In early 2018, Aurora Cannabis (ACB.T) made one of their most interesting asset acquisitions to date, when it bought into the Liquor Stores N.A. chain, snaring 19.9% for $103.5 million.

It was the sort of balls out deal Aurora is famous – or infamous, depending on your viewpoint – for, bursting out into a new market segment by grabbing the perceived leader in the space, part of its ‘gold rush’ strategy for ensuring it isn’t left behind by the bigger players.

It wasn’t the killer deal Aurora hoped for, mostly because their gamble was that the federal government would allow private liquor stores across the nation, and that provinces would welcome the grown up players with existing controlled substance experience to engage on that front.

That’s not how it ended up.

New provincial governments in BC and Ontario, from the hard union-happy left and wild-eyed ‘make it up as we go along’ right respectively, threw a lot of roadblocks in the way of any notions that a well financed, well run organization might be able to convert existing liquor stores to multi-product outlets, or (at the worst) buy it’s way into the retail landscape.

Alcanna, as it’s now called, has managed to open five cannabis stores, all in Alberta, mostly around Edmonton, which, while nice, is hardly the hundreds – or even dozens – of stores once visualized.

Retail cannabis in Canada is rough going, with the granting of stores as much down to luck as good planning. The once renowned Tokyo Smoke chain, which sold T-shirts and coffee in the early days as it strove to build a brand while brands were still able to be built, was sold to Hiku, which was then sold to Canopy Growth Corp (WEED.T), for some $250m.

What that’s brought Canopy on the TS side is precisely four cannabis stores in private retail friendly Manitoba, six cafes based in who gives a shit, and one ‘education centre’ in BC, which sounds like code for ‘we couldn’t get the permits to sell coffee but we signed the lease so, to hell with it, here’s some flipbooks.’

Former Equity.Guru client Choom Holdings (CHOO.C) says it has 78 retail leases in hand thus far (which is different from having opened stores 78 locations), and over 50 applications for stores lodged, with ten stores under construction and six completed.

But 21 of those leases are in BC, which has said it won’t let one company own more than 8 stores. 20 are in Ontario, which is running a lottery system on retail licenses and may not hand any to CHOO and, of the rest (all in Alberta), it appears the company is hoping to work with owner operators who’ll use their brand, rather than build their own stores.

That’s one way to save on the capital expenditure end, but it also means Choom may end up with a bunch of stores under license, or it might end up with nothing. The investor deck I’m working from may be out of date, but that’s the complicated path to retail that exists in Canada right now, regardless of whether you have money, experience, or even an existing 200 stores selling booze responsibly across the country.

That lack of certainty also pertains to private dispensaries hoping to upgrade to the white market. I’m an early shareholder in one, the Village Bloomery in Vancouver, that is considered by many to be the best of the best. But that outfit suffered real issues when a local individual went on a letter writing campaign claiming local residents hated the business, trying to get the city to shut it down. Watching the company working diligently to follow every rule placed in front of it, only for more rules, some of them contradictory, to be placed in front of them, has been a frustrating experience.

The fortunes of Blissco (BLIS.C) follow this pattern pretty closely. Head honcho Damian Kettlewell is someone I’ve known for some time, as one of the pioneers of the effort to get small growers licensed, going as far back as 2015. Kettlewell’s family are long time private liquor store owner/operators in BC, and many rightly expected that experience and connection would bring him some priority consideration when BC opened the doors to retail.

It hasn’t. Blissco has a grow license and is doing fine, but it’s not opening dispensaries.

So when a company comes along suggesting it’s going to penetrate the Canadian retail cannabis space, I’m going to raise an eyebrow and lower an edge of my mouth and hit them with the lazy eye.

Okay, Solo Growth. Show me.

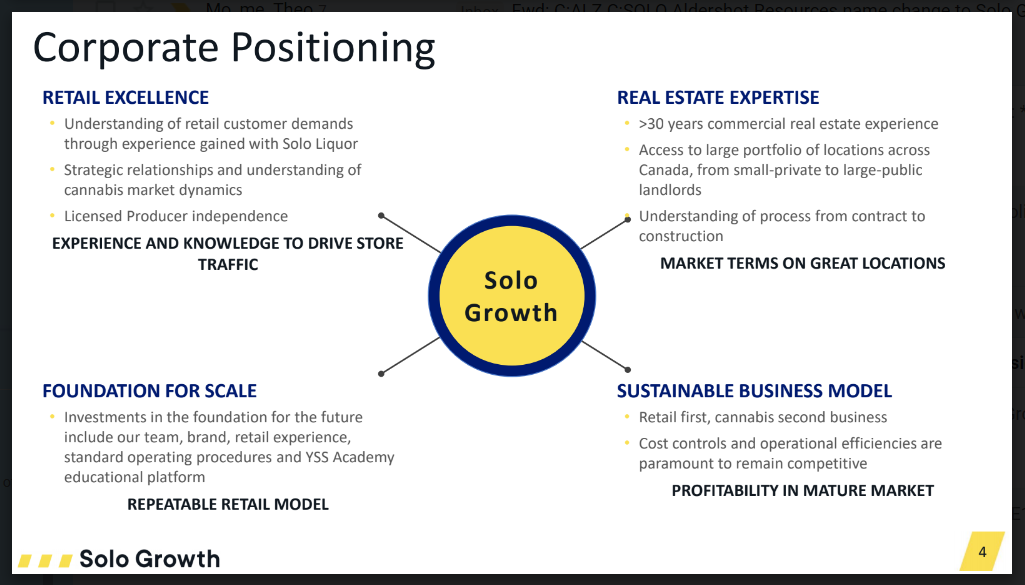

Of all the words and slides in the Solo investor presentation, this is the one that best encapsulates the opportunity.

Admittedly, there aren’t a lot of words here that are going to grow wood among the usual cannabis investor crowd, but phrases like “access to large portfolio of locations” and “retail first, cannabis second business” and “profitability in mature market” really trip my trigger.

“Investments in the foundation for the future” and “cost controls and operational efficiencies” – oh man, that’s going to require a kleenex.

See, the thing with retail is, even guys who understand it and have decades of experience in it can struggle. Go look at your average shopping mall right now, it’s empty storefront, empty storefront, Forever 21, Orange Julius, empty storefront.

So while it might be a great market play, and short term value builder, to rabbit on about how much money you’re going to spend buying everything that pops up, or how much you’ll save in the short term by not actually applying for your own store licenses, further down the road it’s going to be a case of smart people who get it making smart acquisitions of stores owned by the lucky, the sneaky, and the sophisticated, with the cost ramping up depending on which option you choose.

In California, whenever a new rule lands, the folks who got in early increasingly place their stores for sale on Craigslist, to be taken over by companies run by grown ups, who can fill in paperwork and pay taxes. Sure, there was money to be made in getting open first, but there’s more to be made by cherry picking the best locations being poorly run, or poor locations being run by innovators.

Such is how it will be in Canada. Ask Manitoba for a license, or buy one? Enter the Ontario lottery, or be waiting for those winners who need financing to actually get the doors open?

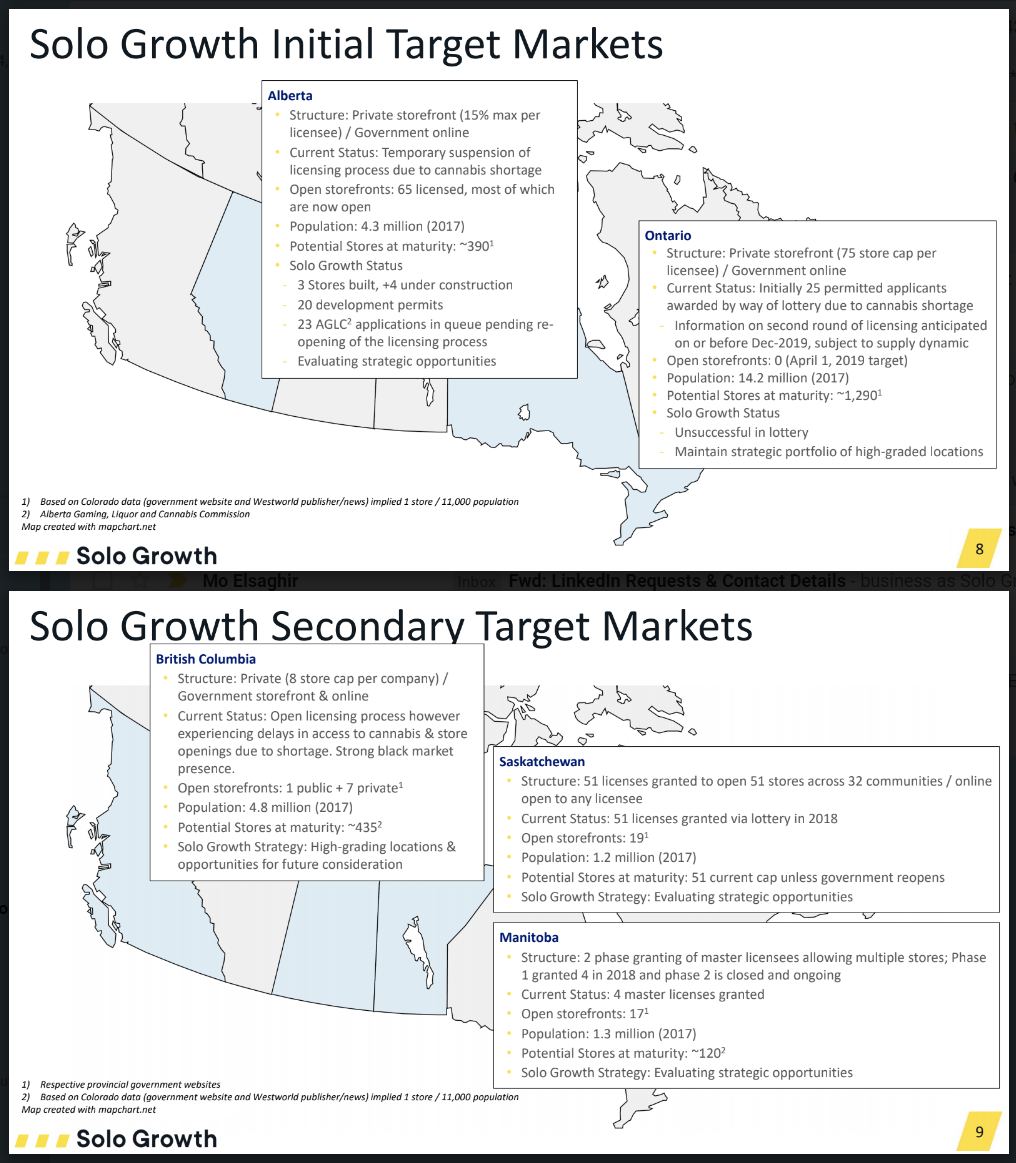

Right now, solo has no operational stores. Like Choom, it has deals in place all over, securing it 20 development permits in Alberta, with three stores built and 4+ under construction, with 23 ALGC applications in the queue. It has prime retail leases held in BC, waiting for chances to do something with them, and in Ontario it didn’t manage to win any lottery spots, which is unlucky but not the end of the story as only 25 have been handed out to date.

It also sits on $23 million, which is enough to build more than 40 stores, and has an annual run rate of a few million per year. In essence, if it takes a decade to figure out the retail scene in Canada, solo Growth will still have the office lights on.

But it won’t take that long. Shortages already proliferate, and as company after company in the cannabis space is exposed taking short cuts and failing in standards, smart, reliable players who have spent 22 years in the controlled retail space in Canada will end up being the go-to.

I like that Solo doesn’t bullshit the investor. In fact, these two slides showing the status of dispensaries in every Canadian market ends the same way every time: “Solo Growth Strategy: Evaluating existing opportunities.”

Mm-hmm.

I love it when you don’t call me pretty, guys.

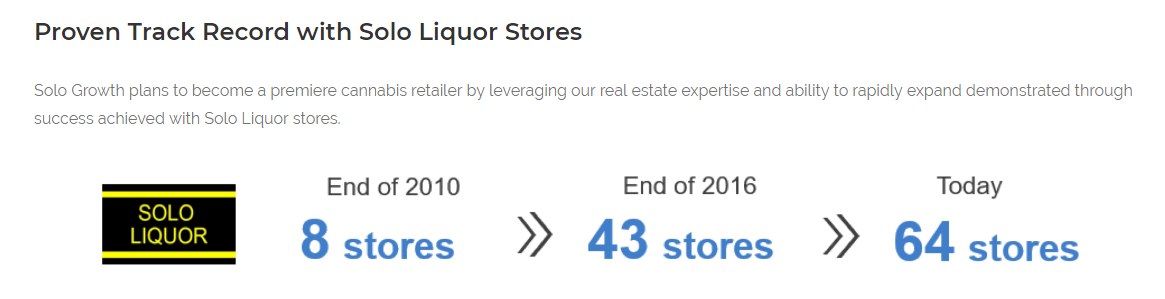

Pali Bedi is the President and CEO, and has spent many of the last 22 years he’s been in the controlled retail game running Solo Liquor.

If you’re unaware what that is, this will help:

That’s substantial growth. Hell, let’s remember ACB bought under 20% of Liquor Stores N.A for $103 million, and they have 231 stores. In doing so, what they actually paid for wasn’t the sparkling opportunity of selling you a sassy little merlot, they were buying the logistics knowledge, the business growth expertise, the ability to negotiate terms on leases with genuine heft behind them, and smart people who can take a new retail business – the cannabis biz – and grow it like they have already grown it before.

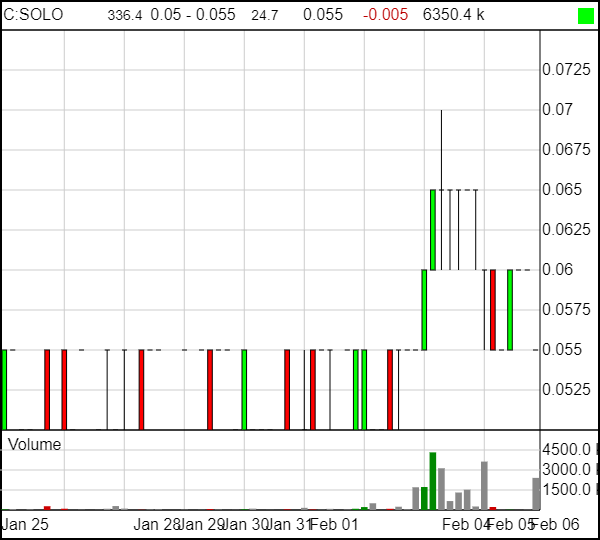

But hey – maybe it’s too early for you, and if that’s your take, I get it. You’re talking a 5.5c stock right now, and a few things admittedly need to fall into place to move this thing hard.

But here’s the two things that make me think hard about this one.

- Today’s market cap at Choom is $76 million, and it’s been as high as $200 million.

- Today’s market cap at Solo Growth, even after a few days of EXTREMELY HIGH VOLUME, is just $33m.

If I’m buying Solo today, it’s to lock it in a box and write ‘do not open until 2021’ on it. I’d be buying knowledge, not leases. i’d be buying track record and low price with every upward tick being a 10% move from this point.

You can buy a lot with $23 million. My guess is we won’t have to wait long for these guys to execute.

— Chris Parry

FULL DISCLOSURE: Solo Growth is an Equity.Guru marketing client

Leave a Reply