For the past few decades gold has stuck to a fairly reliable schedule – a cycle if you will – in carving out a major low every 8-years, roughly:

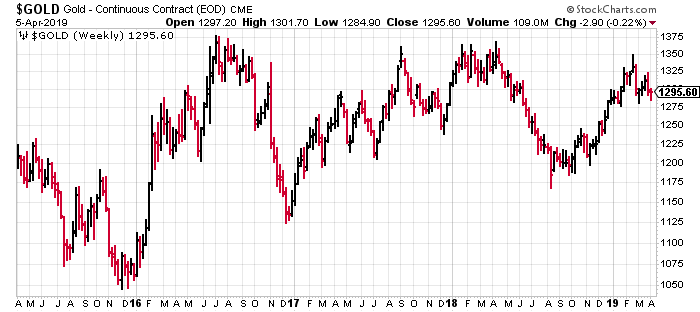

Note that the above chart takes us only up to mid-2016. The projected gold price trajectory (green line) was a bit aggressive, but the chart illustrates the 8-year price cycle quite neatly. Also, note that subsequent price action has not tested the late 2015 low of $1000.00 and change (chart below).

The 8-year gold price cycle remains intact.

There’s a lot of tension building, a lot of cross currents in the gold market right now. There’s a whole laundry list of underlying dynamics at work promising firm to higher prices in all terms – short, medium and long.

These underlying dynamics include:

The US is $22 Trillion in debt. I can’t even begin to calculate the interest owed on that money, let alone the principal itself. One thing is for sure: there’s no way the FED is going to normalize its balance sheet via higher interest rates. The equity markets won’t even tolerate a paltry 4%.

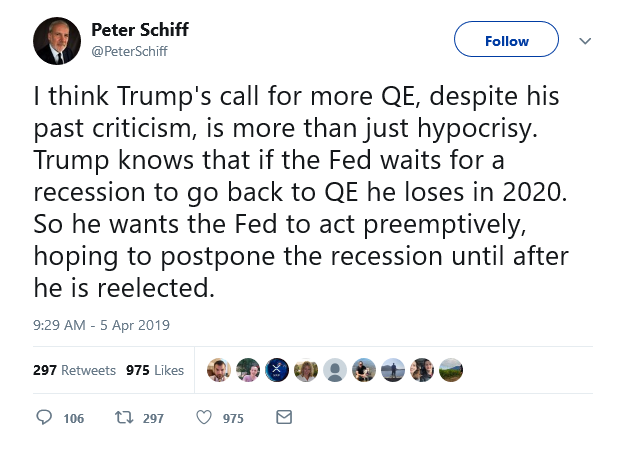

These are strange times. These are also uncharted waters. Not only is Trump urging the FED to lower interest rates, he wants another round of quantitative easing. QE-4 is now a distinct possibility. WTF?!

And it’s not just the FED, other CB’s (Central Banks) around the globe, those shackled with similar debt burdens, are likely to follow suit:

I’m curious what Peter Schiff – CEO of Euro Pacific Capital – thinks about the possibility of yet another deluge of easy green sloshing around the global banking trough. You curious?

Schiff’s recent comments on Twitter:

Also, this:

Well, as long as this ‘President’ is happy in his hypocrisy, I guess.

For those still unclear of what constitutes QE, this hilarious video pounds it home brilliantly:

It’s the illusion of prosperity, all of this loose n fast fundage. It’s total fucking BS if you ask this humble observer.

This may seem naive, but I view the currency of a country the same way I view the share structure of a company. A country’s currency is its common stock in my mind. When a central bank creates money out of thin air, it dilutes its citizenry (shareholders), reducing the value/purchasing power of its underlying currency.

So? As currencies around the globe face further debasement, what are the alternatives? Is there a currency, anywhere, that can’t be run through a printing press or created digitally via a few misguided keystrokes?

How about gold?

Gold is a currency btw, no matter how hard the talking heads on biz TV try to convince you otherwise.

Gold is the only financial asset that’s not simultaneously someone else’s liability.

Other potentially supportive factors for the yellow metal: an inverted yield curve (long-term debt yields succumbing to short-term debt). This inversion occurred after a recent FOMC meeting produced dovish tones from FED members – no further hikes this year dashing any hopes of balance sheet shrinkage.

Equity Guru’s Lukas Kane pondered this unfortunate circumstance. An inverted yield curve is often the prelude to a recession:

Martini-time for gold investors as the U.S. treasury yield curve inverts

As if all of this fiscal over-adventurousness wasn’t enough, geopolitically, we’re living in a world that seems intent on blowing itself to hell just as fast as we can arrange it.

THE overriding fundamental

If you brush all of this fiscal and geopolitical insanity aside, the one fundamental factor that Trumps all (scuse the pun): Peak Gold.

I believe it was Ian Telfer who first broached the subject with any real conviction.

“Are we bad at finding it? Or have we found it all? My answer is we found it all”, Telfer stated when asked for his views in a mid-2018 Financial Post article.

‘We’re right at peak gold’: All major deposits have been discovered, declares Goldcorp chairman

It’s a crazy concept. We actually may have tapped out all of the largest near-surface gold deposits our planet has to offer.

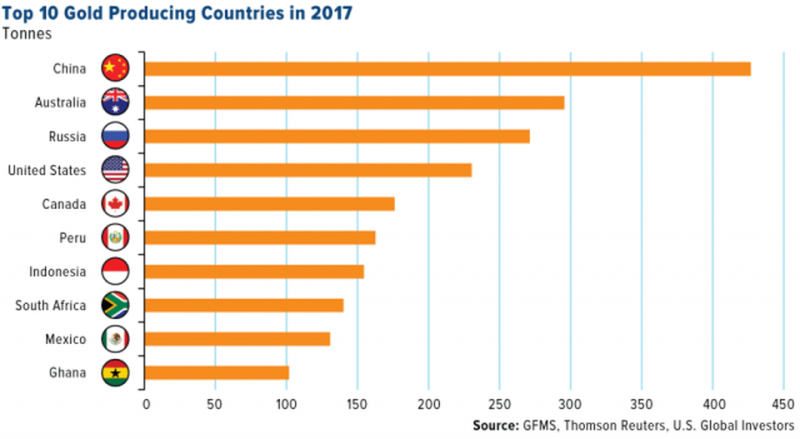

I reckon South Africa is the smoking gun.

This is a country that once stood as THE largest gold producing nation on the planet, by a wide margin. It’s currently ranked eight:

From 1,000 tonnes of annual gold production a half-century ago to a mere 139.9 tonnes in 2017 – that’s a colossal hit.

What’s more, according to the Environmental Economic Accounts Compendium published by African Statistics Day, South Africa is on track to completely deplete its gold reserves in less than four decades.

That’s not surprising when you consider they’re mining ore more than 4 kilometers below the surface!

The above stats make for a compelling-trippy ass’d smoking gun if you ask me.

Telfer is not alone in his belief that we’ve peaked:

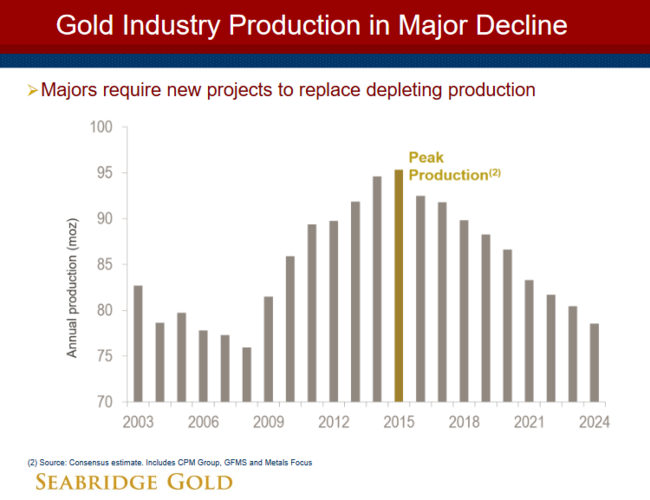

While I was researching gold exploration companies in B.C.’s Golden Triangle, I came across this chart demonstrating how things might play out in the coming years:

If the above chart reflects reality in any way, I think a person can safely ignore everything else and simply rely on good ol fashioned stock picking to hit pay dirt. Shortlisting ExplorerCo’s with ounces-in-the-ground is what I’m getting at – uncovering gems currently valued at a mere fraction of what they’ll ultimately be worth when this market heats up.

How to position oneself for the inevitable feeding frenzy

Gold producers both big and small are running out of inventory. Every day they are in business – every day they mine their asset base – they reduce the number of ounces on their books. These companies need to acquire more gold deposits if they are to survive in the future.

Put bluntly: they need what the small guys – the ExplorerCo’s – got. And what the small guys got won’t go cheap in the months/years to come.

Where to look for opportunity in this space?

Right here…

Nexus Gold (NXS.V) expands its jurisdictional scope: Red Lake UPDATE

Barrian Mining (BARI.V): a new gold ExplorerCo grabs a chunk of prime Nevada real estate

For a broader sweep of potential candidates in mining friendly climes, the following Guru offerings are a good place to start:

BC’s prolific Golden Triangle: a selection of ExplorerCo’s for your consideration (Part I)

BC’s prolific Golden Triangle: a selection of ExplorerCo’s for your consideration (Part 2)

A potential breakout in gold and 11 dirt cheap ExplorerCo’s in the Yukon

Gold opportunities in the Abitibi Greenstone Belt: 13 dirt-cheap ExplorerCo’s for your consideration

Gold production is going down while the metals safe haven status fortifies with each reckless misstep by the global banking community.

The ExplorerCo’s linked above? There are clues that the market for this group is changing: Prices of many of the co’s I follow are firming up. Private placements are oversubscribed.

END

~ ~ Dirk Diggler

Feature image courtesy of GeologyIn.

Full disclosure: Aben Resources (ABN.V), Nexus Gold (NXS.V), and Barrian Mining (BARI.V) are Equity Guru marketing clients.

Leave a Reply