Anyone who has followed the Creso Pharma (CPH.ASX) story over the past year was aghast when they read the recent company announcement revealing that CPH issued Assena Wealth Solutions with 1,000,000 shares as consideration for “marketing and promotional services to potential investors”

That’s only a problem if Asenna Wealth, or its CEO Assad Tannous, has been recommending the stock without disclosing the blatant conflict of interest.

According to the Australian Financial Review:

– Mr Tannous denied he was paid to promote any companies in his Twitter feed, saying the Creso share issue was for advisory work. He said the description of his role must have been a “mistake”. –

Was it just a “mistake”?

You decide.

The particulars of the announcement with respect to Assena Wealth Solutions Pty Ltd (“Assena”) are as follows:

- Creso Pharma (“the company”) engaged Assena in March 2017 for a one year term to provide marketing and promotional services to potential investors

- Pursuant to the engagement agreement, the company issued 1,000,000 ordinary fully paid shares to Assena at a deemed issue price of AUD $1.10

Assena are a brokerage house based in Melbourne, offering phone and net-based trading with brokerage rates starting from4 AUD 35 per trade. They also operate a live chat room (“The Trading Pit”) where, according to their website, “Asenna Traders and Members come together to discuss the markets, current trading strategies and stocks of interest.”

It also appears they trade for themselves, i.e. operate a house account. (based on the contents of tweets stating “that was us” when referring to purchasing a particular stock.)

The front-man of Assena is Assad Tannous, who over a 20 year period has successfully made the transition from trading from home to running his own outfit. Well done. Many are called, few are chosen.

He appears to have all the trappings that accompany a successful trader – exotic cars, envious holiday destinations and a busty blonde bombshell by his side.

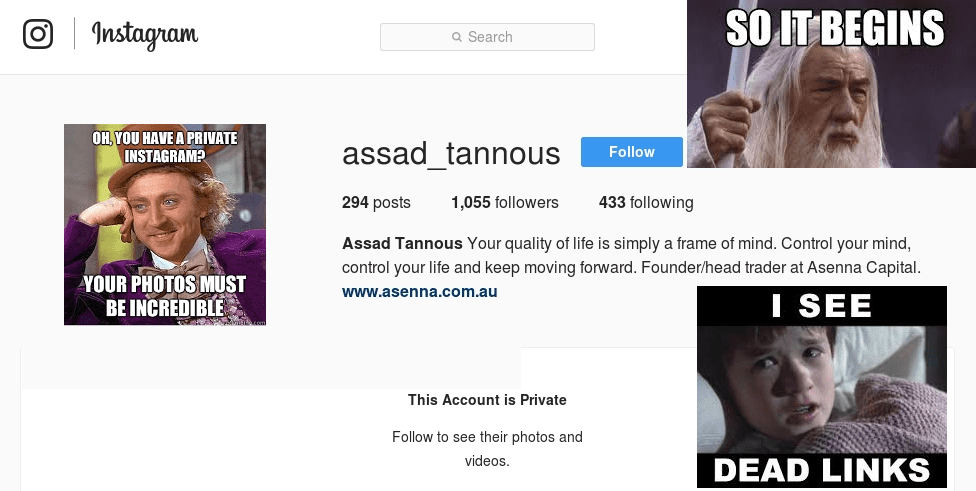

We had some pics to show you of the above but they took away our toys5 🙁 Never mind.

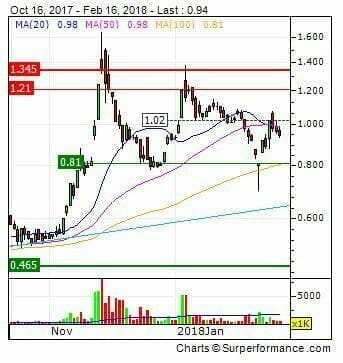

Before we venture into the muck, let’s take another look at the CPH share price2.

Slowly but surely, it’s falling apart.

The stock recently broke down below $0.80 before recovering slightly and now appears to be firmly in a downtrend.

Friday’s action finished at $0.94 with the daily trend carving out a now familiar LOD (Low of Day) close.

Mondays open should be a beauty, given what the AFR have published after market close Friday.

Thirsty for more. We’ve got you covered – read on!

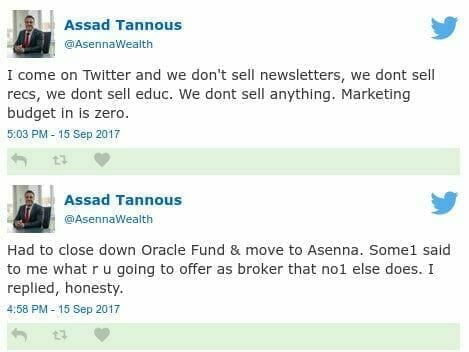

Honesty – nowhere can we find an instance of Tannous disclosing his commercial arrangement with Creso Pharma. Yes money indeed makes people do strange things in this game.

‘Paid-to-pump’ – Why does Creso need promoters?

The above picture shows the happy extended Creso family (hey Miri never smiles much, does she?) with the CPH board seated towards the back of the bus and Tannous capturing the selfie. When asked what he’s up to his reply – “Top Secret”

Secret no more. The Instagram post, dated April 20th 2017, was taken during a European road trip which took in Switzerland and Slovakia and was presumably paid for by CPH shareholders.

What exactly does Tannous bring to the table for Creso? i.e. the “marketing and promotional services to potential investors” as per the announcement?

The ‘marketing and promotional services’ part is tricky. The ‘potential investors’ not so much.

He has a loyal Twitter following (>36K) and is a prolific user, having launched 47,699 tweets into the ether since opening his account back in May 2012. Works out to an average of 21 tweets per day.

He also has, one assumes, the ear of those in his Assena ‘Trading Pit’ chatroom.

As an influencer, Tannous presides over a lot of potential investors.

His Tweets are a mix of trading anecdotes, “knowledge bombs” and generally talking up his book, which often consists of cheap paper received from seed and IPO rounds of emerging small-cap stocks.

Retail, generally speaking, can’t get in on the same terms. So there’s that for starters.

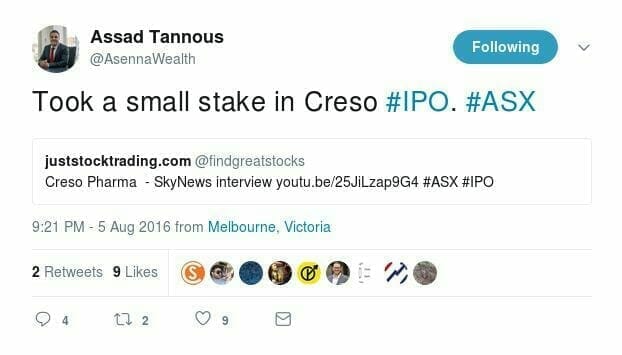

When it comes to his tweets on CPH, we’ve found some inconsistencies.

He starts out by informing the faithful he’s taken a small stake in CPH. This on the 5th August, 2016 (before CPH IPOs – which was in October of the same year)

Are these shares held in his own account or the firms? We don’t know. His Twitter followers should, though.

By the time the pump had played out, the small stake had turned into a monster position.

What exactly constitutes a monster position? 10,000 shares? 100,000 shares? A million? Take a wild guess because we can’t tell you – information we assume only those in the Assena inner sanctum would know.

We do know that Assena’s holding hasn’t breached the 5% reporting threshold which would require a notice to be filed with the ASX and we can’t find one to that effect.

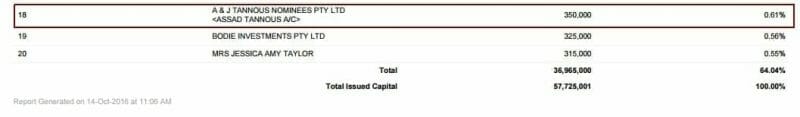

We found this, in the catacombs of the ASX website – A report titled “Top Holders Grouped Report – Creso Pharma” [As-at-date 14 October 2016], which lists Tannous at #18 (of 20)

A & J TANNOUS NOMINEES PTY LTD <ASSAD TANNOUS A/C> holding 350,000 shares representing 0.61% of (then) issued capital.

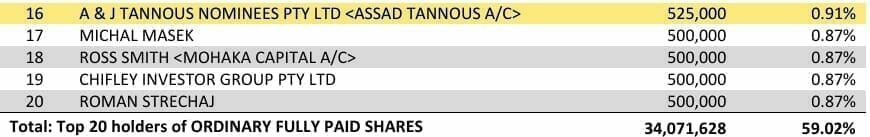

Then when CPH revealed it’s full year results in February 2017, Tannous had climbed up a few ranks to 16th place and was reported to hold 525,000 shares representing 0.91% of issued capital (see page 57).

If we include the 1 million gifted by CPH as per the announcement then that’s a position of over 1.5 million shares valued at more than AUD $1.4 million given Friday’s closing price of $0.94 per share.

Fair call Tannous – it is a monster position.

For the record, Tannous does document adding to the position at around the $0.54 level.

Wouldn’t Creso be better off pumping shareholders money into product research and development in an effort to fast-track sales and revenues?

Instead, they see fit to hand it to parties outlined in the announcement, of which Assena is one.

And yes, we understand it was a scrip deal and not cash received. Still results in shareholder dilution which hurts existing shareholders.

The underbelly of social media and small caps

Fairfax columnist Jemima Whyte, writing for the Australian Financial Review (AFR), recently published a piece titled “How Twitter, social media boost small cap stocks“ which examines the Creso / Assena connection in depth.

[Ed – The AFR house some of their content behind a paywall. If there’s a problem with the link, that’s why. Apologies ]

In the AFR article, Whyte recounts her discussions with Tannous in an attempt to clarify the services he provides to Creso: (recall his 1-year contract isn’t up yet so we assume he is still providing said services – fair question?)

when contacted by AFR Weekend and asked whether he was paid to promote other stocks, Tannous denied he had been paid to promote Creso and says “the share deal was struck before the group was listed and was payment for advisory work, including giving business advice before and after site visits to Switzerland and other countries, feedback on packaging and sharemarket insights (Emphasis ours)”

Sharemarket Insights? ROFL

I hope he provided Miri with a copy of his favorite trading tome, the most excellent Reminiscences of a Stock Operator3 by Edwin Lefèvre. (Yours truly had a few copies, including a rare edition sourced in a 2nd-hand bookshop. Sadly they didn’t make it with me to Bangkok after my arduous journey from Australia.)

Anyway, the next time you see Tannous throw out consecutive tweets about one of his holdings you might want to think of selling if you’re also long.

This flurry of tweets culminating on November 22nd mirrored the current high-water mark in the CPH share price.

“HOLDING THE LOT” – are you still old boy? Will you tell your disciples if and when you aren’t?

That’s the problem with Guru’s isn’t it? (we advise you to never trust anyone, including ourselves!)

You shouldn’t trust anyone. No newsletter writer, no stock tout website, no Twitter pundit. The phrase ‘do your own due diligence’ is said often as a defense by people who are telling you to buy or sell stocks because they don’t want you to sue them when you lose money taking their advice having not read the fine print disclosure that reveals how much they were paid and how conflicted they are.

Our disclosures are simple: We own the stock or we don’t, the company we’re talking about is client or it isn’t. We don’t tell you to buy. We don’t tell you to sell. We are a part of your due diligence. (Emphasis ours)

And before you jump down our throats accusing us of hypocrisy – yes, we are share promoters ourselves. But our clients’ cash doesn’t necessarily buy them favorable coverage, and we say so.

But when those companies pay us to discuss them, they don’t receive an automatic pass. We’re clear with them about this: they have to hit the milestones they’ve laid out, they have to run their company as a business and not a promotion, they have to do what they said they would do when they invited you to be a part owner.

We work hard to ensure our readers are aware of our disclosures and disclaimers and they tell us it’s one thing they like about our stock coverage.

Creso has lost all credibility.

Why Blumenthal needs to go, and soon.

It’s not the first time we’ve said it – Blumenthal being on the board of Creso and chairman of EverBlu Capital is a conflict of interest.

In April 2017, Blumenthal was interviewed by The Constant Investors’ Alan Kohler.

Here’s an excerpt: (taken from the transcript in above link. We have expanded the speakers’ initials to names)

Alan Kohler: How much cash has the company got on hand at the moment?

Adam Blumenthal: Creso’s got approximately 11 million dollars in the bank, so it’s probably one of the most well-positioned medical marijuana companies on the ASX. Yeah, 11 mil cash. That’s more than enough capital now for us to fast track all of our production and commercialization plans. It also leaves additional capital in there for any MNA opportunities that we see fit. (Emphasis ours)

MNA (sic) opportunities? Guessing that’s M&A i.e. Mergers & Acquisitions? Been a few of those already, eh.

More than enough capital? Seven months after this interview took place CPH was again tapping the market for funds, with EverBlu pocketing more fees in the process.

The bromance with Tannous – Remember the first rule of Fight Club

Peruse the Twitter & Instagram feeds and you’ll find them celebrating birthday’s together and catching up for post-work drinks and meals at fancy restaurants. Nice to see how the other half lives, sure.

As the AFR article explores, Creso isn’t the only stock to have emerged from the EverBlu stable that Tannous is pumping talking about. Spreading the word to the faithful, if you will.

And he seems to have the knack of constantly getting his hands on the cheap paper we mentioned above – participation in the juicy seed and IPO rounds which others miss out on.

Is there an arrangement, financial or otherwise, between the two parties?

Or is it just a case of looking after your mates?

Whyte asked Tannous this very question.

When asked if he had done any other paid work for any other companies associated with EverBlu, Tannous tells AFR Weekend he has not.

Blumenthal appears to have gone to ground. Whyte cites a Creso spokesman who said “director and co-founder Adam Blumenthal, whose firm EverBlu also advises Creso, declined to comment on questions about Tannous’ work and whether he had contacted the company to correct its statement.”

Has Blumenthal thrown his mate under the bus?

Does Blumenthal have any links to Oliver Curtis, who was convicted of insider trading in June 2016?

The question arises because of the photo snapped of Blumenthal frolicking with a dolphin and, ahem, Curtis’ wife Roxy Jacenko, PR queen and Sydney socialite. Nothing nefarious, his partner Annabelle was with him at the time, so is it safe to assume they’re all mates and Blumenthal & co were providing Jacenko with some much needed moral support while her husband, Oliver, was doing hard time in prison for insider trading?

Interestingly, the 36-year-old and her daughter Pixie were joined by Adam Blumenthal, who is the co-founder of a business specialising in another type of ‘green.’ The entrepreneur – who’s connection to Roxy is currently unclear – is part of a multi-million dollar marijuana operation which legally develops and distributes marijuana products with bases in Switzerland and Israel. (Emphasis ours)

Wait a minute. Insider trading? Prison? Say what?

I guess you want the backstory, right?

Curtis was jailed after being found guilty of conspiring to commit insider trading on 45 separate occasions, using CFD’s (Contracts for Difference) a derivative which mimics futures on individual stocks (They are not available to US market participants)

As the ABC reported:

During the trial, the court heard Curtis received tip-offs from his former best friend, John Hartman.

Prosecutors said Mr Hartman, who worked for Orion Asset Management, told Curtis when to buy and sell “contracts for difference” and at what price, using information not available to the public.

At the time of the trades, they were sharing a $3,000-per-week Bondi apartment, allegedly funded by the proceeds of the transactions.

Curtis was released from Cooma jail on June 24, 2017. Sentenced to the minimum (1-year) it still would have been tough. Cooma, located in NSW, is the gateway to the Snowy mountains and enjoys scorching summers and freezing winters.

How do I know? I grew up in the Cooma Hotel, my old man was the publican. We lived 100 meters from the jail.

Interestingly, when Curtis and Jacenko married in 2015 their wedding snaps were shot by Blumenthal Photography.

Coincidence? We don’t believe in them.

From where we stand, it seems Creso is pissing shareholders money away with little regard.

–// Craig Amos

FULL DISCLOSURE: The author does not hold securities in Creso (CPH.ASX) nor are they an Equity Guru marketing client. Furthermore, we have never approached Creso nor have they approached us with respect to conducting any marketing or promotion. So the grapes – not sour.

Footnotes:

1. Photo credit (Cooma Hotel): http://www.gdaypubs.com.au/NSW/cooma/47739/cooma-hotel.html

2. CPH chart: 4-traders.com

3. No affiliate links with Amazon – just posted the book cover and linked through in case you want more info. A great read, btw.

4. Rates listed in the Assena Financial Services Guide (FSG) appear slightly lower than those shown on the Assena website. At the time of publication, we are unsure which is the correct (lower) rate.

5. We had linked to some cracking photos from the assad_tannous Instagram account, but at some stage post-publication on Monday 19/02/18 the account privacy settings were modified, so we’ve removed the links.

Leave a Reply