EDITOR’S NOTE: We believe, this year, resources will make a pretty hard move, just as cannabis and blockchain did in 2017, and because many of our investor readers are new to the mining space, we decided to bring aboard a writer who can dig deep into the details and explain what matters and why.

Greg Nolan, AKA Dirk Diggler, is a fount of mining knowledge. His brief: Take a look at mining and oil and gas explorers and producers, and tell us what he feels, positive or negative, with no fear nor favour.

We encourage readers, if they come across a phrase or concept that they don’t understand, to let us know in the comments, as we’re putting together a series of pieces that will explain terminology in greater detail. See more of Greg’s work here.

—

Lean times ahead for gold producers’ could produce fat rewards for junior gold’s…

Peak gold: we may have already arrived at the precipice, the one where the industry faces steady annual production declines going forward.

South Africa might be proof positive, the smoking gun if you will. Once boasting over 1,000 tonnes of annual gold production a half-century ago, it produced a mere 167.1 tonnes in 2016.

Even worse, South Africa may completely deplete its reserve base in less than four decades – this according to the Environmental Economic Accounts Compendium published by African Statistics Day. When you consider that South Africa is currently ranked the fifth largest gold producer on the planet, that is an ominous forecast.

A dearth of significant new discoveries is the problem; it’s a challenge faced by nearly every miner today. The brutal bear market of the past 6.5 years forced producing companies to dramatically scale back exploration spending – that didn’t help matters much.

It’s also possible that we, a species long obsessed with boring deep holes into the earth, have cherry-picked all of the low hanging fruit. We’re now forced to go deeper. We’re forced to mine rock that is becoming increasingly difficult to process; rock that is barely economic at current precious metals prices. Exacerbating the situation: many of our largest gold deposits, like those in the Witwatersrand Basin in South Africa, are nearing the end of their life cycles.

This desolate forecast affecting larger producers’ presents an extraordinary opportunity for smaller exploration companies, especially those developing large, potentially economic gold deposits. The junior exploration sector isn’t exactly teeming with this kind of opportunity, but certain companies – co’s with ounces in the ground – are being watched very, very closely by those higher up on the food chain…

Equity Guru’s Lukas Kane, in this excellent article from September 2017, goes further, peeling back the layers of the (highly supportive) fundamentals currently underpinning the gold market – a compelling read.

Enter Granada Gold Inc (GGM.V):

Best to cut right to the chase with this resource-rich junior exploration company…

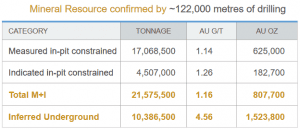

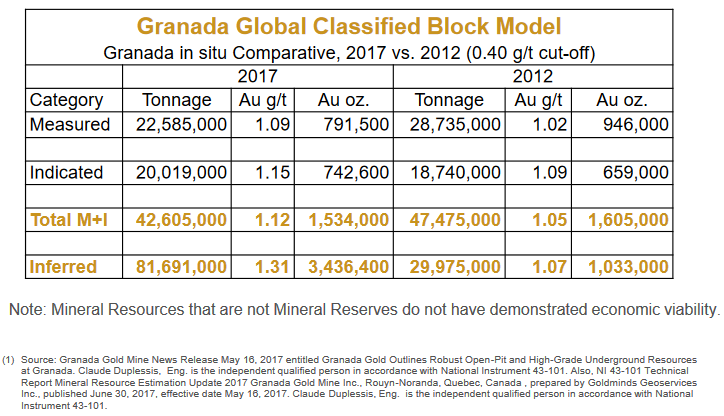

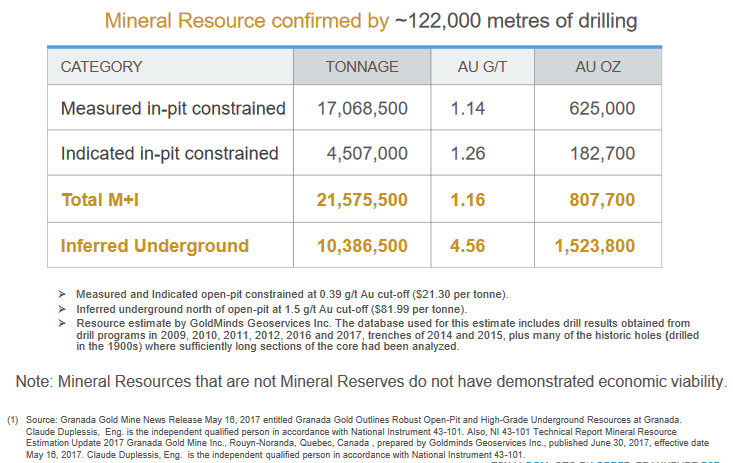

Granada, led by the very competent Frank J. Basa – a hydrometallurgical engineer with expertise in milling, gravity concentration, flotation, leaching, and refining of precious and base metals – has a global resource of nearly 5 million ounces in a mining friendly jurisdiction. Within that global resource lies a pit-constrained measured and indicated resource that has been blocked-out to serve as the foundation for a future FS (Feasibility Study).

More on that subject later.

Note the higher grade ‘Inferred Underground’ component of this resource. You can bet the company is eager to convert those ounces into a higher confidence category.

The neighborhood and a bit of geology:

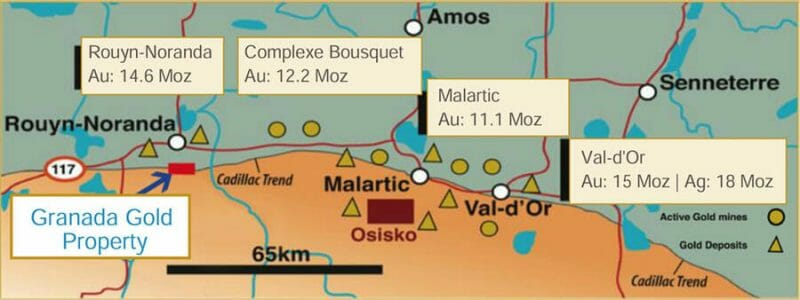

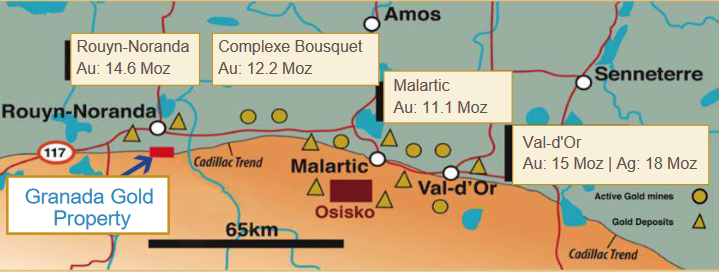

The Granada Gold Property, located near Rouyn-Noranda, Quebec, is a mesothermal, structurally controlled vein deposit positioned prominently in the prolific Cadillac Trend, which itself lies in the heart of the famous Abitibi Greenstone Belt – an area that has produced 160 million ounces of gold since the early 1900’s.

Over 50 million ounces of gold have been produced historically between the cities of Rouyn-Noranda and Val d’Or alone. Note that all four gold mines in the vicinity of the Granada property sport double-digit deposits. This is a very upscale neighborhood for a junior exploration company…

A bit of company history:

The Granada Mine was originally staked in 1922. Following extensive prospecting, Granada was brought into production in 1930, producing 51,476 ounces from 181,744 tonnes of ore averaging 9.7 g/t Au and 1.5 g/t Ag.

A fire, one which destroyed all of the surface structures on the property, put an end to mining activity in 1935.

The property has seen very little activity since the 1935 fire. There was limited exploration during the late 1980’s to mid 1990’s. In 2000, approx 2,200 ounces of gold was produced at the mine, but that was about it.

In 2006, Granada Gold acquired the property.

A more recent bit of company history:

A few years back, CEO Basa tabled a ‘rolling start’ plan for a portion of the Granada deposit. This was based on a 2014 PFS (Prefeasibility Study). The idea was to engage one or more mills in the area to process some of Granada’s higher grade, near surface material over the course of 3 years. The economics underpinning the plan are extremely robust. Based on C$1400.00 gold (the metal currently trades at C$1,700.00+) and a very modest Capex ($9.6 million pre-production and sustaining), an after-tax IRR 136% is anticipated.

The rolling start plan would also help establish the ultimate grade of the deposit due to a very high concentration of native gold.

In mining and milling recent and historic bulk samples, the actual grade of the ore came in 30% higher than expected. This could lead to some upside surprises once mining gets underway…

Unfortunately, the rolling start plan is on hold. Temporarily.

After negotiating terms with a number of mills in the area, CEO Basa was unable to convince these operators to honor the agreements. They were either unable, or unwilling, to take on the ore Granada wanted processed. Today, the ‘rolling start plan’ is only ‘a plan’… but a viable one.

Moving along.

Change of focus:

CEO Basa is rolling with the punches. He’s not sitting still. After consolidating the companies stock on an 8 for 1 basis late last year, and stoking the company coffers with both FT (flow-through – that is, financing dollars that must be spent on exploration as opposed to general business) and hard dollars, the company has its sights set on bigger things.

The company is currently studying the possibility of constructing a 600 t/d mill with its sister company in Ontario.

It’s sister company, Canada Cobalt Works (CCW.V), should be no stranger to Equity Guru readers, especially those who have made good money on Basa’s work there.

The proposed mill would benefit both companies: GGM’s ‘rolling start’ ore could help it transition into a nicely profitable (small) producer in a very short time frame. CCW, which appears to have at least one extremely high-grade Cobalt vein at its Castle Silver project, could use the mill to process its Co ore. Win-win.

More exploration – a solid plan:

In a recent interview, I was delighted to learn that the company is planning to explore what could evolve into a 7 km long mineralized structure on the property, one which includes the 5 million oz global resource, and a number of untested high-grade targets along strike. Only 2 kms of this structure has been explored to date. 80% remains to be tested with the drill bit.

Bulk sampling at the Aukeko target, approx 1 km to the east of the main resource area, produced ore that graded 7 ounces of gold per ton back in the day. Approx 300 tons of this high-grade material was delivered to the surface at Aukeko during the 1930’s. The plan here is to trench the area thoroughly, then launch a 6,000-meter drill program, one which targets extensions of these uber-rich high-grade veins.

CEO Basa stated that if drilling is met with success at Aukeko, they’ll accelerate the program. Accelerating a drill program in a high-grade zone would be music to shareholder’s ears.

Higher grade zones at depth….

CEO Basa stated in a recent interview that they want to go deep. The reasons for this are obvious: expanding the current underground resource – some 1.5 million underground oz’s grading 4.56 g/t Au along 600 meters of strike immediately north of the main open-pit deposit – will have a profound impact on the project’s economics. Higher grade underground ounces give the company a much better handle on their cash costs, as well as their capital costs – higher grade rock generates less volume than an open pit scenario requiring a significantly smaller mill to process the ore.

Beyond the Aukeko target, further to the east, sits the Austin Rouyn target where grab samples yielded uber-fat grades of up to 225.2 g/t Au.

Genesis:

There doesn’t seem to be any shortage of high-grade targets on Granada’s property. Genesis (the red blotch on the map below) lies immediately south of the Cadillac fault. The target – hypothesized as a ‘heat engine’ – includes a large granite intrusion with intense shearing. I gotta admit, I really like the ‘heat engine’ metaphor.

Though only conceptual in nature, this target should see drilling over the 2018 field season. Several deep holes might validate the theory, and in doing so, light up the area like a pinball machine.

Looking beyond exploration:

CEO Basa stated recently that he wants to initiate an FS (Feasibility Study) on the pit-constrained portion of the main resource, including the higher grade underground component. The window for such a study is probably 12 to 18 months from its inception.

A 2012 PEA (Preliminary Economic Assesment), based on an earlier block model of the resource, envisaged an open-pit and underground mining scenario with a milling rate of 7,500 tonnes per day producing 100,000 ounces of gold per year. Capex was estimated at C$259 million.

An FS will give us a much clearer picture of the deposits current economics .

Catalysts:

In my mind, there’s no better catalyst for the upward mobility of a stock than drilling success, especially when the targets are high-grade in nature. Granada has a number of potential catalysts in play….

It doesn’t end there with the company. There are royalties:

- a 1% NSR royalty that is to be paid out to GGM shareholders after Canada Cobalt Works (CCW.V) goes into production.

and…

- a 3% NSR to be paid out to GGM shareholders in a gold or cash dividend after Granada goes into production. Cool beans!

There will also be a dividend (share distribution) of 2.5 million CCW shares (plus 2.5 million CCW $0.10 one-year warrants) in early 2019. This is being carried out as part of a spin-off arrangement – CCW.V was actually a spin-out of Granada Gold (7.5 million CCW.V shares have already been distributed to GMM shareholders over the past 2 years).

Final thoughts:

This company has a fair number of moving parts. I like it. Aside from the obvious geological features backstopping the stock, its cap-structure stands out:

When you factor in the 5 million oz resource, the 1.5 million oz higher grade component underpinning the lower grade open-pittable ounces, the plethora of high-grade exploration targets on the property – not to mention the NSR royalties and the future share/warrant distribution schedule – the company looks extremely cheap here.

The fact that it’s adequately cashed up and ready to hit the ground running makes it all the more appealing. Did I already mention that I like this company?

PostScript: The company just put out a corp update earlier today.

Mr. Frank Basa, President and CEO further stated, “the company will proceed in 2018 with a bankable Feasibility Study for a new mill at Granada Gold Mine with a production capacity of 80,000 to 100,000 ounces of gold per year.”

END

~~ Dirk Diggler

FULL DISCLOSURE: Canada Cobalt Works is an Equity.Guru marketing client, and owns stock in both CCW and Granada Gold. The author does not own shares in Granada Gold.

Leave a Reply