Was just looking at a bunch of news releases, trying to figure out which to cover when I remembered, ‘didn’t you just use to do all of them?’

Why yes, self, I did. So let’s give ‘er to everyone, just like the old days.

NOTHING EASY AT SPEAKEASY (EASY.C)

I’ve had several nice discussions with the folks at Speakeasy over the last few years, about their decent business plans as a grower collective on 290 hectares in BC’s Okanagan region, and their 15 years history in cannabis. By rights, they should be worth a lot more than their current $28 million market cap, but nobody has had worse luck in the markets than they have.

My first introduction to them came at the tiny hands of Ali Mawji, who opened the conversation with a confession that he’d been done in Germany for stock manipulation and served time in jail but that he ‘had learned his lesson and didn’t want to do that again.’

Speakeasy was being walked around town by him and this would be his legacy, he said.

We agreed to write a story about the company, but he didn’t pay his bill, and we’ve not set eyes on him in the year since. Months after the stiffage in question, other marketing companies that apparently pursued harder than we did would find themselves dragged in to the Bridgemark scandal currently playing out in front of the BCSC, with Mawji in the middle of it all.

Bullet dodged for us. Bullet most assuredly not dodged by Speakeasy, which took one right between the eyes and has worn the scarlet letter ever since for their association with the whole sorry lot.

That’s a shame, because there is a real business there, and some real people who are doing the work. They’re exactly the kind of group that Health Canada wants to bring in from the cold – grey market growers who know what they’re doing and would be better inside the system than outside.

Today, their struggles came to a head and played out through a boardroom reshuffle.

Marc Geen will resign as the Company’s CEO and the position will be filled by Dr. Bin Huang. Bin, former President and CEO of Emerald Health Therapeutics Inc., comes with a wealth of knowledge and experience in this industry.

Uhh.. I liked Geen. And, frankly, running Emerald Health doesn’t strike me as being a big branding win, unless you’re looking to prove you’ll be good at playing with Howe Street going forward.

Under her reign at EMH, Bin oversaw a big rise in market cap but little actual progress on the ground, leading to her ouster late last year.

Geen further states, “I will be temporarily moving to the Advisory Board as we move through the final stages of the Health Canada approval process”. Health Canada rules state that security clearances must be issued to the directors and officers of the corporation or to any individual who exercises, or is in a position to exercise, direct control over the corporation.

This passage was a little confusing to me because, reading between the lines, it appears Geen was suggesting he wouldn’t make it through security clearance.

Let’s be honest, Health Canada doesn’t historically play nice with the old grey market crowd, and the Bridgemark affair makes for a rough batch of search engine returns when one looks up his name, so a falling on ones sword to get the company back on track is a fair move.

But it’s not just about him, it would seem, as pretty much everyone connected to the old guard is making the advisory board shift at Speakeasy today.

Along with Marc Geen’s resignation as CEO and board member, Brian Peery, President and board member, Alexander Kaulins, CTO and board member, and Jeremy Ross, board member, will resign from their directors’ and officers’ positions and join Marc Geen on the Company’s Advisory Board.

Christ on a bike. Anyone else?

Dave Cross will resign as the Company’s current Chief Financial Officer however, the day to day financial operations will remain with his firm, Cross Davis and Co. The acting Chief Financial Officer position will be filled by Patrick Geen, who has been involved with the Company since its inception. Along with being appointed to the Board of Directors, Pat is also the Company’s Head Grower. [..] Mervyn Geen resigns as board of director and Chairman of the Board.

Translation: This is a house cleaning. Anyone who may drag the company down as it tries to navigate licensing is being shunted aside, though still leaving a hand on the wheel. For a family run business, that covers its marketing with images of that family, to unfamily the place is a big deal.

But, credit to them, it might just have been the big step needed for folks to give them the fresh start they’ve been looking for over the last year and, more importantly, a little more love from regulators.

With the changes above implemented, Speakeasy believes it has reached full compliance for meeting the Health Canada rules for licensing.

Health Canada may yet disagree. Moving to an advisory board might check the boxes on a form, but it may also still be a little close for the regulators.

The new body in the CEO seat appears designed for this exercise. At Emerald, Dr. Bin has, if nothing else, experience in getting licenses locked down, so I can see the logic in bringing her in. Making good use of those licenses once they’re acquired hasn’t been her strong suit, but the Geen’s, I expect, will be happy to take on that work when and if it happens.

In the meantime, EASY stock has pretty much followed the fortunes of the sector over the last six months, with a good January to March and a bleed out in the months since. But what they never got was the massive valuation blow out that competitors were getting, while they were undoing their Bridgemark issues. That, IMO, presents them as an interesting side bet right now.

Repeat: That’s a $28m market cap.

SPROUTLY (SPR.C) POSITIONED NICELY FOR BEVERAGE RULES

If you want to be uncharitable, and many folks do for a variety of reasons, you could point to Sproutly and say ‘they got nothin’ but a little grow’.

It’s true, they have a small grow. And a license, which is also worth noting.

And a beverage technology deal that, IMO, they got VERY cheap.

And they have an agreement with Moosehead Breweries to work together on future products.

And an extraction license that allows them to play with beverage formulas before the government releases their expected edibles rules. And they’ve been doing exactly that.

Is all that worth $120m?

Yeah. Yeah, I think so.

Sproutly Canada Inc. has successfully completed the first run of the proprietary aqueous phytorecovery process (APP) extraction technology licensed from Infusion Biosciences Inc. at its wholly owned Toronto Herbal Remedies Inc. (THR) licensed facility. This initial APP run successfully recovered both water-soluble cannabinoids (Infuz2O), with onset of effects within approximately five minutes and which dissipate within approximately 90 minutes, and oil-based cannabinoids (bio natural oil), a strain specific cannabis oil. The initial Infuz2O and bio natural oil recovered is expected to be used for research and development and product formulation purposes for cannabis beverages and edibles within the proposed regulations recently announced by Health Canada.

For the uninitiated, the Sproutly tech is around a process whereby Sproutly ‘washes’ the cannabis with reagents that bring a lot of the goodness from the plant along with it.

Traditionally, you’d extract oil from the plants that contains the CBD etc you want in your beverage, but making oil mix with water, which you need to create a drinkable product, isn’t an easy process.

Oil tends to coagulate, so one mouthful may be all oil and taste gross and hit you with a ton of CBD, while the next may be the opposite. That’s not ideal. It’s a situation those companies like Lifestyle Delivery Systems (LDS.C) have had to tackle when they make edible ‘strips’.

Naturally Splendid (NSP.V), which has been struggling for some time on the markets, revealed their own tech several years ago which would powderize the oil, thereby making it water soluble, but they’ve struggled to execute in a meaningful way.

The reason I bring up Sproutly is precisely because I think their tech makes the most sense for a future beverage market, and their entire timeline of news for the past year appears to have been designed not to sell stock, but to position them for a time in the very near future where the things they have will be worth a premium.

I watch Sproutly from the corner of my eye, with little concern if it’s up or down on the day, but more focused on the little things they’re doing that work toward that eventual goal.

The company has $9m in cash in the bank, so there’s little need to go get more unless their stock runs, or they want to buy something on the end of a raise. The license provides feedstock to their product development. And their products have zero value now, but may, suddenly, be very valuable on a given day in October.

Between them and Tinley (TNY.C), which has reemerged from a product development slumber with five SKUs of de-alcoholized weed drinks in California that are testing really well, the beverage space is starting to sprout buds. Watchlist.

BRUCE LINTON: IT’S GOOD TO BE THE KING

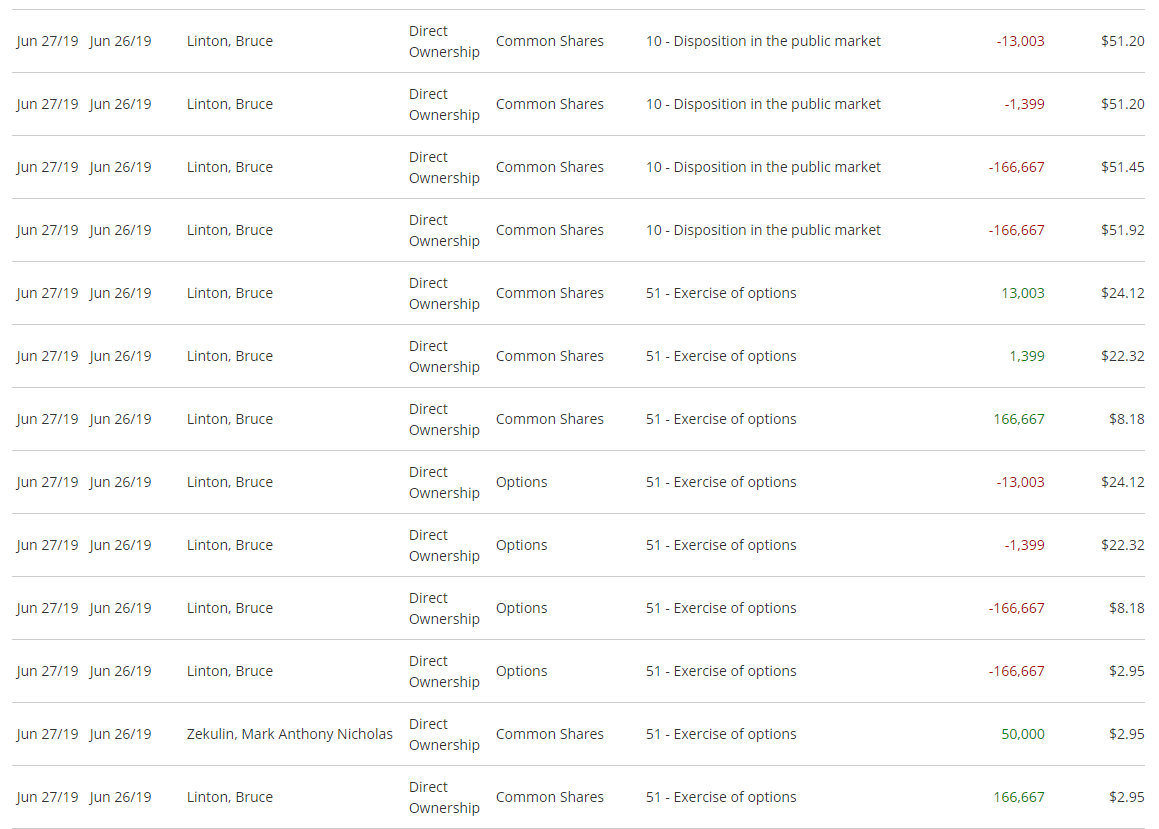

Over the last few days, Canopy Growth (WEED.T) boss Bruce Linton has been doing some press, released financials (showing another epic loss), and posted some interesting insider trade documentation.

For those with squinty eyes, Linton has exercised the stock options he’s been sitting on for years, acquiring Canopy shares for as little as $2.95 per (it’s trading at $52.36 at the time of writing), amassing $17,965,750.19 in stock that cost him just $2,199,861.75.

That’s fair – the man has been integral in driving the share price of WEED.T upward, and options are granted in thanks for exactly such eventualities.

BUT… It’s worth noting those options were valid until 2022 and 2024. Why take them down now, if you think the share price is going to drive upward further still from where it is?

<devils advocate>

Maybe Linton is buying a waterfront mansion and a small harem of busty pool cleaners – we don’t know. It’s his right to cash in his chips whenever he feels the need, and certainly he’s still got more in hand – 64% of his previous available total, in fact, is still reportedly sitting in wait.

</devils advocate>

The remaining options average out at an exercise price of around $20 per share, so one of several scenarios is likely:

1: Linton only needed the $15m in profits he hauled out of the pool today and let the rest slide for later

2: He thinks, going forward, Canopy shares will stay well above the $2.95 and $8.18 he cashed in at, but might eventually test the $20 mark of what’s left and may not be such a good bet to take out just yet.

3: He’s not done selling yet but doesn’t want to obliterate the share price by doing it all today.

It should be noted, others in the WEED team also executed their warrants today, so there may be validity in a scenario where the company wanted those cheap options moved out of the way for bookkeeping reasons.

Either way, on an $18.3 billion market cap, $17m+ in extra volume won’t exactly cause much of a pothole under the Canopy truck. The $300m loss they just announced is far more likely to bring about a wreck than a little executive bonus time.

One thing worth noting about Canopy arises when you look at the last year’s worth of chart movement: Considering they’re the biggest player out there, and have had such big infusions of investment into them, and have done such big deals to acquire others… nobody is in profit if they bought this stock ten months ago.

Institutions may still hold their ‘safe bets’ in cannabis in WEED.T, but I suspect there’s a large number of retail investors out there starting to find value in sub-$30m market cap players.

GTEC NEARING BIG MILESTONE

Owners of GTEC Holdings (GTEC.C) have long been waiting for Health Canada to get off the pot and slap that company with a license or two.

GTEC Holdings Ltd.’s wholly owned subsidiary, Alberta Craft Cannabis Inc., has recently completed a Health Canada licence inspection.

Alberta Craft had requested and scheduled the recent inspection with Health Canada, which is required in order to receive its standard processing licence. [..] Health Canada inspectors conducted the inspection during June 25 to 26, 2019, at the Alberta Craft facility in Edmonton, Alta. Alberta Craft expects to receive a formal inspection report from Health Canada in the coming weeks.

GTEC has been busy of late, acquiring dispensary chains and achieving milestone payments as early acquisition targets progress towards licensing.

Alberta Craft has a cultivation license and is permitted to sell to other license holders currently, which has led GTEC product to being a top seller on CanMart.

According to CannMart, the company’s flagship medical brand, GreenTec, had previously become No. 1 selling product on the CannMart medical cannabis marketplace, and year to date, it continues to be. CannMart is an on-line medical e-commerce marketplace, wholly owned subsidiary of Namaste Technologies. GTEC has established a similar selling arrangement with CannaFarms (a wholly owned subsidiary of Vivo Cannabis) and Pure Global Cannabis. The company has also been in negotiations with several of the top-five-largest (by market capitalization) Canadian publicly listed cannabis companies on finalizing further supply agreements to increase exposure into various medical and recreational platforms.

Market cap?

Consider they have several grow facilities in various stages of licensing and sale, plans for dispensaries in Alberta and BC, and good sales numbers on online selling platforms..

Just $59 million. A bargain.

ALSO IN ALBERTA’S DISPENSARY SCENE:

High Tide (HITI.C), which owns and/or operates a bunch of ‘weed stores’ in Alberta, announced losses of $7.1 million on $11 million of revenue for the first half of 2019.

Here’s the catch: Only a handful of those stores features weed. The rest are either opening soon, or have no weed on the premises.

This is what pisses me off about a lot of the Canadian, and US frankly, dispensary space; it’s all so much bullshit.

You know, to be able to say ‘we have four dispensaries’ is no failure. It’s a great starting point. But this outfit prefers to open ‘cannabis accessory’ stores which, to me, is a dodgy PR workaround.

“Ermagherd, we’re selling so many bongs!” – no retail investor, ever.

If you’re going to open a shit ton of stores and most of them are a big letdown for clients, then yes, you’re going to run a loss. And you’re going to hurt your brand. And you’re going to fool some investors, but not many, and not for long.

Be real, bois.

— Chris Parry

FULL DISCLOSURE: GTEC, Tinley and Sproutly are Equity.Guru marketing clients

Leave a Reply