When I have money in hand and a hankering to go invest some, I look for a company that has a situation like this:

- Increased buying: I want an uptick in trading volume

- Steady flow of up days: Give me those green candles, kids

- Sector strength: Or an asset that Kim Kardashian would say is ‘on fleek’

- Management, management, management: Don’t hit me with those ‘market’ guys

- A low share price: The lower the share price, the higher percentage you get out of every uptick

Blue Sky Uranium (BSK.V) is all of the above, and I’m loving this as an entry point.

You can look at this chart and see both the ‘blue dress’ and the ‘gold dress’.

The blue dress would be that January to May slide, which is fair for a uranium junior, especially one in a foreign jurisdiction, which some Canadian investors have a problem falling in love with.

The gold dress would be the last two weeks, where BSK has risen from $0.13 to $0.19 – and right in the middle of a financing, at that.

Share prices don’t often go up during a financing, where folks will sell their stock to buy back in and get a full warrant attached to each share. They sure as hell don’t go up when the financing price is $0.14 – five cents below the current share price.

And yet, here we are: Blue Sky is ripping up the charts, the financing is not only filled but over subscribed, and there hasn’t been a red day in two weeks.

Due to high investor demand, Blue Sky Uranium Corp. has increased the private placement amount announced on June 1, 2018, from $2.66-million to $3.08-million, consisting of 22 million units at 14 cents per unit.

Each unit will consist of one common share and one transferable common share purchase warrant. Each warrant will entitle the holder thereof to purchase one additional common share in the capital of the company at 30 cents per share for two years from the date of issue.

Why is Blue Sky suddenly lifting?

It’s not the uranium, though they’ve got a new resource estimate and the resource is near enough to surface you could collect it in a bucket.

- Inferred mineral resource estimate of 23.9 million tonnes averaging 0.036% U308 and 0.019% V2O5, containing 19.1 million pounds of U3O8 and 10.2 million pounds of V2O5, at a 100 ppm uranium cut-off.

- The Ivana uranium-vanadium deposit exhibits characteristics of both Surficial and Sandstone-hosted uranium-vanadium deposits and includes an upper zone, comprised mainly of oxidized mineralization, and a lower zone, containing predominantly primary-style mineralization.

- Mineralization is hosted by loosely consolidated sediments from surface to 24 metres depth; potentially amenable to physical beneficiation by simple scrubbing and wet screening as previously demonstrated elsewhere on the Project (see Blue Sky news release dated February 7th, 2011).

- Preliminary alkaline leaching results of the surficial oxidized mineralization returned recoveries of over 95% for uranium and 60% for vanadium in 3 hours.

Nope, it’s not the U, despite the fact that the company’s Argentine deposit is very much anticipated and wanted by the local government, to help fuel nuclear power reactors that are being constructed in Argentina.

And it’s not management, which is top rate and rife with local knowledge.

[Chairman Joseph] Grosso is the President and Founder of Grosso Group Management Ltd. and President and CEO of Golden Arrow Resources Corporation (GRG.V). He became one of the early pioneers of the mining sector in Argentina in 1993 when mining was opened to foreign investment, and was named Argentina’s Mining Man of the Year in 2005. His knowledge of Argentina was instrumental in attracting a premier team which led to the acquisition of key properties in Golden Arrow’s portfolio. He has successfully formed strategic alliances and negotiated with mining industry majors such as Barrick, Teck, Newmont, Viceroy (now Yamana Gold) and Vale, and government officials at all levels.

No, the reason we’re seeing increased buying – I think – is this:

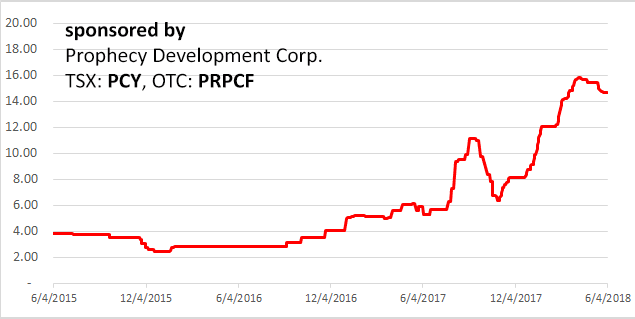

That’s a chart of European vanadium prices from 2015 until now.

In fact, since 2017, vanadium has risen from $6 to over $14. That’s led to a massive investment in vanadium in Australia, with companies on that market having attained big ‘Canadian weed’-like valuations in the last year.

Blue Sky has uranium, that we know, but it also has a vanadium kicker which is profitable enough right now, should it come to production, that there’s some real interest in what’s possible.

“This first resource estimate represents the biggest uranium discovery in Argentina in the last 40 years and it represents for Blue Sky a major step towards our goal of defining a low-cost regional-size uranium producing district,” commented Nikolaos Cacos, Blue Sky President & CEO. “We are excited to move forward with a preliminary economic assessment this year, particularly as the project remains open for expansion.”

Table 1. Mineral Resource Statement for the Ivana Deposit, Amarillo Grande Project, February 28, 2018

| Inferred Resources – Base Case at 100 ppm Uranium cut-off grade | ||||||

| Zone | Tonnes

(t) |

U

(ppm) |

V

(ppm) |

U3O8

(ppm) |

U308

(%) |

Contained U308

(lb) |

| Upper | 3,200,000 | 132 | 131 | 156 | 0.016 | 1,100,000 |

| Lower | 20,700,000 | 335 | 105 | 395 | 0.040 | 18,000,000 |

| Total | 23,900,000 | 308 | 109 | 363 | 0.036 | 19,100,000 |

That’s not just vanadium being present, but vanadium being present at surface.

This story is picking up supporters, and that’s why the stock price is running when there’s every reason for it to be artificially suppressed during that financing.

Now the financing is oversubbed, the boot is off BSK’s neck and the time to put that new money to good use is upon us.

I’ve described uranium as a ‘permanent next big thing’ for some time now. I like its prospects, but I liked them two years ago and they haven’t exactly bore fruit as of yet. But I like cheaper costs to get it, having it at surface, having local customers ready to buy it, and that secondary-not-so-secondary vanadium kicker.

When I walked a ‘tour’ of investors over to the Blue Sky booth at the recent Cambridge House Mining Investment show in Vancouver and they were told the story, I legit had one studied investor approach me afterwards, asking in hushed tones, “Is this for real? Why haven’t I heard about this?”

Now you have.

Buy, don’t buy, I’m not your father. But take a deeper look because I think all the pieces are falling into place.

— Chris Parry

FULL DISCLOSURE: Blue Sky is an equity.Guru marketing client, and the author owns stock in the company.

Leave a Reply