C21 Investments (CXXI.C) is about to get a lot bigger south of the border.

The Canadian cannabis company just finalized the purchase of Swell Companies, an Oregon-based marijuana producer with 41 full-time employees. The acquisition helps C21 kill two birds with one stone: expand its U.S. operations while tapping into the fast-growing consumer packaged goods segment.

C21 expands U.S. footprint

In a Monday press release, C21 Investments announced it had finalized the purchase of Swell through a combination of cash and shares.

As part of the deal, Swell’s share vendors will receive 1,266,667 common shares of the company at a price of $3.00 U.S. ($4.03 CAD). They will also receive warrants to purchase 1.2 million common shares at a price of $1.50 CAD until May 24, 2024.

C21 has also agreed to pay the vendors the following cash sums:

- $500,000 U.S. ($672,000 CAD) on or before July 1, 2019

- $350,000 U.S. ($470,000 CAD) on or before September 30, 2019

- $1,370,586 U.S. ($1,842,471 CAD) on November 23, 2020

- 7,350,000 U.S. ($9,880,000 CAD) via 2.45 million common shares on May 23, 2021

C21 is no stranger to M&A activity south of the border. Swell is the company’s fifth such acquisition and provides a key gateway to a fast-growing segment of the American cannabis market.

Robert Cheney, C21’s President and CEO, issued the following statement:

“Acquiring Swell fulfills a critical segment of our expansion strategy, positioning C21 as a competitive player in the rapidly growing consumer packaged goods segment of the industry by bolstering our extraction and manufacturing expertise across all of our operations.”

Swell CEO Alleh Lindquist said oil derivatives such as vapes represent “the most significant component” of the marijuana industry. Swell just so happens to be a leader in this disruptive market.

That’s all the intel we got on Swell for now. This is what the official website looks like:

Follow the bright green

C21 has been eyeing Oregon cultivators for quite some time. Back in October, the company announced it had reached a definitive agreement to buy Phantom Farms, a “legacy cannabis brand” with 120,000 square feet of grow space.

For the Vancouver-based C21, Oregon provides plenty of runway to expand into the fast-growing U.S. market. The state was among the first to legalize non-medical cultivation and use of marijuana all the way back in 2014.

Of course, expansion isn’t as easy as filling a truck with CBD flowers and shipping them across state lines. Most U.S. states currently uphold a blanket ban on recreational cannabis.

But that’s quickly changing.

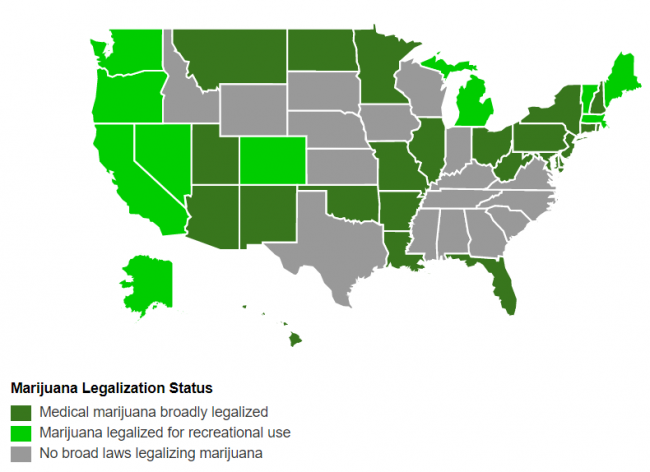

Take a look at the latest marijuana legalization status map across the United States:

It doesn’t take an expensive marketing consultant to suggest that the west coast is the best place to start your U.S. expansion. As the chart clearly shows, the Pacific states are flush green.

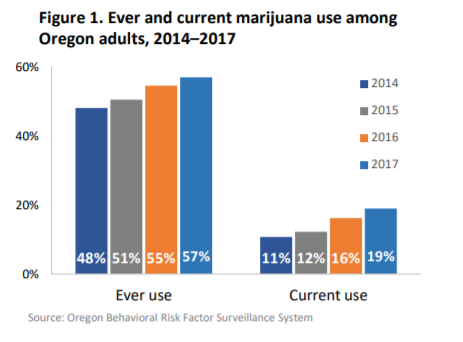

While Oregon is no California in terms of size, scale and consumption, it’s still one of the most important states for the cannabis industry. More than a decade ago, the National Organization for the Reform of Marijuana estimated that more than 8% of Oregon residents used cannabis recently. That figure swelled to one-in-five in 2017.

More than half of the adults in the state have used cannabis at some point in their life.

Against this backdrop, it’s reasonable to expect that Oregon pot sales will reach $1 billion by 2025, according to the latest research. By January 2019, more than 4,300 cannabis business licenses were submitted to the state. This included 1,114 producer license.

Not to get too far off-topic, but this is extremely important: where legal marijuana usage grows, opioid prescriptions fall. To whit:

Two papers published [in 2018] in JAMA Internal Medicine analyzing more than five years of Medicare Part D and Medicaid prescription data found that after states legalized weed, the number of opioid prescriptions and the daily dose of opioids went way down.

Basically, states that have implemented medical and/or recreational marijuana programs have seen a sharp decrease in daily opioid doses. This was identified as far back as 2016 in a study that looks at Medicare prescription uses.

The study found that medical cannabis programs led to a decrease of 1,826 daily doses for opioid medications filled per doctor each year.

So while Oregon may seem like a small step for C21, the implications could be huge.

Full Disclosure: C21 Investments is an Equity Guru marketing client, and we own the stock.

Leave a Reply