Beijing, China – Yesterday I had lunch with a 28-year-old electrical engineer named Xiao Jian in the Xidan Commercial District in central Beijing.

While he’s at work, Xiao Jian’s pregnant wife stays in their 1-bedroom apartment in the Shunyi district – a 90 minute 1-way trip, via bus and subway.

What this young man does during his daily 3-hour commute is an important part of this story.

But first – the news:

iQiyi (爱奇艺), the Chinese video streaming service has filed for a $1.5 billion IPO on the Nasdaq.

Chinese media conglomerate Baidu (BIDU.Nasdaq) – valued at $89 billion – owns 70% of iQiyi’s shares.

Most analysts value IQiyi between $8 and $12 billion. Goldman Sachs, Credit Suisse Group and Bank of America are leading the IPO.

More than 12,000 English-language articles refer to iQiyi as “The Netflix of China”.

It isn’t.

It’s something much bigger.

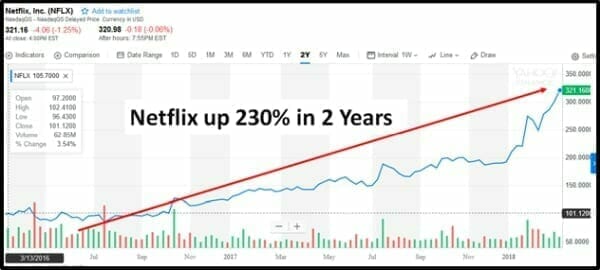

For investors buying into iQiyi IPO, the Netflix comparison may be cheering.

But the streaming business opportunity in China is different for this reason:

Netflix wants to dominate your living-room.

iQiyi wants to dominate your cell phone.

In terms of the value of the real-estate, that’s the difference between Little Rock, Arkansas – and N.Y.C.

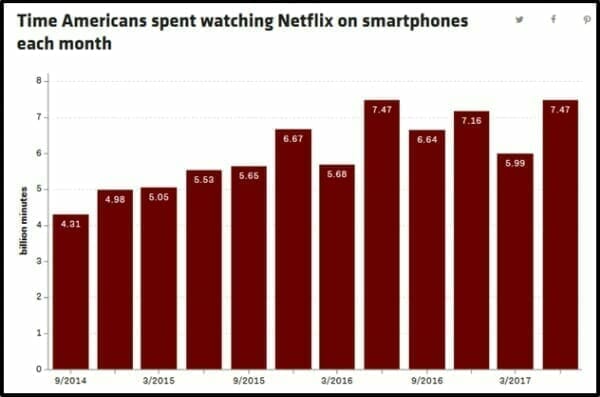

Despite the much-ballyhooed shift to mobile devices, Netflix mobile usage is still small (an average of 3 minutes a day).

According to ComScore, US Netflix subscribers spend about 7.5 billion minutes per month watching Netflix on their cell phones.

According to IResearch, Chinese iQiyi subscribers spend about 408 billion minutes watching iQiyi on their cell phones.

That’s 5,400% more mobile minutes on iQiyi for a company that, after the IPO, will have about 8% the market cap of Netflix.

Here is some key iQiyi data from the IPO prospectus;

- Last quarter, iQiyi had 421.3 million monthly active users

- 126 million active daily mobile users.

- Total 2017 revenue increased to $2.67 billion [including Ads]

- Subscription revenue for 2017 was $1.05 billion

The Living-room/cell phone dichotomy isn’t just about user-minutes and screen-size, it’s about competition for eye-balls.

In your living-room, there are a variety of things you (hopefully) enjoy doing – other than watching Netflix.

Chess? Scrabble? Reading?

What’s that other super old-fashioned thing?

Oh yah – talking.

Chinese nationals spend 3.2 hours per day on their cell phones.

Most of that time they are in line-ups, in restaurants – or commuting.

iQIYI ranks top “in terms of average time spent watching content,” stated Baidu founder Robin Li on a recent earnings call, “We’re No. 1 in terms of number of paying subscribers, and we are No. 1 in terms of profitability.”

iQiyi plans to offer Class A shares to the public, while Baidu will hold all of the company’s Class B shares.

Watching movies on cell-phones is not a generational fad in China.

A survey of 1,000 Chinese children ranging from ages 0-5 discovered that 80% of these little kids use cellphones. 50% of Chinese parents believe that a mobile phone is a healthy way to “relax” a child.

So what does iQiyi need $1.5 billion for?

In a word: content.

As Chinese consumers warmed up to subscription-based video content – iQiyi needs a war chest to acquire domestic and international programming.

iQiyi has shown an increasing appetite to spend money buying premium content.

It paid top dollar for the China market rights to the Korean drama Descendants of the Sun – which generated more than 1 billion views to iQiyi.

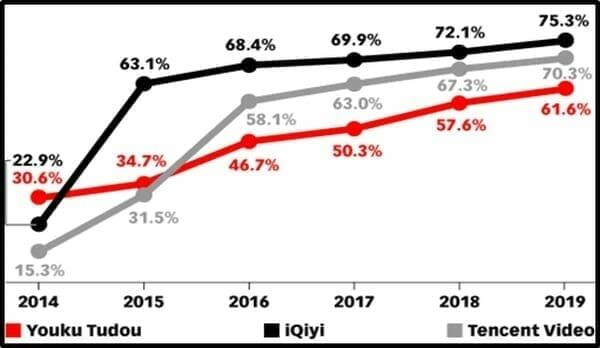

Unlike Netflix which is the undisputed top dog in North America – iQiyi is in a vicious scrap with Alibaba-owned Youku Tudou (acquired in a $3.5 billion deal a couple of years ago) as well as growing competition from Sohu and Tencent.

Who’s winning the battle?

That depends on what metric you apply.

Tencent Video is the market leader with 460 million monthly mobile Monthly Active Users (MAUs), iQiyi in 2nd place with 450 million, Yukou Tudou in 3rd place around 325 million mobile MAUs.

iQiyi is the leader in average time spent, number of paying subscribers, and profit margins.

Which is to say, iQiyi is losing less money than its rivals.

At this stage of the game, it’s about acquiring eye-balls, not turning a profit.

Given the aggressive subscriber and revenue growth – and the infancy of the market – the value of a paid subscriber in China is low.

In Q4, 2017 Netflix reported 110 million global subscribers. With a market cap of $137 billion, Netflix subscribers are valued at more than $1,000 each.

In Q4, 2017 iQiyi reported 50 million Chinese subscribers. With a projected market cap of $10 billion, iQiyi subscribers are valued at $200 each.

iQiyi’s biggest threat is Tencent, which is a social media goliath with about 1 billion WeChat users.

If you’ve been to China – or have Chinese friends – you’ll know that WeChat is Facebook, Twitter, G.mail, Skype, Instagram and IM – all rolled into a Visa Card.

If Tencent and iQiyi get into a dogfight over content, that could drive up acquisition costs, delaying profitability for both companies.

My friend Xiao Jian subscribed to iQiyi 3 months ago.

He estimates he spends 2 hours a day watching streaming iQiyi content on his cell phone.

I asked him what kind of stuff he likes watching.

Normally – “action movies, historical dramas and screwball comedies”.

But his favorite show right now is “Stranger Things”.

Yes – that’s a Netflix show.

In April 2017, iQiyi signed a licensing agreement with Netflix to stream some of its content. It is currently the only Chinese media company that licenses content from Netflix.

iQiyi’s future isn’t about taking over living rooms.

It’s about stopping Xiao Jian from getting bored on his long ride home.

Leave a Reply