The Crypto Company (CRCW.OTC) “offers a portfolio of digital assets, technologies, and consulting services to the blockchain and cryptocurrency markets.”

A bit vague?

Alright, let’s dig deeper into the corporate materials.

“The Crypto Company is developing proprietary technology, including trading management and auditing software, tools, and processes, to assist both traditional companies — from start-up businesses to well-established companies — to operate with and/or trade in cryptocurrencies.”

Still not impressed?

Well – too bad – other crypto currency investors were.

On that business model, CRCW rose 17,000% in less than three months. The meteoric rise came screeching to an abrupt halt on January 3, 2018 when the SEC suspended trading amidst concerns “regarding the accuracy and adequacy of information in the marketplace”.

The stock was trading for $165 on December 4, 2017, $642 on Dec 11 and it’s now in suspension at $174.

We did warn our readers that all crypto-currency companies are not created equal.

Look at the stock charts of just about any company in the blockchain space right now and it’s clear, to me anyway, that people are no longer focusing on legitimacy, they’re chasing highs.

Whatever is hot today goes up, and the money going into it is coming from other things that were hot yesterday. The new money is going into private placements. The big money is in day trading, an evil mistress who will steal your furniture while you’re at work.

In the last few weeks CRCW shareholders have been swarmed by platoons of lawyers offering to sue CRCW on their behalf:

“Pomerantz Law Firm Reminds Shareholders with losses on their Investment in The Crypto Company of Class Action Lawsuit and Upcoming Deadline…

The Law Offices of Vincent Wong Notifies Investors of Commencement of a Class Action Involving The Crypto Company and a Lead Plaintiff…

Brower Piven Notifies Investors of Class Action Lawsuit And Encourages Those Who Have Losses In Excess Of $100,000 From Investment In The Crypto To Contact…

Levi & Korsinsky, LLP Notifies Shareholders of The Crypto Company of a Class Action Lawsuit and a …

The Klein Law Firm Reminds Investors of an Investigation Concerning Possible Violations of Federal Securities Laws by The Crypto Company…”

According to the release by the Rosen Law Firm, there are concerns “about compensation paid for promotion of the company and statements in SEC filings about plans of company insiders to sell their shares of The Crypto Company’s common stock.”

The SEC also announced that questions have arisen concerning potentially manipulative transactions in The Crypto Company’s stock in November 2017.

Like the other circling lawyers, the Rosen Law Firm makes it easy for CRCW shareholders to join the lawsuit:

How could this have gone so horribly wrong?

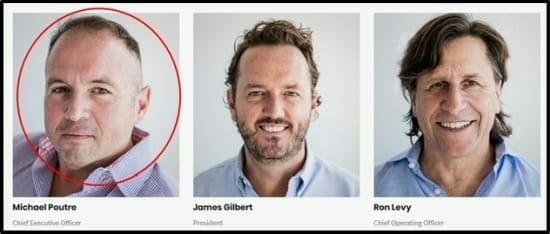

CEO Michael Poutre has more than 25 years in the Banking and Corporate Finance industry.

President James Gilbert was An Ernst & Young Entrepreneur of The Year nominee.

COO Ron Levy was the CEO of the 6th largest custom home development company in Los Angeles.

The Crypto Company’s key management may not be blockchain wizards, but these three men have proven, without a shadow of a doubt, that it’s possible to be simultaneously rugged & adorable.

According to the CRCW website, “The Crypto Company is set up for success with a leader like Michael Poutre at the helm”!

If you say so.

On December 14, 2018 Time Money published an article about Poutre titled, “How a Disgraced Former Stock Broker Became an Overnight Bitcoin Billionaire.”

“The astronomical rise in the price of Bitcoin briefly turned a little-known former stock market trader into one of the richest people in America,” stated the article. “Michael Poutre, the CEO and owner of a fifth of the shares of Crypto Company, was briefly worth $3.9 billion on paper on Monday, The Wall Street Journal reports, as bitcoin’s rise helped rocket his company’s stock price to $642 per share.

The company says it provides consultation, platforms and infrastructure to businesses interested in digital currencies.

But then share prices tumbled by 75% on Tuesday, nd rallied to just over $312 per share on Wednesday. In a private deal hinting at the value of the company, Poutre disclosed on Wednesday he had sold shares to “accredited investors” at just $7 each, a 97% discount on Tuesday’s market price, Bloomberg reports.

Poutre was suspended from trading for two years and fined $5,000 in 2010 by the Financial Industry Regulatory Authority, though he has tried to have his record expunged.”

The sound of lawyers revving motorcycles outside the CRCW offices cannot be pleasant.

Rosen Law Firm’s recent successes include:

Beck v. Walter Investment Management – The complaint alleged that the Company concealed its true financial condition. The parties settled the action for $24 million in cash.

Hayes v. Magnachip Semiconductor – The complaint alleged that the Company’s issued false financial statements. The parties agreed to a partial settlement of the action for $23.5 million in cash.

Deering v. Galena Biopharma – The complaint alleged that the Company concealing an undisclosed stock promotion scheme. The firm secured a partial settlement for $20 million…etc.

The Rosen lawsuit claims that:

- The Crypto Company unlawfully engaged in a scheme to promote and manipulate the company’s stock; and

- The Crypto Company’s public statements were materially false and misleading at all relevant times. When the true details entered the market, the lawsuit claims that investors suffered damages.

On December 13, CRCW announced plans to execute a 10-for-1 stock split.

“We are aware of the recent fluctuation in our stock,” stated Poutre, “and want to see orderly market activity surrounding the trading of our stock. Splitting the stock will increase our float of free trading shares and is the responsible thing to do.”

In 2013, MasterCard completed a 10-for-1 stock split.

There are a lot of companies taking advantage of the euphoria associated with this space, and we do not want to be associated with them.”

Good to know.

At Equity Guru we’ve been tracking crypto-currency and blockchain companies, as well as the sector as a whole.

The public markets have been turbocharged on the back of crypto price rises of late, with the Venture scene being dominated by new blockchain issuers. To date, when crypto prices surge, so too have crypto stocks.

When there’s this much money being made, this quickly, dodgy characters will emerge from the shadows.

Even punters on the message boards are figuring it out.

The implosion of The Crypto Company doesn’t mean Bitcoin is over, or blockchain is going away.

But it’s a reminder that the old rules of investing still apply in this new world.

Do your research.

Make sure the company has a business model that you understand, management you believe in, and stated milestones you can judge them by.

Full Disclosure: The writer has no equity position in The Crypto Company.

Leave a Reply