Aurora Cannabis (ACB.T) has been named as the sole winner in the Italian medical cannabis tender process, an announcement tempered by worries over the company’s mounting debt and disappointing revenue.

On July 18, Aurora fell 1.2% after Bank of America (BAC.NYSE) downgraded the stock’s rating to “neutral” from “buy.”

Bank of America analyst, Chris Carey, described Aurora as one of the best operators in the cannabis sector, but expressed concern the company’s cash burn could lead to a cash-negative Q1 in 2020, Bloomberg‘s Kristine Owram reported today.

One of Carey’s largest apprehensions concerned Aurora’s debt via convertible debenture which, if it stays out of the money, will burn through a considerable portion of its cash position.

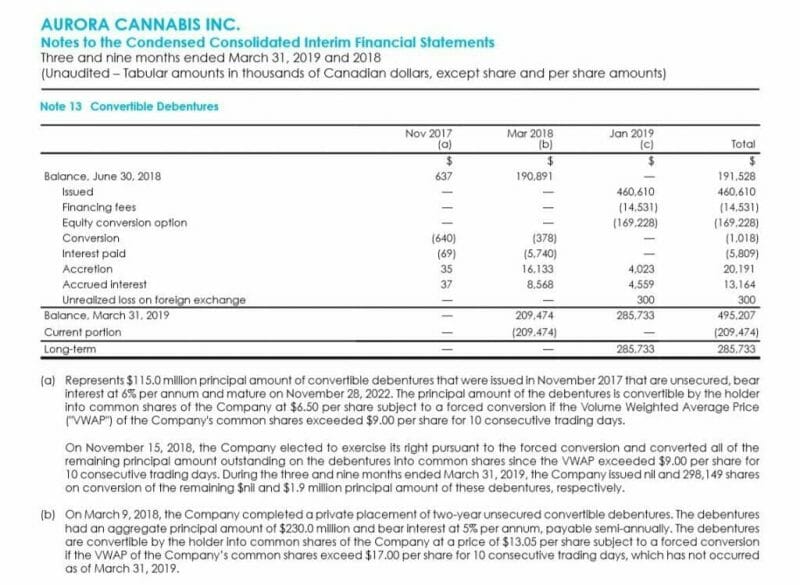

Of the two debentures listed here, $115M issued in November 2017 and $230M issued in March 2018, it’s the latter which is still outstanding.

The debentures are convertible by the holder into common shares of the Company at a price of $13.05 per share subject to a forced conversion if the VWAP of the Company’s common shares exceed $17.00 per share for 10 consecutive trading days, which has not occurred as of March 31, 2019.

The issue being Aurora is is currently trading in the neighbourhood of $9 per share, and debt has been mounting.

Skeptics and short sellers have long posed a question regarding the company’s fundamentals which management have done little to answer: what is the long-term strategy and at what stage is Aurora currently at within its trajectory?

Press releases detailing new acquisitions and new supply deals abound, but these do not directly address the immediate material concerns of shareholders concerned about the company’s losses.

Aurora’s losses from operations totaled $77.6M in Q1 2019 and $270M for the nine months ending in Q1 2019. Gross revenues, conversely, were $75M and $167M during the same periods.

The company’s cash position at the end of Q1 2019 was $346M, a number which one must assume to be larger than the figure Aurora would produce today if pressed.

Normally, the company’s losses would not be overly concerning. I say overly because the market is still nascent, and it is possible with the advent of concentrates, edibles and expansion into Europe that the company could become profitable before exhausting its treasury.

If losses and growth stay constant, the challenge isn’t insurmountable. But, and this really is the crucial detail, the company’s convertible debenture is due in March 2021 if the stock does not exceed $17 for more than 10 days. This means the debt must be repaid in full in addition to the interest payments made in the interim.

Aurora cannot afford this. If the directive was to become profitable in two years, that itself would seem difficult. But now the company must not only become profitable before depleting its reserves, it must also double its share price or repay the $230M debenture in cash.

What is the path forward?

In respect to financing themselves, Aurora also faces significant challenges. Here are strategies which have worked for other, and admittedly smaller, cannabis companies:

- Issuing shares for debt

- Selling off assets

- Finding corporate backer

- Write-downs

Printing paper is nearly a national pastime for Canadian cannabis companies, so why wouldn’t it work for Aurora? After all, it has in the past.

Unfortunately for shareholders, this is precisely the problem. Aurora’s share count currently exceeds one billion, three times Canopy Growth’s, and it’s this writer’s opinion the company has simply gone to the well too many times with this strategy.

The company could always sell of assets, but the company needs cash. Nobody in the sector has the cash Aurora needs and an all-share transaction does nothing to address their problem.

Besides, the only company with the war chest to free Aurora from the grips of destitution is Canopy, a company which recently ejected their CEO for buying overvalued assets.

Then what about finding a Constellation Brands (STZ.NYSE) to finance operations? This is anecdotal, but, although I regularly chide Aurora’s management for less-than-practical decision making, the company is not manned by idiots.

Cam Battley and company have an intimate understanding of the challenges they face, after all, it’s what they’re paid to do. I am almost certain that if an equivalent to Constellation Brands could have been found, Aurora would have found them.

I don’t even want to discuss writing down assets, a desperate course of action only taken when no other option presents itself.

If you are going long on Aurora, this is a good time to ask yourself what you know that Bank of America doesn’t.

–Ethan Reyes

Leave a Reply