Are we on the verge of a new bull market in gold? Will the companies that explore for the stuff – the junior exploration companies aka ExplorerCo’s – rise from the smoldering ruins and come back into the light?

We’ve laid down a solid case for this undervalued, under appreciated lot here at Equity Guru in recent weeks. It’s my firm belief that these ExplorerCo’s are about to put on a really big show (Ed Sullivan voice).

Perhaps one of the more compelling underlying fundamentals supporting gold, aside from out-of-control currency debasement and peak gold theory, is the fact that Producers, both big and small, are running out of gold to mine.

Producing companies, particularly those at the top of the food chain, are mining deposits that are closer to the end of their life cycles than the beginning. The Witwatersrand Basin in South Africa is a prime example. The Mponeng mine in that country is currently being exploited at a depth of 2.5 miles (4 kilometers). That smacks of desperation if you ask this humble observer.

Companies are forced to dig deeper. They’re forced to mine rock that is becoming increasingly difficult to process – ore that is barely economic at current gold prices.

Further, every day that a gold miner digs ore out of the ground – every day the company is in business – they reduce their inventory of the precious metal. And these ounces are not easy to replace. For companies producing millions of ounces of gold annually, adding to reserves in a meaningful way requires a steady stream of new discoveries.

Unfortunately, the brutal bear market of the past 7 1/2 years hasn’t helped matters – it forced producing companies to dramatically scale back exploration spending. If you don’t spend money exploring for new sources of gold, you don’t replace what you extract. It’s no different from a grocery store owner stocking his shelves only once, without setting up a supply chain to replenish the goods he sells.

This dire situation sets up an interesting dynamic: as gold producers grow increasingly desperate to replace the orebodies they deplete, asset rich ExplorerCo’s will be needed to help fill the gap.

Let the bidding wars begin.

Where to look for undervalued gold ExplorerCo’s…

I’m a firm believer that we’re nearly tapped out, that our planets massive, close-to-the-surface orebodies have already been found.

Deeper deposits – those lurking undercover, at depth – likely still exist, but it’ll require a lot of good science, a lot of good money, and a skillfully angled drill bit to tap the bounty.

So where to look, where to position oneself?

In this day and age of heightened geopolitical tension, protectionism, terrorism, and a host of isms too numerous to mention, there’s a strong case to made for elevating ‘jurisdiction risk’ to the top of one’s due diligence checklist. It might make sense to cross out a few names if the underlying risk profile exceeds your comfort level.

Normally, companies that explore for gold in (politically) safer mining jurisdictions trade at a premium to those operating in higher-risk regions. But this premium appears to have evaporated in recent years/months.

ExplorerCo’s operating in mining friendly Canada have seen their valuations decimated right along with their higher-risk counterparts.

It makes more sense than ever to target these ‘safer’ companies now that their valuations have hit rock bottom.

Another reason to focus on Canada: the Great White North is rich with resources – its currently ranked the fifth largest gold producer on the planet, behind only the U.S, Russia, Australia, and China.

That’s not to say that Canada is without risk – the permitting process in most Canadian provinces can be a protracted affair. If a company lacks respect and attentiveness, issues can develop with the local First Nations. Failure to engage them every step along the way can result in flared tempers, locked gates, even litigation. It is, after all, their land – how would you like it if you looked out your kitchen window and discovered a group of strangers digging up your garden?

Fortunately, the risks in Canada can be mitigated with a little common sense and etiquette. It’s highly unlikely that a company’s operations will be derailed by a terrorist attack, or expropriated by government greed.

For the reasons cited above, our focus for the remainder of this article will be to identify companies exploring for gold in the Canadian provinces of Ontario and Quebec.

Companies that discover significant gold deposits in these provinces will be in a unique position to create substantial value for shareholders.

The Abitibi Greenstone Belt:

Without a doubt, the most epic discoveries have been along the Canadian Shied, specifically, the Abitibi Greenstone Belt of Ontario and Quebec.

Holding the title of THE largest greenstone belt on the planet, the Abitibi GB boasts production of more than 180 million ounces of gold since the first deposits were discovered in the early 1900s. Only the gold fields of South Africa have surpassed this mind-boggling ounce count.

The genesis of Abitibi’s mineral-rich orebodies ~ Archean Age geology:

Roughly 2.6 billion years ago, the Abitibi region was a hostile place. Volcanoes erupted spewing huge volumes of mafic and felsic lava – flows which laid the foundation for an assemblage of volcanic, sedimentary and intrusive rocks. It’s estimated that there were seven periods of volcanic activity. These rocks were subsequently subjected to compression via plate tectonics, where one plate was forced under the other.

Heat, pressure and time did a number on these volcanic and sedimentary rocks. The impact: low grade metamorphism. The benefit: uber rich mineral deposits.

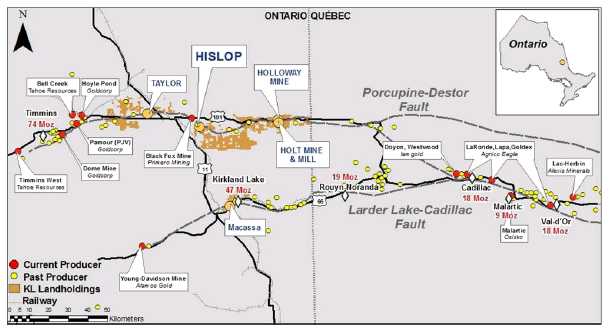

Structural breaks, including the Porcupine-Destor and Cadillac-Larder Lake faults, are home to some of the richer deposits along the Abitibi Greenstone Belt.

Abitibi’s deposit types include shear-hosted quartz-carbonate vein deposits (gold), porphyries, iron-formation hosted deposits and volcanic-hosted massive sulfide (VMS) deposits.

The Camps:

The prolific gold camps formed along Abitibi’s two major shear zones – the Destor-Porcupine and the Larder Lake-Cadillac Fault zones – include:

- The Timmins-Porcupine Gold Camp of Northern Ontario, home of the Dome, McIntyre and Hollinger gold mines.

- The Kirkland Lake Gold Camp, a Mile of Gold sporting no less than seven high-grade mines all chipping away at one single orebody.

- The Red Lake Mining District, called the “high-grade gold capital of the world”, where Goldcorp launched itself from lowly cash-starved ExplorerCo to a mighty Senior producer.

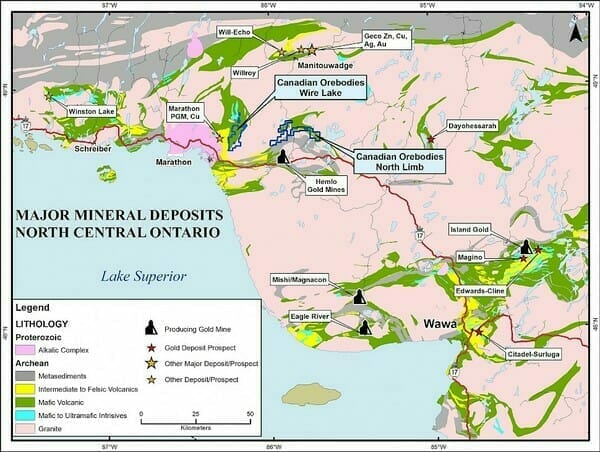

- The Hemlo Gold Camp, sparking a staking rush which rivaled the Klondike, setting up the rich Page Williams, Golden Giant and David Bell Mine gold mines.

- The Malartic Gold Camp, home of Quebec’s largest gold mine at 500,000-plus ounces per year.

That’s right… Red Lake is not in the Abitibi, technically speaking. It’s on our list anyway!

The ExplorerCo’s:

It’s said that the best place to find gold is in the shadow of the headframe of an old mine.

The Abitibi landscape is peppered with headframes. That’ll be your first clue.

I’m casting a fairly wide net here, but this is by no means a definitive list. For the most part, I’ll be focusing on ExplorerCo’s with dirt-cheap valuations. The only criterion assigned to each: they need to have a plan – they need to be active on the exploration front.

A dirt cheap valuation coupled with the possibility of exploration success could result in impressive upside share price trajectory. It’s the reason for this list.

The basics, starting at the bottom of the alphabet…

Chibougamau Independent Mines (CBG.V)

- 41.96 million shares outstanding

- $2.52M market cap based on its recent $0.06 closing price.

CBG operates in the northeastern part of the Abitibi greenstone belt, in the Chibougamau region of Quebec. The region boasts over 6.7 million ounces of historical gold production. The company has a historic (non 43 101 compliant) resource with decent copper and gold values spread out across nine projects, three of which could be down dip extensions of major deposits.

At a $2.52M market cap, the shares should respond well with any meaningful resource definition or exploration success.

Central Timmins Exploration (CTEC.V)

- 44.1 million shares outstanding.

- $4.41M market cap based on its recent $0.10 close.

This is a new company which began trading only a few short months ago. It’s primary focus is on the Timmins Gold Camp of north-eastern Ontario. One of its projects – Deloro – has a historic drill hole from the 1940’s which intersected three mineralized intervals: 2.2 g/t Au over 11 meters, 1.8 g/t Au over 12.2 meters and 3.3 g/t Au over 22.0 meters. This historic hit may represent a significant gold discovery. Drilling will confirm the potential.

Canadian Orebodies (CORE.V)

- 53.9 million shares outstanding.

- $17.79M market cap based on its recent $0.33 closing price.

CORE is a Hemlo focused exploration company run by Gordon McKinnon, son of Don McKinnon, co-discoverer of the Hemlo Gold Camp back in the 1980s. The company’s current focus is on its Wire Lake and North Limb projects located in the heart of the Hemlo camp.

Recent drilling at CORE’s Wire Lake project tagged 133.2 g/t Au over 2.0 meters, including 443.0 g/t Au over 0.6 meters.

The company’s share price has benefited from this recent drilling success. There could be room to run should they succeed in tagging additional high-grade mineralization at either project.

Great Bear Resources (GBR.V)

- 36.13 million shares outstanding

- $73.35M market cap based on its recent close at $2.03.

GBR is an excellent example of the gains possible when a small ExplorerCo hits high-grade gold with the drill bit:

The excitement started when the company hit uber high-grade gold at its Dixie Project in the prolific Red Lake District of Ontario. Discovery highlights reported last summer from the Hinge zone included intervals of 16.35 metres grading 26.91 g/t Au and 7.00 metres grading 44.47 g/t Au. Subsequent Hinge zone results included 3.65 metres grading 27.36 g/t Au (inc 0.5 metres grading 153.73 g/t Au).

At its current $73.35M market cap, the stock may appear expensive, but this is the ‘high-grade gold capital of the world.’ Discoveries in the Red Lake region command a premium. Continued success with the drill bit should be well received by an appreciative audience.

GFG Resources (GFG.V)

- 92.81 million shares outstanding.

- $18.1M market cap based on its recent close at $0.195

GFG owns 100% of the Pen and Dore gold projects, two large and highly prospective gold properties west of the prolific Timmins Gold Camp.The company began a phase-1 drill program of 5,000 to 6,000 metres back in late October. Drill assays are pending.

Granada Gold Mine (GGM.V)

- 69.22 million shares outstanding.

- $12.11M market cap based on its recent close at $0.175

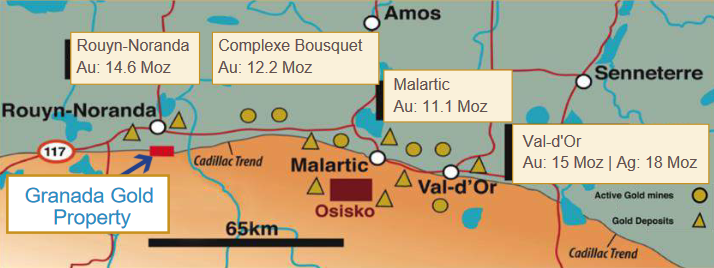

GGM is developing a significant gold resource along the prolific Cadillac Trend in Northern Quebec’s Abitibi Greenstoné Belt.This is monster country…

With its sights set on production – a high-grade “rolling start” plan – the company continues to explore a number of highly prospective targets along 5.5 kilometers of strike. Recent drilling results have been positive.

A $12.11M market cap looks cheap. GGM should produce a significant volume of news this year.

Genesis Metals (GIS.V)

- 101.84 million shares outstanding.

- $8.66M market cap based on its recent $0.085 closing price.

GIS is exploring its 100% owned Chevrier Gold Property located in the Chibougamau region of Quebec, an area boasting over 6.7 million ounces of historical gold production. The Main Zone at Chevrier hosts a resource of 295,000 oz’s at an average grade of 1.99 g/t Au. Its South Zone has target potential of between 8.5 and 9 million tonnes grading 1.8 to 2.2 g/t Au.

According to the company website:

Genesis management sees potential to unlock significant upside and enhance the value of the deposit. For the remainder of 2018 Genesis will complete an updated NI 43-101 resource estimate and identifying new targets on the property. This includes the re-logging of drill core, surface mapping and geochemical sampling.

There are a number of potential catalysts here which could move these shares off their sub-dime level.

Gowest Gold (GWA.V)

- 388.23 million shares outstanding.

- $15.53M market cap based on its recent $0.04 closing price.

GWA’s North Timmins Gold Project is located on the Pipestone Fault / North Pipestone Break, two highly prospective gold-bearing structures within the Timmins Gold Camp. According to the company’s homepage, its 100% owned Bradshaw Gold deposit is on the verge of “becoming the newest gold producer in Timmins.”

On Nov. 15, 2018, the company updated progress on the Bradshaw development front:

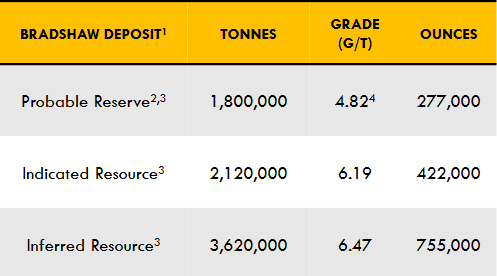

Bradshaw’s reserves and resources:

The company’s market cap is modest for an advanced stage development project in the Timmins Camp. With its current 388 shares outstanding and a four-cent share price, investors wonder if a share rollback is in the cards. It doesn’t matter – cheap is cheap.

Metals Creek Resources (MEK.V)

- 69.52 million shares outstanding.

- $3.48M market cap based on its recent $0.05 close.

Metals Creek is exploring its Ogden Gold Property, a project boasting eight kilometers of strike along the prolific Porcupine-Destor Fault in the Timmins Gold Camp. The project, a 50/50 joint venture with Goldcorp, hosts a historic (non 43 101 compliant) resource of 1 Mt @ 4.12 g/t Au.

Recent exploration has yielded positive results – there are a number high priority targets on the property which require follow-up drilling.

The company has irons in the fire in Ontario, Newfoundland and the Yukon. Continued success with the drill bit shouldn’t go unnoticed for these nickel ante shares, especially in a rising gold environment.

Moneta Porcupine Mines (ME.TO)

- 266.83 million shares outstanding.

- $41.36M market cap based on its recent $0.155 closing price.

Moneta’s 100% owned Golden Highway project is located along the Destor Porcupine Fault Zone in the Timmins Gold Camp of northeastern Ontario. This is a large property with a global resource north of 4 million ounces – 1,091,000 ounces at a grade of 1.09 g/t Au (Indicated), and 3,204,000 ounces at a grade of 1.20 g.t Au (Inferred).

ME is in the process of finalizing a new 43 101 resource estimate which could come any day. The company is also generating multiple new drilling targets based on re-interpretation and modelling of the high-grade mineralized structures at Golden Highway.

It’s difficult to ignore a resource of this size. Tying the Golden Highway’s multiple zones together to create greater continuity within the resource base will be the objective of future drill programs.

Pelangio Exploration (PX.V)

- 35.59 million shares outstanding.

- $5.16M market cap based on its recent $0.145 close.

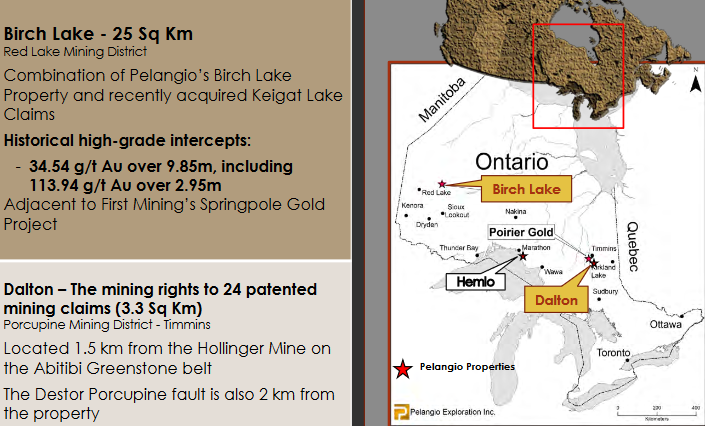

PX’s current focus is on its recently acquired Dalton Property located in Timmins Gold Camp, and the Birch Lake Property located in the Red Lake Mining District.

PX recently consolidated its interests around Birch Lake and Dalton by acquiring 5SD Capital. Just last week, the company provided an update on the Dalton Property.

It’s a common theme: a modest market cap offers tremendous opportunity should the company tag a significant high-grade discovery at either project.

Prosper Gold (PGX.V)

Project summary (no corp presentation)

- 60.11 milion shares outstanding.

- $9.02M market cap based on its recent $0.15 closing price.

PGX is exploring several properties in the vicinity of the Destor-Porcupine fault of the Timmins Gold Camp. Recent results reported from its Currie Project include six meters of 4.79 g/t Au & 118.4 g/t Ag. Just last week, the company updated us on its progress at Currie:

Read: Prosper Gold 2,500m Phase 1 Drill Program Update: Currie Project – Matheson, Ontario

PGX’s valuation has benefited from this recent drilling success at Currie. Additional gains are likely should the company continue to hit with step out drilling.

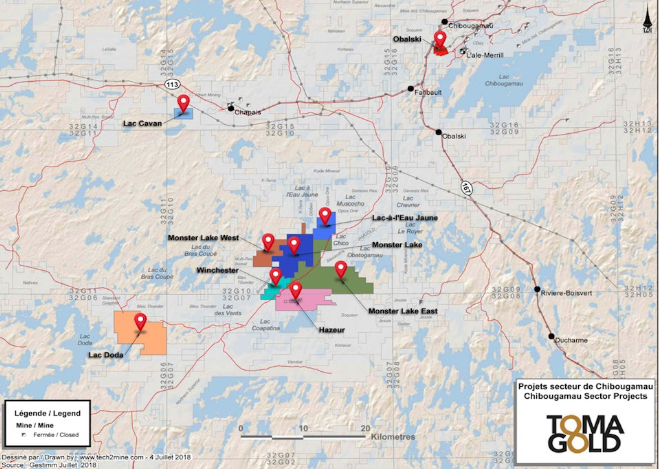

TomaGold (LOT.V)

- 140.26 million shares outstanding.

- $7.01M market cap based on its recent $0.05 closing price.

TomaGold has interests in six gold properties in the Chibougamau mining camp of northern Quebec:

The company’s flagship asset is its Monster Lake Project, a joint venture with IAMGOLD (IMG.T). Back in March of 2018, the two companies tabled an inferred gold resource of 433,300 oz’s at a grade of 12.14 g/t Au. In a recent development, LOT consolidated its position in the high-grade Monster Lake Project.

LOT has a number of irons in the fire, some of which are under joint venture. A $7M market cap seems modest considering the high-grade nature of its project portfolio, and the potential to add ounces to its current resource base.

As noted above, this is by no means a complete list.

I haven’t even touched on the Abitibi companies further up on the resource-development-valuation foodchain.

Very briefly, the following Abitibi GB development companies should be considered to round out one’s investment portfolio:

Canada Cobalt Works (CCW.V)

- 75.48 million shares outstanding

- $37.74M market cap based on its recent $0.50 close.

Harte Gold (HRT.TO)

- 599.54 million shares outstanding.

- $251.81M market cap based on its recent close at $0.42.

Osisko Mining (OSK.TO)

- 257.19 million shares outstanding.

- $714.99M market cap based on its recent $2.78 closing price.

Pure Gold Mining (PGM.V)

- 256.34 million shares outstanding.

- $169.19M market cap based on its recent $0.66 close.

Wrapping things up:

Senior and mid tear gold producers are desperate to add ounces to their rapidly depleting resource bases. Years of slashed exploration budgets have choked off their pipeline to new sources of the metal.

New discoveries made in mining friendly jurisdictions will become highly coveted assets.

‘We definitely need more assets in Canada,’ Barrick’s new CEO says

Enter stage left, our list of Abitibi Greenstone Belt ExplorerCo’s.

We stand to watch.

END

~ ~ Dirk Diggler

Full disclosure: Equity.Guru has no marketing relationship with any of the companies mentioned above.

Feature gif courtesy of Giphy.

Leave a Reply