Buried in Sunniva’s (SNN.C) April 29, 2019 “strategic update” was the news that “current development plans for the Sunniva Canada Campus in Okanagan Falls, BC have been suspended. As a result, the supply agreement with Canopy Growth Corporation will not proceed.”

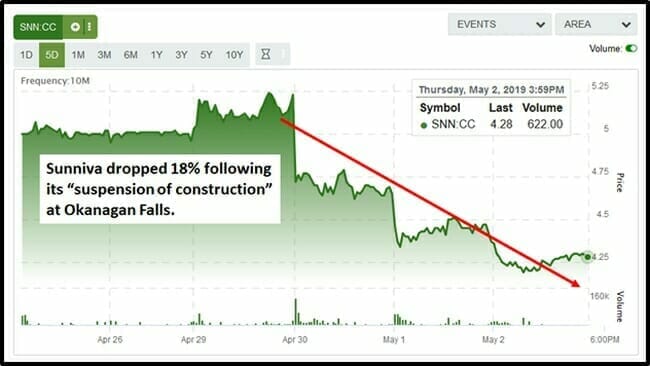

In the following three days, SNN shed about $40 million in market cap.

Luckily for Sunniva shareholders, SNN is not a one-trick pony.

Sunniva stated that going forward it will “focus primarily on the ongoing development of California assets and brands”.

In the same press release SNN announced 2018 gross revenue of $18.8 million, up from $16.1 million in 2017.

A year ago, SNN was planning to invest $125 million in the Okanagan Falls facility, including a 124,000 sq. ft greenhouse and a second 290,000 sq. ft. greenhouse – creating 220 full time jobs.

“Despite urging from several regional directors to slow down the process, large-scale production of medical marijuana will be allowed in industrial zones in the Regional District Okanagan-Similkameen (RDOS),” stated the Penticton Western News.

Three local directors voted against the monster greenhouse facilities including Tom Siddon, Area D (Kaleden/OK Falls), who “spoke at length about his opposition to allowing cannabis production facilities in industrial areas” and conflated that disapproval with a “general opposition to recreational marijuana use.”

“Why rush to ramrod this through?” Siddon asked. “Half the public meeting time was spent advocating for that project. That isn’t fair. The public is confused.”

“We would like to direct these cannabis facilities to the industrial zone,” stated Karla Kozakevich, chair of the RDOS in 2018, “We would rather not see agriculture land taken up by monster size buildings that are doing production inside like turning the plants into oils and pills and edibles.”

The April 29 press release did not give a coherent explanation for the U-turn. An April 30, “executive management conference call” also failed to elucidate the decision to terminate construction. For the next two weeks, you can hear a re-play of that carefully stage-managed call by dialing 1-855-669-9658 or 604 674-8052 and entering code 3178.

We advise listening to the above SNN conference call in conjunction with dusting, dishwashing or watching episodes of “When Animals Attack” on You Tube.

The lack of narrative detail provided by SNN has inspired shareholders to fill in the blanks on the bull-boards:

“This is code for, we ran out of money,” stated one shareholder. “SNN was one of my largest holdings,” posted another, “but that was because they had the Canadian campus + deal with Canopy. How much is management making in salaries?”

“The only assets I am aware of in Canada, is the land in OK Falls that if sold at cost, would generate about $3.5 million after a note secured on the property – and shares of NHS,” posted another investor, “As NHS is facing a pending law suit on a data breach , why would anyone purchase these shares until the lawsuit is settled?”

In truth, “selling pressure” is something Sunniva is well acquainted with. For most of its 15-month trading life (2019 was a rare bright spot), the stock has been pounded mercilessly.

Construction of SNN’s phase one 325,000 square foot “Sunniva California Campus” has “experienced delays and is now expected to be operational in late Q3 2019.”

Estimated capital costs of the leased Sunniva California Campus have increased to CND $127 million due to “additional costs for the temperature control and lighting systems”.

It is possible, in the wake of California cost over-runs, that SNN simply could not find favorable financing for the Okanagan Falls facility.

According to a well researched May 2, 2019 joint-article by Viridian Capital and MJ Biz Daily, “the number of cannabis capital raises may be slightly down so far in 2019, but the amount of money raised is almost double”.

Year to date, marijuana-related businesses have raised $5.17 billion through 199 deals compared with $2.8 billion via 222 deals in a similar period last year.

This week, $845 million was raised including: San Francisco-based Pax Labs, a vaping products company, closing a $420 million raise, and Aphria, the Canadian cannabis cultivator, closing a $350 million debt raise.

The take-away here for cannabis investors is that planning to do something is not the same thing as doing it, and there many ways for an ambitious young company to stumble – including not having the money to fund its own stated plans.

SNN announced that it “will not proceed with the previously proposed ‘Spin-Out’ of NHS and Okanagan Falls property into a separate publicly traded entity.”

Full Disclosure: Equity Guru has no financial relationship with SNN.

Leave a Reply