On October 2, 2017 Metalla Royalty & Streaming (MTA.C) published it’s 2017 annual letter to shareholders. It’s a clinic on clear corporate communication and accountability.

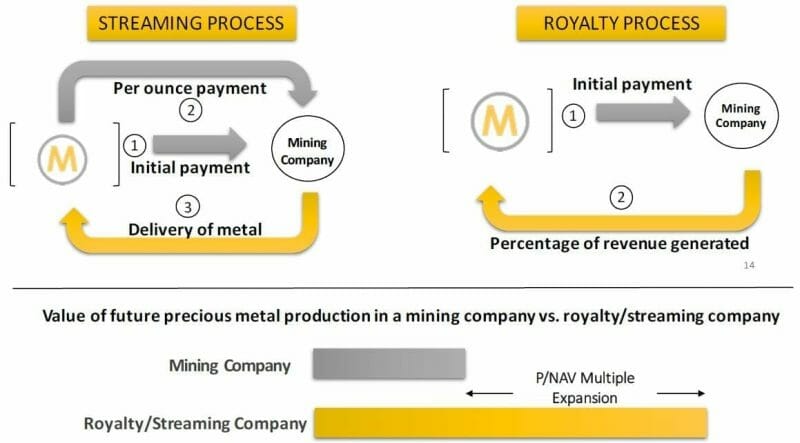

But before we get into that, we want to remind you why we like “precious metal streaming” as a revenue generation model – and why are excited about this company in particular.

We first wrote about Metalla on May 3, 2017 when the stock was trading at .47. It has been rising steadily since then, and is now at .58 (23% higher).

Streaming companies lend money to miners in exchange for a chunk of their future cash flow. They exist because bankers don’t understand the mining business. Or rather, they don’t understand it well enough to invest in it.

Metalla’s rising stock price is not about “investor sentiment” – or “momentum trading”. In fact, the precious metals markets have been choppy. Metalla is moving because it is putting together smart deals.

This summer, Metalla (MTA.C) acquired a portfolio of three (3) royalties and one (1) stream from Coeur Mining (CDE.NYSE).

Coeur Mining has a market cap of $1.7 billion. It operates five precious metals mines in the Americas (Mexico, Nevada, Alaska, South Dakota and Bolivia). The company also has a non-operating interest in the Endeavor mine in Australia.

We drilled down into the deal and it looked good from a geological risk/reward perspective.

But here’s what made it really stand out.

Coeur Mining took control of about 20% of Metalla’s stock through a Convertible Debenture. Coeur will be paid interest on the $13 million investment, while the investment converts into common shares of Metalla during future equity financings.

CDE has a platoon of grizzled geologists advising its acquisition team. If Coeur is buying a big chunk of a small company – there’s a reason.

Now let’s hand the megaphone to Brett Heath, Metalla President and CEO:

“To: All Shareholders: at a time when experts in the precious metals sector told us the royalty and streaming space was too competitive, it’s a sector with high barriers to entry, we were too late, and only modest returns are left to be made…we set out to build our new company.

We saw an opportunity to capitalize on the success of larger, more established competitors. Focusing on an underserved part of the market, we were able to quickly aggregate a portfolio of royalties and streams that didn’t make sense for the majors to spend their time and money on.”

The following is an abridged summary of MTA’s manifesto.

- Accretive Transactions – The most expensive mistakes made by competitors are making deals that were not accretive to shareholders. Every new royalty or stream we acquire needs to add value to our Company. We typically pass on any process run by an investment bank, as it often leads to lower returns.

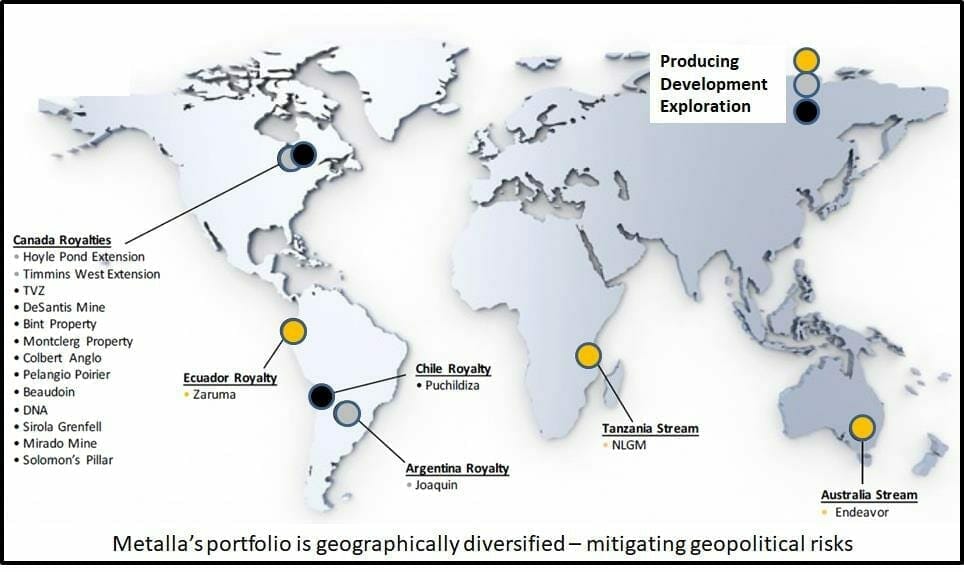

- Diversification – Metalla closed 6 transactions in its first year. It bought 18 assets on 4 continents. Owning a wide array of royalty and streaming assets gives Metalla shareholders exposure to real value for decades to come.

- Strong Counterparties – The miners must pay for expensive drilling, operate fleets of massive earth moving equipment etc. Smaller mines mean bigger problems. We acquire royalties and streams on projects operated by major mining companies with strong balance sheets.

- Dividends –Today, very few mining companies pay meaningful dividends. We intend to pay out 50% of our after tax/G&A cash flow in the form of a cash dividend, beginning January 2018. The remaining 50% will remain on hand to fund accretive transactions.

- 100% Exposure to Gold and Silver – Historically, companies in our business that choose to focus exclusively on gold and silver assets enjoy a higher market valuation. This is what you can expect now and for the future with Metalla.

Health points out that typically only insiders get in on the ground floor of a royalty and streaming company – because streaming companies are usually spun-out of a major mining companies.

Metalla was launched a year ago, with the first financing done at the post share consolidation price of 30 cents. The company raised about $2 million at a valuation just above $8 million. Since then MTA has completed 6 acquisitions worth $22.8 million – financed through share acquisitions and one capital raise of about $4.5 million at 50 cents a share.

Acquisition bullet list:

- 100% Endeavor Silver Stream –Endeavor is expected to deliver just under 1 million ounces of silver to Metalla according to the updated mine plan from CBH through June 2019.

- 2% NSR on the Joaquin Project –Pan American recently purchased the Joaquin project from Coeur for US$25 million. The Joaquin project is estimated to contain a M&I resource of 65.2 million ounces Silver (Ag) and 61,000 ounces Gold (Au). An update is expected from Pan American in Q4 2017 on a production timeline.

- 1.5% NSR on the Zaruma Gold Mine – Between 2012 and 2014 the Zaruma mine produced 72,430 ounces Au and 152,292 ounces Ag. The Zaruma gold mine has an estimated Measured and Indicated resource of 1.094 million ounces Gold (Au) with an average grade of 12-13 gpt.

- 2% NSR on the Hoyle Pond Extension –The deposit is trending toward the extension property at depth. Goldcorp, the operator, completed the Hoyle Pond Deep Project at a cost of $194 million to access and develop lower levels with the #2 winze being only 600 meters west of the property boundary.

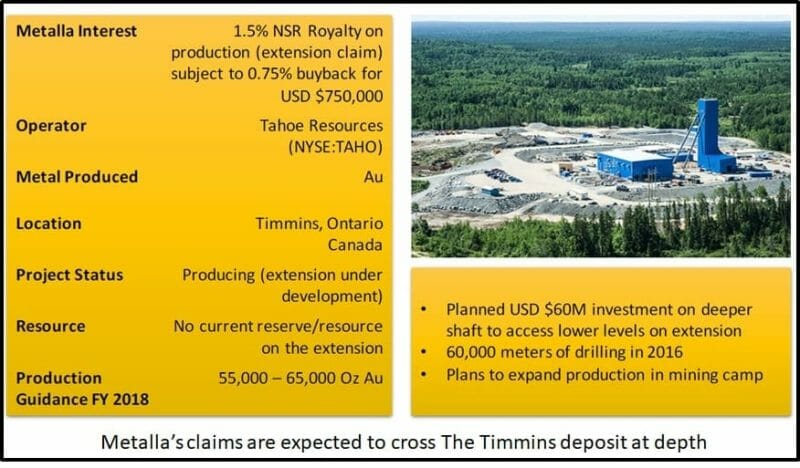

- 1.5% NSR on the Timmins West Extension – Metalla has a 1.5% Royalty on the Wallingford claim which lies on the extension of the Timmins deposit. The Timmins deposit plunges towards the NW onto Metalla’s claims and is expected to cross the boundary at depth.

- 15% Silver Stream on the NLGM – The New Luika Gold Mine produced a record 87,713 ounces Au and 126,572 ounces Ag in 2016. The company also reported AISC of US$661/oz Au in its Q4 2016 production and operational update.

The DNA of a successful streaming company is its ability to locate good opportunities and negotiate good deals. MTA has been doing that.

The company also gets high marks for the clarity of its message. So we’ll give the last word to the CEO, Brett Heath:

“We see our 2016 fiscal year as the year we built the machine that will propel us through this bull cycle in precious metals. We think that bull market cycle is just getting started.

We feel strongly that we will be able to keep up the pace we set in year one from a transactional perspective. More importantly, we feel that our next fiscal year will be when the market recognizes what we have built, rewarding Metalla shareholders with a valuation that better represents where our peers are trading.”

FULL DISCLOSURE: Metalla is an Equity Guru marketing client, we are also investors.

Leave a Reply