Bag-holders bitch loudly when a CEO unwinds a position in the company he or she is managing.

Yes, the optics suck.

But it’s really none of our business what insiders do with their shares.

“Bruce Linton [the recently fired CEO of Canopy Growth] has exercised the stock options he’s been sitting on for years, acquiring Canopy shares for as little as $2.95 per (it’s trading at $52.36 at the time of writing),” wrote Equity Guru’s Chris Parry, “amassing $17,965,750 in stock that cost him just $2,199,861.”

“That’s fair – the man has been integral in driving the share price of WEED.T upward,” continued Parry.

“BUT…it’s worth noting those options were valid until 2022 and 2024. Why take them down now, if you think the share price is going to drive upward further still from where it is?

Maybe Linton is buying a waterfront mansion and a small harem of busty pool cleaners – we don’t know. It’s his right to cash in his chips whenever he feels the need.”

Divorce, lawsuits, alimony, real estate acquisitions – there are many legitimate reasons why an insider might need cash fast.

Selling shares isn’t the same as shorting a stock. It’s not a bet that the stock will go down. It’s an action designed to make the bank account go up.

What does the other side of that coin look like?

When an insider BUYS shares on the open market – is that always a bullish sign?

Not necessarily: the insider could be sending a signal to the board of directors that he is committed to his job. Or he could be blinded by his proximity to the company – and not realise the ship is sinking.

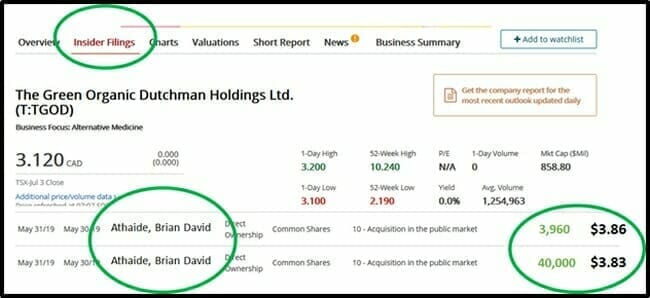

At any rate Brian Athaide, the CEO of The Green Organic Dutchman (TGOD.T) has recently been buying shares of TGOD on the open market.

Globally, TGOD grows premium organic cannabis, focusing on medical markets in Europe, the Caribbean and Latin America.

Domestically (in Canada) TGOD does the same thing, but also sells organic weed to the Canadian recreational market. As a kicker – TGOD recently entered the U.S. CBD beverage market.

Two weeks ago, TGOD announced that it has entered into a multi-year agreement with Neptune Wellness for extraction, formulation and packaging services.

The company has a massive (50,000 sq. ft) processing facility in Sherbooke, Quebec – loaded up with scientists and technologists who specialise in making oils.

Neptune’s wholly owned subsidiary, 9354-7537 Québec, is licensed by Health Canada to process cannabis. You can tour Neptune’s mega-facility here.

Deal Highlights:

- TGOD gets exclusivity on extraction, formulation and packaging of certified organic products within Canada.

- In partnership with Neptune, TGOD will scale up production of wellness products.

- TGOD will allocate 230,000 kilograms of cannabis and hemp biomass to Neptune.

- Neptune will process TGOD’s ingredients into premium certified organic products.

“The Green Organic Dutchman takes organic seriously,” stated BTV, “Their processes are certified by both ECOCERT and Pro-Cert. In addition, they’re the only Licensed Producer where 100% of their cannabis products is organically grown.”

Pro-cert is the 2nd certification body to endorse TGOD’s organic process at its Hamilton facility.

All TGOD cannabis products are certified by ECOCERT, a global organic certification body. ECOCERT verifies that production standards are met through surprise audits, and product analysis.

TGOD’s organic cannabis is grown in living soil without the use of synthetic fertilizers, pesticides or herbicides. The result is a cleaner, premium product for Canadian consumers across both medical and recreational uses.

Many Canadian cannabis companies talk about “global expansion” and the “Europe opportunity”. TGOD has moved well beyond the talking phase.

On May 13, 2019 TGOD announced that its 100% owned subsidiary, HemPoland, has inked a deal with Mediakos to be the exclusive distributor of CannabiGold, a premium hemp CBD brand, for the German pharmacy market.

Last summer TGOD purchased the privately-held Hemp Poland.

Hemp Poland Deal Highlights:

- Acquisition cost of $10.4 million & 1.9 million TGOD shares

- $13.8 million cash for rapid European expansion

- Performance-based incentives up to $15.8 million for delivery of $42.1 million of EBITDA in fiscal 2021

- Distribution channels to over 750 million people

- Sales in 700 locations across 13 countries

- Premier selling CBD oil brand “Cannabigold”, a product leader in the EU

- 32,000 kgs of dried flower production from 1,250 acres of cultivation

- Organic brand with unique IP

“This Poland acquisition will significantly add to the TGOD’s top and bottom line,” stated Brian Athaide, CEO of TGOD. “This accretive acquisition provides a gateway to Europe’s 750 million people, while accelerating our plan to become the world’s largest organic cannabis brand.”

It’s not breaking news that organic cannabis is harder to grow and more profitable to sell than regular weed – but the psychology behind the rapid adoption of organic consumables is not often discussed.

Consideration of Future Consequences (CFC) is a measure of the extent to which people calculate the future consequences of their current behaviour.

Bagel-eating researchers with PHDs have determined that the higher a person’s CFC, the more likely they are to buy organic food.

TGOD’s Q1, 2019 Results

- On-track with construction at Hamilton and Valleyfield sites

- Investment amounting to $46.9 million in the first quarter of 2019, an increase of $7.4 million

- Achieved revenues primarily from HemPoland of $2.4 million, a 28% increase over the prior quarter.

- Strong balance sheet and liquidity, including $224.4 million of cash

- Net loss of $14.1 million as it continues its preparation for commercial production and entry into the recreational market later this year.

- net loss improved by $4 million compared to the previous quarter as a result of increasing sales in Poland and stronger net results from Epican in Jamaica.

“In a recent study conducted by Hill & Knowlton,” states TGOD, “over 50% of recreational consumers stated it was important that their cannabis was organic. When the same question was posed of medical patients, that number increased to 63%.”

“It’s exciting to reach new milestones as we begin commercial production,” stated Athaide, “Growing certified organic cannabis at scale is a highly complex process which has taken time, great care and extensive research to refine.”

Athaide is preaching patience.

By buying shares of TGOD on the open market – he’s also practicing it

-Lukas Kane

Full Disclosure: TGOD is an Equity Guru marketing client.

Leave a Reply