Ask a Canadian investor about Potash – and they’ll start nattering about decreasing arable land and a new generation of carnivores in India.

Same thing with gold, oil, copper, lithium, graphite; rudimentary knowledge is commonplace.

Ask most people about Manganese, they’re not sure if it’s a baking ingredient or the family name of a French footballer.

Manganese is important.

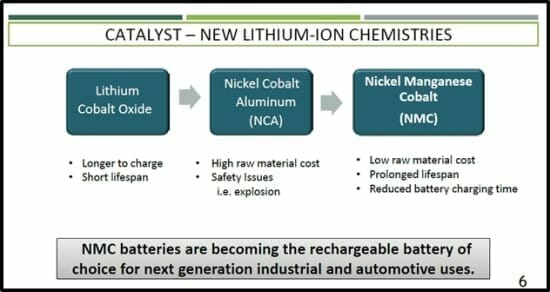

Here’s why: Lithium-ion batteries are expensive to manufacture and prone to over-heating. A recent innovation that makes batteries cheaper and safer – and requires manganese.

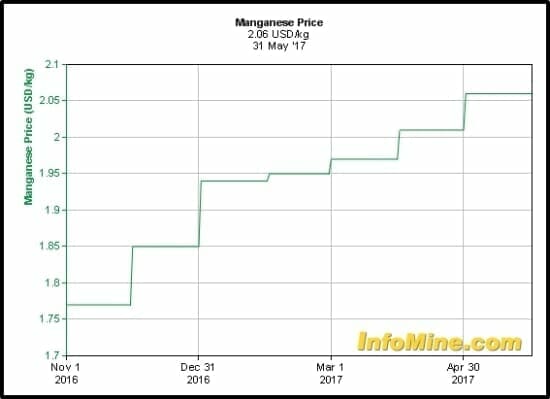

There’s a production shortage, which why the spot price keeps marching higher.

Manganese is increasingly being used in cathode materials.

The cathode is a battery’s negatively charged electrode. Lithium Nickel Manganese Cobalt Oxide (NMC) cathodes are made of nickel, manganese and cobalt.

The Green Car Congress has confirmed that NMC cathodes have improved power balance and thermal stability at a lower cost to conventional cathodes

Manganese X (MN.V) is developing a low-cost open-pit manganese project in Canada. There are currently no operating manganese mines in North America. Most of the supply comes from China and Africa – which brings political risks, tariffs, and transportation costs.

MN recently completed a diamond drill program designed to evaluate three historic manganese occurrences on its Woodstock New Brunswick property.

Drilling was completed over a 1.8 km strike length of the prospective manganese occurrence trend.

Conclusions from the Drill Program

- The initial drill program, consisting of wide spaced drill holes, has confirmed significant widths of near surface manganese mineralization over a strike length of approximately 1.5 km.

- Intersection widths of up to 87.7 m (287.7 ft) and MnO grades of up to 21.5%.

- Mineralization remains open to depth and along strike.

- The mineralization shows good continuity and has been intersected from surface to vertical depths of 115 meters.

But MN is not your typical exploration company.

On September 14, 2017 – Manganese X announced that is had signed a confidentiality agreement with the University of Minnesota to develop value added manganese products.

According to the press release, the company “will also continue to work with the additional prominent manganese engineering companies already engaged in our various metallurgical projects.”

“Having the University of Minnesota on board along with our team of experts will enhance tremendously and expedite our development of our Battery Hill Woodstock New Brunswick manganese property,” stated MN CEO Marin Kepman, “with the intent of being the first North American supplier of value-added materials to the lithium-ion battery and other alternative energy industries, as well as the steel industry”.

On August 24, 2017, MN announced the commissioning of a 43-101 mineral resource estimate and technical report on its Battery Hill manganese property located in Carleton County, about 5 kilometers outside of Woodstock, New Brunswick.

The technical work will include an independent study of MN’s confirmation drilling programs.

The market is reacting positively to the company’s dual focus of metallurgical innovation and resource development. The 60-day chart below shows a share price increase of 90%.

The Battery Hill manganese technical project will have two phases:

Phase 1 Preliminary deposit modelling including grade/tonnage block model estimates, with the primary objective to establish the magnitude of potential resources,

Phase II Completion of a NI 43-101 mineral resource estimate based on the results of Phase 1 and the completion of data validation and verification,

“We now have a detailed roadmap to create Canada’s first high-grade manganese product,” stated Kepman, “Our strategic location is only 10 km from the US border. We also have access to major rail lines, making us an obvious potential supplier to the lithium-ion battery market.”

Manganese has the following demand drivers.

- A critical component of the cathode material in modern alkaline, lithium, and sodium batteries

- Green/clean energy credentials – weening off fossil fuels.

- Manganese is likely to remain the preferred energy material for the future.

- Manganese is also well suited for cathode mix in bulk energy storage & energy management for portable power and integrating solar and wind renewable energy.

The chemical subsidiary of LG Electronics, LG Chem and 3M, have already started using NMC cathode materials in lithium-ion batteries. LG Chem supplies NMC-based Li-ion batteries to plug-in vehicles, including the Chevy Volt.

Despite the recent share-price run, Manganese X is flying low under the radar, with a market cap of only $8.1 million.

When the 43-101 resource estimate is completed, the valuation is likely to be higher.

Full Disclosure: Manganese X used to be an Equity Guru client. Ever had an old boyfriend or girlfriend you’re still fond of? It’s like that.

Leave a Reply