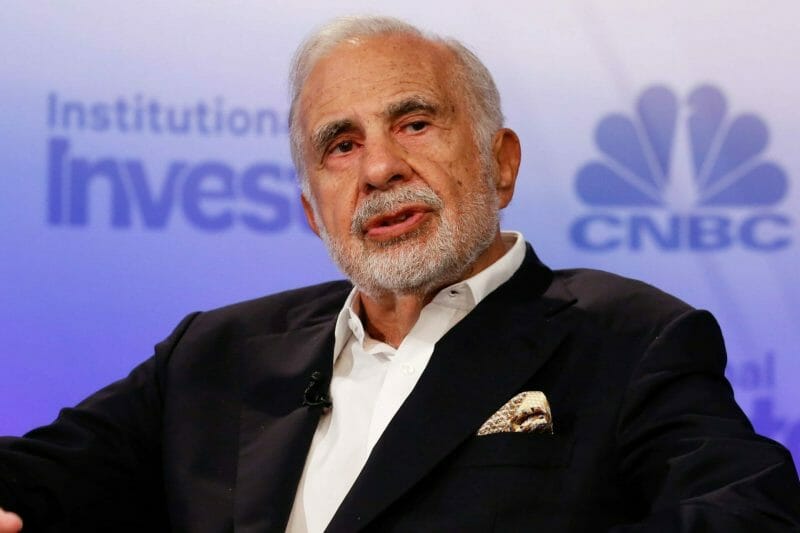

Tuesday Recap: Carl Icahn’s Big Short

Carl Icahn’s Big Short Billionaire Carl Icahn is betting against mall owners. He thinks they will be unable to service their debt. A lot many traders have made the same bet and lost millions of dollars, but it’s not something that’s stopping Icahn anytime soon. Icahn stands to gain as much as $400 million if…

-

Tuesday Recap: Political Economy, AbbVie, and Apple

Before it’s here, it’s in your inbox. Sign up for our daily markets newsletter here. Daily updates about what’s moving the markets. Political Economy I’m certain that Donald Trump’s legacy as President will contain many things, one of which will certainly be his impact on global markets. I think this will be iconic for two distinct reasons:…

-

Investor Alert: here’s what a regular Chinese communist thinks about the trade war

I recently met an electrical engineer in Chengdu China I’ll call “Mr. Kin”. He’s 53 years old, works for a private utility company. He’s been a member of the Communist Party of China since he was 18 years old. Mr. Kin is not rich, but he’s not poverty-stricken either. His daughter is studying psychology at…

-

The end of the world, or, how I learned to live with a habitually shrinking PMI

The Institute of Supply Management (ISM) U.S. manufacturing survey was released yesterday and, boy, did it ever raise alarms. Estimations of the ongoing U.S.-China trade war have been on a piecemeal basis up until now: It is common knowledge American soybean farmers are struggling, but calculating the material effects on U.S. business as a whole…

-

Long and Short (Ep 2): The rate cut and what it means

For the first time since 2008, the Fed cut rates by 25 basis points to boost economic growth. In a perfect world, a lower cost of borrowing would’ve made the market soar. But stocks fell yesterday, and they fell today. It’s complicated. Let’s get into it: Interest rates and the economy The interest rates set…