In 2015, when we started this outfit, our business model was to steer clear of conventional wisdom and the same old pubco marketing techniques, and instead focus on rich niches.

Honest coverage of client companies that is negative when justified was one niche. Being inclusive of women was another. And appealing to a younger investor audience, even if it didn’t really exist at that point, was the big one, the twist that the whole enterprise was built on.

At the time, others laughed.

“Who’s going to give you a cheque to say ‘don’t buy this stock?’” – turns out, there’s a demand for that.

“Women don’t have money – I don’t have any women on my list.” – turns out, women control more of the purse strings than men do. It’s why they’re called ‘purse strings’ and not ‘wallet droppings.’

And the millennials, well they’ve just gone right out there and turned the public markets on their ear. The entire cannabis market has been built on new investors moving in and understanding something the grey hairs didn’t. For the first time, grandparents were asking their grandkids for investment advice.

The lithium pop from a few years back, and cobalt after that, were a verifiable pair of runs that came from the young crowd again, a crowd that understands more than anyone why rechargeable batteries are important.

And then there was blockchain, and the cryptocurrency run. The kids were already buying houses with their bitcoins when hotel ballrooms across Vancouver and Toronto started filling with blockchain seminars and brokers looking to figure out what the hell it all meant.

Now we hear a constant drumbeat around e-sports from those same brokers, who’ve figured out that gaming is a thing but have yet to understand how it works or how money will be made from it.

Watch live video from DrDisrespect on www.twitch.tv

If you’re in business in the public markets and you don’t talk specifically to younger investors, you’re not likely to be in business in the public markets for long. The old audience – the one that doesn’t like our animated gifs and bristles when we put ‘motherfucker’ in print, the guys who send legal threats when we tear apart their pump and dumps and don’t understand what the Streisand Effect is – they’re dying off, year by year. And those who are still clinging to life are hanging on to their fixed income until the flesh falls away.

And yet, mining companies, the entire industry behind them, and the biggest names in finance that live and die on those finance deals being heavily bought into, still think of millennials as idiots and rubes, a lost cause that will never pay attention to a mining explorer or an oil and gas play, even though they were front and center on lithium and cobalt.

To be fair, sometimes millennials are idiots, same as anyone else. If the existence of Logan Paul and the shareholder base of Namaste Technologies (N.V) have told us nothing else, it’s that nobody has ever gone broke appealing to the dumbest guys in the room.

But there’s a lot more potential out there than the ‘fool and his money’ crowd. Millennials run everything but politics, and that last hold-out is just a matter of time, as we’ve seen from the fear the old white man crowd has for new political firebrand Alexandria Ocasio-Cortez.

They’re right to be scared.

You know who else should be scared of millennials as they take over?

Mining companies.

Jesus Christ, what is wrong with you guys?

I get it. Back in 2006, all anyone in mining needed was a 2001-era templated website with a picture of a truck on it, a ‘guy in Germany’, an office on Hastings with a pretty receptionist taking sub docs and cheques, a Cambridge House investor conference booth once a year, and a promo account with Stockhouse – and everyone got a Porsche for their trouble.

Terrific.

But it’s over a decade since and you’re STILL pumping out the Geocities websites, you’re still sending email blasts to burned lists of 3 million people who put you on spam block in 2012, your news releases read like a 1940’s librarian writes them, and you’re shocked – SHOCKED – that kids who’ve been making thousands buying into bullshit weed deals that fly up 10% a day aren’t queuing up to buy into your Moose Jaw cow paddock mag flights that get results back in Q3.

Stop the madness!

Oh, I can hear the IR cries already, the “We can’t market ourselves because the exchange won’t let us say anything!” line and the “we’ve been doing this for 24 years and it’s always worked until now” canard.

Bullshit.

Step one of any good marketing program in the real world, where actually selling products is how you live or die, is to NOT market to the same old crowd in the same old way, every time. That’s just a pathway to the middle of the pack, at best.

If you sell garden shovels, you don’t market to little old ladies who garden, you market to bodybuilders and sell shoveling as a get fit regimen. You market to teenage girls and show them there are big audiences on Instagram for #organics. You hit the niches that nobody else is thinking about and you go where nobody else has thought to go, and those little old ladies who are looking for your product anyway? They’ll come to you as a matter of course.

Mining companies don’t get that sage advice because, much like newspaper owners when Craigslist was consuming their age-old, easy money classifieds business, or when taxi drivers watched Uber eat their business without bothering to put out an app of their own, as long as they’re making some money, even if it’s a lot less than in years before, most people have no desire to rebuild something that’s always been there for them.

But here’s the thing: You don’t need to blow your fucking brains out to market a resource deal to young investors. They’re already into resources.

The video below is Minecraft.

Your kids and/or grandkids probably play it. Hell, your broker has probably played it, because it’s the most successful video game on the planet for just a few months shy of a decade now.

How successful? Microsoft (MSFT.Q) bought the rights for $2.5 billion a few years back. By late last year, over 150 million copies had been purchased, with many players buying it on several platforms and billions of dollars more spent on downloadable content.

If you’ve never seen this before, you don’t have kids. But if that’s the case, your next question is probably, what exactly do you do when you play Minecraft?

WHY GRANDPA, YOU MINE, OF COURSE.

Yes, you kill monsters and build houses and explore, but mostly you discover resources and mine them so you can do the other stuff with the ore.

Coal, iron, diamonds, gold, emeralds, even lapis la-fucking-zuli can be found in great big underground caverns.

Yes, your kids know what lapis lazuli is. Because they’re spending hours every day MINING it.

Minecraft isn’t an outlier. Mining and the gathering of resources is also important in hundreds of other titles, some of them immensely popular, such as No Man’s Sky, Deep Rock Galactic (seen below), Fallout 4, Terraria, Astroneer, Eve Online, old school Runescape…

Mining is SUCH a big part of modern day gaming that there are entire categories of game sites dedicated to it.

You’ll even find it as a part of gameplay in that great pre-teen obsession of the moment and frustration to parents everywhere, Fortnite:

If you think this is just a game thing and doesn’t translate to what young folks would put their money into in the real world, guess again. Mining interest among millennials has a storied past, even if they’re also concerned that the real business of rock picking has a rough environmental exploitation side.

In fact, if you think back to last year’s brief explosion of interest in cryptocurrency and blockchain, the biggest slab of interest in that space wasn’t in the buying and selling of the currencies themselves, it was in the mining of them by public companies that, for a while there, were worth hundreds of millions of dollars.

Admittedly, that sort of mining didn’t require an understanding of how an NI 43-101 resource estimate works, and didn’t involve metals in any way other than those found on the circuit board of an exceptionally overworked GPU, but crunching the numbers on what the value of a given mined crypto-resource was, and what it would cost to produce it, was at the heart of every crypto enthusiast’s daily reading.

And all of that’s before we even get into the MOST OBVIOUS interest millennials have in resources, that of what goes into rechargeable batteries; lithium, cobalt, manganese, vanadium, nickel, copper, graphite, etc etc… all metals we carry with us in our pockets, and buy based on, among other things, the efficiency of the battery components therein.

SMARTEN UP.

When I do a keyword search of all Sedar documents for the word ‘millennial’, this is what comes up:

A cease trade order was issued by the Ontario Securities Commission on Jan. 7, 2019, against Millennial Esports Corp. for failing to file its audited annual financial statements, its management’s discussion and analysis relating to the audited annual financial statements, and the certification of the foregoing filings, for the period ended Aug. 31, 2018, as required by National Instrument 52-109, Certification of Disclosure in Issuers’ Annual and Interim Filings.

Ugh. Do better.

‘PISH!’ said the oldies!

I’m sure there are mining guys out there right now who are doing just fine without appealing to ‘those darned kids and their rock and roll music and the cars with the rim jobs and their LOLs’, and who think it should be incumbent upon new investors to do what their grandparents did and just study up.

Grandpa didn’t actually study up back in the 80s, when mining was cranking out millionaires on the Vancouver Stock Exchange and promoters were buying small island nations. No, grandpa attended weekend seminars put on by brokerage houses, that taught them what mining was, how to invest, what to look out for, and helped those brokerages build up giant client lists in the process.

They don’t do that anymore. Brokers don’t go looking for new clients these days because they don’t make money on trade commissions from small investors, which are heavy on paperwork and compliance and low on actual dollars in the door, and most of which happen nowadays at cut price online trade desks like Qtrade anyway.

Today, brokers make their money from running financings, which they hope to fill by getting high net worth guys to take as much as possible, and which they’ll get a 7.5% of. They don’t want the retail guys involved, because you guys are hard work.

And the mining companies, they fall right in line with that thinking and just do it ‘the easy way.’ The old way. The way they’ve always done it.

Never mind that those big fish will kill a company’s stock if they decide to dip out four months down the line. Never mind that the whales are getting older now, and fewer in number. Never mind that they’ll call the CEO and tell them what’s expected of them, that they should make decisions in the short term interest of that investor, rather than the long term health of the business.

I have four brokerage accounts. I get calls with an ‘idea’ maybe once every six weeks, and it’s always a deal the broker is financing. Not one time has a broker I’m involved with brought me an idea they just found floating around out there, that they figured I could make some change on.

Nope, I’m a guy they call to fill a sub. And those subs are almost always for whatever sector is hot right now, rather than a metals explorer with good fundamentals.

Recently, the regulators changed some rules to allow for crowdfunding of financings by non-accredited investors. This was a great move, because the real money on a public company is usually made by insiders and heavy hands, with warrants they get from financing deals that are made when a company is yet to go public. Now, Johnny Lunchpail can get in on those, admittedly for small amounts and, admittedly, with all the risk that something they buy privately may not ever go public.

That hasn’t gone amazing so far.

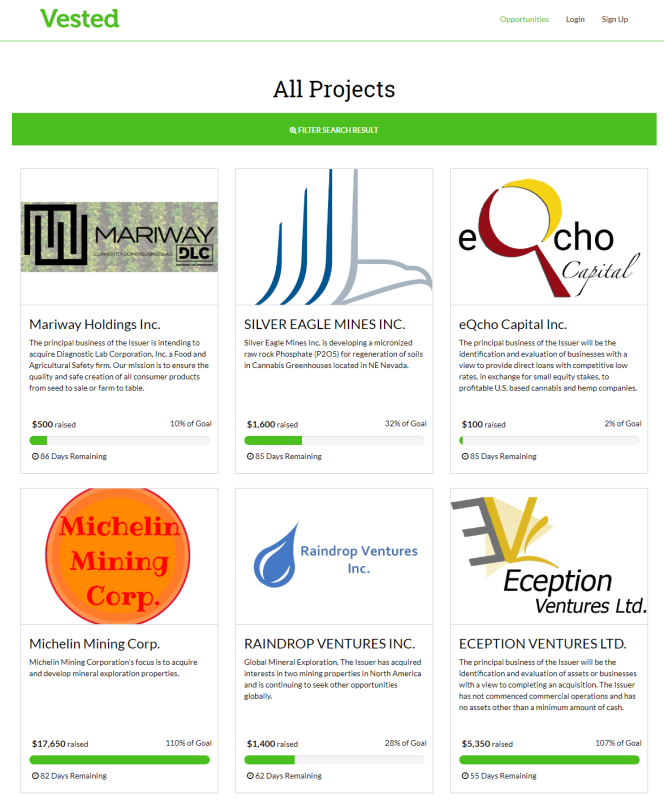

This is the front page of Vested.ca, a crowdfunding portal that allows you to buy in on financings when you’re not accredited – that is, you’re not earning $200k a year or sitting on a million bucks liquid or a close personal friend of the CEO.

The success rate isn’t earth shattering, with the average deal closing at low five figures, occasionally six, sometimes four.

Over at ConsiderFunding.com, there’s only one deal on offer: a Jamaican weed deal, and it is struggling. I’ve used both platforms, and completed sign up and closing of the offers in minutes, which is far more user friendly than going through a broker. But the amounts we’re talking about are small.

There have been winners, including Kal Minerals (KAL.C), a company that was turned onto the millennial kick early last year, touting a focus on changing the mining industry into a more environmentally focused enterprise, and calling their project the ‘Jack White‘ property.

They pulled in 150+ shareholders over two crowdfunding pushes, and went public in November of last year.

CONGRATS to @KalMineralsCorp on reaching their #equitycrowdfunding goals! ⛏ #investing #Vested #changemining pic.twitter.com/0nVY2VKEqB

— Vested.ca (@VestedCa) August 29, 2017

Other companies are factoring in the younger audience in new and impressive ways. Here’s Orix Geoscience using the artists at VisualCapitalist to put out an infographic that tells a newbie what the pathway to production is for a young mineral explorer. It’s worth your time to take a look at the full version.

And just today I came across a deck for a small pre-public gold explorer with two properties they’re raising some money to go drill, Barrian Mining.

The executive team is a who’s who of ‘sons and nephews of legends’, and their attitude is to break the mold entirely of what’s expected from an explorer.

The slogan they’ve chosen? Mining For Millennials.

Count me in, Barrian Mining. I like your ‘tude.

SO WHAT DOES A MINER NEED TO DO TO CONNECT TO THESE MINORS?

It’s complicated, but only because they won’t let you get away with just using their terminology.

You just need a few things.

1. Honesty. Don’t sell, just be straight.

- “The results on these holes were shit but we took a few high risk chances and now we have a better idea of where to go next.”

- “We’re going to need to raise money, even if the stock is down, but it’s all going into the ground.”

- “We have no intention of drilling this property, but it was cheap and we think someone will want it later in the year so we’re placing a bet on the sector.”

2. Realism. Don’t hype, if anything underplay.

- “The grade here isn’t the best, but there’s a lot of it so we think that’ll be a wash and we’ll do okay with it.”

- “We could spend forever drilling to try to prove out a big resource estimate, or we could just start producing on the spots we’ve already drilled, where we know there’s ore in the ground, and gamble that we’ll find more as we go, so we’re going to make some money and see where it takes us.”

- “Mining is an environmentally harmful activity, so we’re going to commit to using best practices and set aside some cash to rehab the land as we’re done with it.”

3. Education. Tell them what to look for.

- “We won’t be getting drill results back for a month, but in the meantime here’s a white paper about what the technical terms will mean when we get them.”

- “There’s a long timeline between exploring and production, with many bankable news events in the time in between, so here’s what you should be looking for as we go.”

- “We don’t know what our drill program will bring us, but here’s what we think would be a really great result, and here’s what we think would be the bottom end that we could work with, so you can compare and contrast when it happens.”

4. Modernization. Show them how you’re a thought leader.

- “We know it’s hard to visualize a project from news releases, so click here for a livestream from the site, where you can see the work being done.”

- “Our virtual reality video presentation allows you to stand on the mountain side in the comfort of your living room, while our CEO talks you through the targets and shows them to you first hand.”

- “We’re using artificial intelligence to scan satellite imagery and look for anomalies that may point to valuable ore formations, and a team of drone pilots to fly over such properties to get a closer look, so that we can identify and file claims on properties not currently walked by geologists as a matter of course.”

5. Difference. Don’t be just another conference booth with a picture of a truck.

- “We have a ton of drilling and production data from the 70’s, when there was a mine on this plot, so we’re putting it on our website and encouraging investors to take a look and see if they can spot something we can’t.”

- “Traditionally we’d be looking for early stage investors now, but instead we’re talking to potential end user customers instead in an effort to encourage them to own a piece of our company early, help us get to production quickly, and then bring them discounted ore going forward so they can lock down future metal supply.”

- “We’ve realized we don’t need an office. We all work from home. If we need to take a meeting, we go to the people we’re meeting with. This will allow us to save on staffing and rent, and will pay for four more drill holes every year.”

Right now, a thousand mining guys are yelling at their computer monitors, and they’re all calling me a dumbass for suggesting things that just aren’t done and may not even be allowable by regulators if they were attempted.

But here’s the thing: They used to call Integra Gold’s executives dumbasses too. Young, brash, too good looking to be trusted, dumbasses.

And they did that because Integra ‘moneyballed‘ gold exploring by doing exactly what we’re suggesting others should do.

- They took over a property that many had tried and failed with before.

- They drilled small, identifying just enough of a resource to warrant going in and taking gold out of the ground, which they figured would pay for more drilling and subsequently help expand the resource.

- They took terabytes of privately held, confidential drill data and open sourced it, offering a cash prize at PDAC to the person or persons who brought them the best drill targets based on that data.

And on each of those moves, they nailed it.

Total success. Big $590 million exit to Eldorado Gold.

Now they’re doing it again, with their stock up 50% in the last six weeks while weed stocks were getting booted in the nards.

The millennial opportunity for resource companies is the single greatest opportunity they’ve had land on their heads in the years since the Bre-X scandal.

Think of all that weed money, all the multi-bagger profits that have been taken this past December, all the folks (like me) sitting on cash and wondering what to do with it next, and you mining guys are sitting on your hands, waiting for the retirees to come back.

Adjusting to this new audience isn’t easy or quick. It took us a year plus to really figure it out, and it changes over time. But there’s billions out there, mining guys, and the first among you to connect with the kids who control it will be the next guys Newmont buys for billions.

— Chris Parry

FULL DISCLOSURE: I don’t own a damn thing mentioned in this story, except for most of the games listed. Also, I have a lot of lapis luzili if you’re in the market.

Leave a Reply