Back in mid-2018, when everyone was talking about how MedMen (MMEN.C) was going to be the biggest weed debut ever, one of my guys looked at their listing docs, specifically under the section relating to executive compensation.

What they found was egregious; the founders had all the shareholder votes, giant compensation packages, insane retention bonuses, and golden parachutes that would basically bankrupt the company.

The surprise to me wasn’t that the folks behind the listing had made such a bad deal with MedMen’s founders to get that company public (others did likewise in the months following, to more poor reviews), but that nobody was looking at the information RIGHT THERE in the documents publicly available.

It wasn’t hidden. It just required someone to go through 60 odd pages of legalese to find.

Granted, the websites established by financial regulators to house public documents so that investors can protect themselves are arcane and almost deliberately difficult to use.

There’s simply no excuse for Sedar to still be putting documents behind generic ‘News release – English’ headlines and not the actual findable headlines, and even less excuse for not housing said documents in a searchable and cross-reference-able format. In a perfect world, we’d be able to find insider connections between companies and cross reference their trading histories, and create feeds so we could easily track news from our favourite companies..

Instead, we get a website that Geocities and MySpace would have cursed as being ‘really pretty shitty.’

Real important to know that the file format was ‘PDF’, and what time it was filed. Less important to know what the document actually is without clicking on 60 of them, apparently.

But hey, if you can set aside some time to read the documents of interesting public companies (particularly the MD&A docs), you can find some pretty intriguing info that can help you get ahead of the pack.

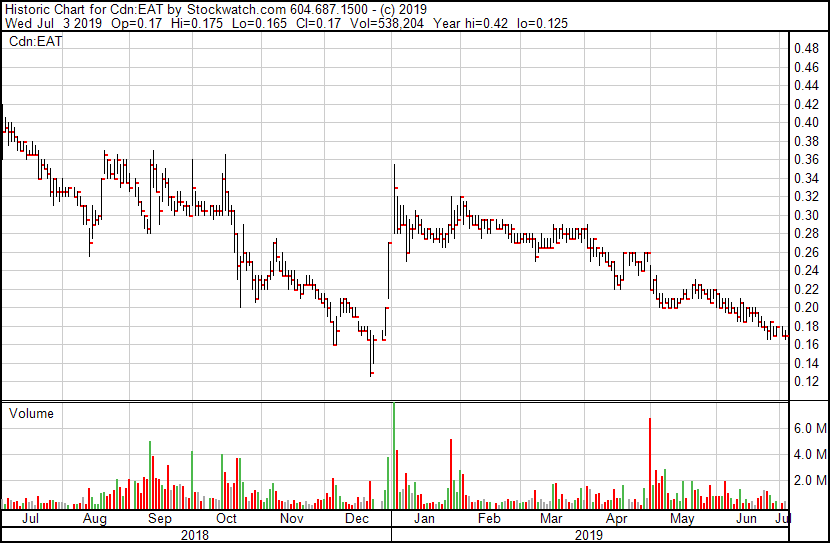

Take the following, from Nutritional High’s (EAT.C) recent financial statement announcement. I had no good reason to look at their docs, other than the fat loss they racked up.

It didn’t take long to find things were a little hinky..

EAT’s loss last quarter was big. But before they got to explaining why, let’s see their highlight reel!

- Five quarters of continuous revenue growth starting Q3 2018, with the latest quarter representing an increase of 368% year over year in Cannabis sales.

Fantastic news! That’s definitely a highlight.

But why compare to a year prior, and not a quarter prior? Quarter by quarter numbers must look great too, right?

- Q2 revs: $6.063m

- Q3 revs: $6.154m

Oh.

I mean, technically that’s revenue growth. An extra $90,000 over three months is fine, streak remains intact and all, but clearly a 1.48% increase in quarterly revenues isn’t as fabulous as the 484% year over year they led with.

But hey, no biggie. The important stuff is deeper down.

The net loss on that $6.154m revenue number was -$9.741 million, which was a roughly 50% jump in lost dough from the previous quarter. That needs a deeper dig because the size of the jump is BIG.

Explain yourself, EAT:

In Q3 2019, the Company enhanced its internal controls – procedures designed to provide reasonable assurance that transactions are properly authorized, assets are safeguarded against unauthorized or improper use, and transactions are properly recorded and reported.

Oh no…

As part of this, management diligently identified the need to record a loss and reserve on inventory of approximately $2.2 million, composed of $1.7 million in overstatement of inventory and $0.5 million in reserve for slow moving inventory.

“Overstatement of inventory” would imply ‘oops, we counted wrong.’

But “procedures designed to provide reasonable assurance that transactions are properly authorized, assets are safeguarded against unauthorized or improper use, and transactions are properly recorded and reported” implies… theft?

Like, $1.7 million worth of theft?

We can shrug at $500k of slow moving inventory, that happens when you’re creating new products that may or may not hit the zeitgeist but, hoo boy, that $1.7m of lost or miscounted or stolen product is 2/3 of the loss increase in Q3.

Not a good look.

To ensure that any material recordings such as the above are minimized in the future, management has conducted a detailed review of current systems, workflow processes, and personnel identifying several areas of opportunities for improvements which include but are not limited to: enhancing and updating all SOPs related to inventory management and valuation tracking; reviewing Operations and Finance workflows and implementing advance training as needed; and upgrading key positions and inventory management systems.

This is good, obviously. I mean, they figured out they were losing product, haven’t exactly revealed how, but at least it should be better going forward now that they’re running the company like real grown up boys.

Then there was this:

Impairment: Due to loss of authorization for cannabis manufacturing at Pasa Verde in February 2019, the Company decided to recognize impairment loss (non {&#A A ; –} cash) of existing intangible assets (license, trade name and customer relationship) and goodwill, of approximately ($6.4) million, also due to a decision of the Company to apply for new local and state licenses.

Oof.

Thing was, they still owed money on that deal, that now has no license.

– Consideration Payable: as part of the acquisition in July 2018, the Company was obligated to pay up to $6.9 million (“the Earn-out payment”) between 12 and 24 months of the closing date, based on certain performance milestones of Pasa Verde. In connection with the license cancellation in February 2019, Nutritional High has now completed a settlement agreement with the previous owner of Pasa Verde, as a result of which it recognized a gain of approximately $4.9 million due to a reduction in its total consideration payable.

So it’s not as bad as it might have been.

The settlement improves the relative financial metrics of the acquisition by significantly reducing future cash obligations, for the Company.

Reducing, but not eliminating.

What’s baffling to me is, if I go looking on social media for folks puzzled by the words above, I find none. It’s as if everyone read the highlights of the news release, maybe squared away the revs and losses, and just moved on without asking ‘why is this loss a thing?’

READ THE FILINGS, PEOPLE.

With all this in mind, is it any wonder there was a change of command at EAT in June?

That CEO change happened without much explanation as to why, which isn’t exactly a rarity. Usually, a company will say ‘the CEO is pursuing other business opportunities’ or ‘he’s spending more time with his family’ in a news release and not ‘he let $1m+ of pot go missing on his watch’, in an effort to let the prior captain move on with pride intact.

EAT did that initially, but when they had to explain that missing weed, they prefaced the CEO change a slightly different way.

Nutritional High has strengthened its top management position with the appointment of Adam Szweras as CEO in June 2019.

I mean, yes, it has, but you usually don’t want to wave goodbye to the last guy by bragging your new guy is better, even if he would pretty much have to be, considering the mess the old guy left behind.

Mr. Szweras is replacing Jim Frazier, who served as CEO of the Company since July 2016, and has stepped down to pursue other business opportunities.

Oh! There it is, the ‘other business opportunities.’

Mr. Szweras is a securities lawyer and an investment banking professional with a successful track record of incubating and scaling cannabis focused companies. He is also currently a director of several leading cannabis companies including Aurora Cannabis Inc., Harborside Inc. and Quinsam Capital Corp.

So not exactly a changing of the guard, but a sign EAT has recognized it had a habit of walking into the furniture over the last year and has decided to turn on the lights going forward.

The rest of the release is actually pretty detailed and makes for a good read as it pertains to this company looking to correct the shonky way it had been allowed to devolve previously, and gives a little confidence that, if you missed out on the downward slide of early 2019, you might be in a good position to benefit from the re-org going forward.

My guess is, the company was owning their mistakes, and were pretty stoked that nobody bothered reading about them up to this point.

Sorry, EAT!

I will say, if you like a turnaround story, keep an eye on this one as all the signs in their financials point to exactly that. I think credit is due when a company realizes they have to do a fundamental rethink of everything, and will actually clear out execs to make it happen, and do so in plain sight.

UPDATE: This morning, EAT announced their partner in California, Calyx, had received a distribution license. Good news, and a sign that, indeed, they’re turning things around.

EAT is not a client.

But 1933 Industries (TGIF.C) is. And we like that because 1933 hasn’t screwed up their last year of business, they just haven’t been recognized for it yet.

If we read into 1933’s public filings, there’s some interesting stuff sitting there, even if it stands squarely behind a solid-sized quarterly loss.

The revenues are growing.

- Q2 revs: $3.72 million

- Q3 revs: $4.59 million

Solid.

The loss is also growing.

- Q2 net loss: $2.9 million

- Q3 net loss: $7.2 million

Oof.

So let’s get into the weeds again and find out where that loss comes from, because not all losses are created equal.

Chris Rebentisch, CEO of the company:

“Since becoming a publicly listed issuer two years ago, we have focused on building one of the most valuable and respected CBD brands in the market and in successfully growing THC market share in Nevada, where we continue to be one of the largest suppliers of wholesale branded products in the state, with a major presence in every dispensary.”

This is true.

“We have spent significantly on the expansion of our infrastructure to support the future growth of our brands and have increased spending in product development, inventory buildout, and sales and marketing efforts.”

Fair. Also, margins are down – marginally.

The decrease in the gross margin as a percentage of revenue from the prior year is primarily due to increased purchases of third party biomass by Alternative Medicine Association to produce concentrates and final products, while increasing market share.

1933 is building out its supply so it won’t be necessary to buy from third parties but sales are growing quickly enough that they’ve needed to find alt suppliers to keep up. That’s expensive, but also good news.

Not everything was good news. 1933 took a write-down on a failed consulting arm.

The company recorded a loss of $7,277,021, which is attributed to building infrastructure scale, investing in brand development and a $3,044,86 impairment adjustment of the company’s consulting arm, Spire Global Strategy Inc.

That’s no small loss.

The company acquired Spire on the basis of an independent valuation, a strong team and a solid business plan to provide services to the burgeoning cannabis sector in Canada and to build a diversified business within the cannabis industry. As the sector evolved in terms of both the regulatory environment and the nature and volume of contracts, the expected revenue and future market development of Spire were not realized.

A $3m write-down is no small thing, but it does explain a third of that quarterly loss as a one time event, and the decision to wrap it up and not throw good money after bad is a smart one.

The company’s strategy has since shifted to consolidate its focus on the nation-wide growth of its consumer branded goods, and supporting cultivation and extraction assets, where the value proposition of these sectors to the business provides a better return on investment.

In other words, getting back to core values. 1933 has done an amazing job getting into every dispensary in Nevada, and building a customer base. To hear they’re ready to spread those brands to other states is BIG NEWS.

Also big news:

The company received the permanent occupancy permit for its purpose-built, state-of-the-art indoor cannabis cultivation facility on June 28, 2019. The facility is now ready to commence operations, culminating in the achievement of one of the company’s most important milestones in securing consistent supply of raw materials for its flower and concentrate branded products and white-label production.

MORE!

The company intends to create a cutting-edge hemp processing facility with increased output capacity and versatility to work with additional cannabinoids. The company, in collaboration with a leading engineering firm, completed an extensive research and development phase to develop a customized design in order to provide for a larger, more efficient and more robust hemp processing facility than originally planned and designed in line with the new regulations and recommendations set out by the Agricultural Improvement Act of 2018 or farm bill in the United States.

I like.

The increased capacity is estimated at a maximum monthly throughput of 68,000 kilograms of hemp biomass, producing approximately 5,000 kg of full-spectrum oils or 4,500 kg of CBD-isolate. The company intends to utilize all isolates in the manufacturing of its own proprietary CBD consumer branded goods, thereby securing the supply of raw materials, increasing its margins and benefiting from a recurring revenue stream from the sale to other manufacturers.

MORE!

The company closed a non-brokered private placement of 10 million units at 45 cents per unit for total proceeds of $4.5-million, which was fully subscribed by one investor.

Man, nobody likes a loss, and when you see a headline that speaks of one, the tendency is to walk on by. But READ THE DOCUMENTATION, because some losses are bad, but show an evolution that’s good, and other losses are good, because they come from a position of genuine growth and long term allocation of capital in a way that will be accretive.

Read the full release. It’s in depth. For mine, 1933 is doing exactly what you’d want them to.

And Nutritonal High is, at the least, getting better at what they do.

— Chris Parry

FULL DISCLOSURE: 1933 is an Equity.Guru marketing client.

Leave a Reply