Top tip: You guys out there whining about ‘the market’ being down are finding excuses for the wrong problem.

Folks be running about with their hair on fire right now, pointing to a sky that for sure is falling because a few of their favourite weed stocks have come off absurd highs and what if it never comes back?!

You guys, give it a rest already.

Sure, the big licensed cannabis producers are down, and hard. And, yes, the US Multi State Operators are down, and hard. And, sure, if your grandma had left you $5m and you’d spread it across every weed stock in February, you’d have about $1.8m left today and granny would be clawing her way out of the coffin to cuff you upside the head.

But to suggest ‘the market is down’ as an excuse for why your favourite jam is headed downward is to generalize in a lazy way.

The market is fine. The market is doing what it should have done two years ago. And three years ago. And five years ago.

The market wants to see your work and, if you cannot produce it, young man, you will get detention.

[contextly_sidebar id=”xMzAJxpYiXwcNNLGQH8fLDpd9ZZGCXM5″]A few years back, you could get away with being overvalued as a cannabis company because everyone else was too, so you could reasonably claim your firm was actually undervalued simply by showing Canopy’s valuation was more absurd than your own.

NOT ANYMORE.

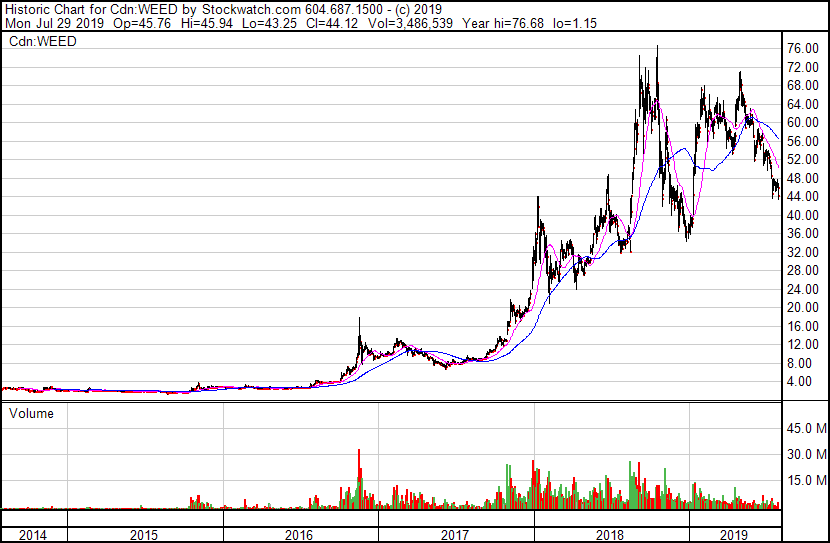

Then, you could make an investment in Canopy Growth (WEED.T) at a market cap of $30 billion while the thing was racking up quarterly nine-figure losses and it was okay because everyone was pretending that didn’t matter (because Amazon, right?). And the stock just kept rising.

Fast forward to the last six months and Canopy has come down hard, by about half actually, but when you look at the carnage on the balance sheet you can’t argue that fall wasn’t justified. Necessary, even. In fact, a further fall will be a healthy thing.

This isn’t just about Canopy. Aurora Cannabis’ (ACB.T) upcoming vig payment is going to be ornery for them, so that company shedding almost half its value in the same time makes at least a little sense.

[contextly_sidebar id=”dC7Ap1IB9gpkmdz1ubKFxh3sxTCPjYng”]And Tilray (TLRY.Q) at $3.3 billion in value is still at a dumb valuation even after the plunge from almost $20 billion last September, and Organigram (OGI.V) is having issues with numbers and HEXO (HEXO.T) is having its head crushed by whispers that it might be hiding problems. Cronos (CRON.Q) is still too expensive for what it actually has and MedMen (MMEN.C) is losing execs by the bulletproof stretch Esplanade-load as it continues to pitchfork any dollars the CEO hasn’t claimed directly into the furnace.

And CannTrust’s (TRST.T) illegal drug supply operation, that was running out of their legal drug supply operation, has peeled back the wealth of anyone invested in that thing, as tends to happen when a billion dollar corporation is run like an Abbotsford youth gang.

Yes, there’s carnage out there. But with the exception of CannTrust, which appeared to be staffed with people taking their college dorm Scarface posters a little too seriously, ALL OF THIS WAS RIGHT THERE IN PAIN SIGHT.

The whole damned mess has always been plain as the nose on your face, you just haven’t acknowledged it.

Canopy has been shoving cash into the shredder since the days when it was called Tweed, and former CEO Bruce Linton had been overspending on things to maintain his elevated market cap for years before his recent dismissal.

But, rather than learn the lessons that the age of hyperbolic market cap growth on acquisition news are over, the retail weed crowd is killing itself playing Sherlock Holmes in an effort to figure out where Linton will land next.

Linton wore a t-shirt on an interview with the name of Martello Technologies (MTLO.V) and the stock jumped from $0.20 to $1.00 in three days. It then slumped back down, obviously, but is still sitting on $0.40 because guys out there be all, “He’s all in on Martello now! HODL!”

This ‘follow the crowd’ mindset is the leaded fuel of the cannabis market, the stuff that helps it run but slowly kills you at the same time.

“I’m going to invest in this thing I don’t actually like, because others will do likewise and they’ll still be there when I’m smart and get out early oh my god what happened to all my money?”

Trying to front run the crowd only works when everyone in the crowd isn’t trying to front run everyone else. When that snake realizes it’s eating its own tail, everyone bails.

We’re at the ‘everyone has bailed’ moment, and the reason why is because the ‘not so secret’ secret behind the cannabis industry is this:

Weed companies are very often run very badly.

[contextly_sidebar id=”DU8q9yqPqZGqqgLV06IURpjnrJ3UMR4B”]Let’s be very honest: The big LPs have always known, eventually, cannabis would be legal and the product would commoditize and their massive grows wouldn’t be so feasible anymore, but the market didn’t give a shit about that long term outlook and rewarded EXACTLY the companies that built not for the long haul, but for short term market spikes.

Like Canopy. Aurora. Aphria.

Aurora has been borrowing money for years to compete with Bruce on the acquisition side, and Aphria (APHA.T) played the same game, only they bought things for a high price off their own CEO and have sunk low enough that they’re almost back at their ‘mid scandal’ price. Hexo management has always seemed hinky, MedMed wrote their largesse right into their listing documents, and Cronos is fine – just fine – but not fine enough that it should warrant a $6 billion valuation.

The problem is, these guys are the creme de la creme. The big boys. The guys who get invited to bank boardrooms. And they’ve taken that credibility and fucked the dog.

These companies are going to need a thorough sweep out. Writedowns are a-coming. Goodwill will burn bright enough to melt the ice caps. And you’ll all be shocked – horrified! – that it all happened because, who could have known weed stocks would fall?

Jeez man, we do this every year. Have you not caught up yet?

THIS HAS HAPPENED EVERY YEAR SINCE 2014:

Historically, every year since there has been a legal public cannabis industry in Canada, the big guys go on a run late in the year.

From February to August things stay level, mostly, because mom and pop hear on CBC that weed stocks are a thing and duly they buy the biggest three companies on the exchange and put them in their RRSP fund alongside Bombardier and Scotiabank, because the bigger companies must be the safest bets, obvs.

So up those three go, which drags up the next ten in order of size, which drags up the ‘me too’ crowd, which gives the deal dogs a strong case for listing another 40 companies and blowing out paper on listings from previous seasons that have since lost their lustre.

WHICH MEANS SOME DEALS HAVE TO DIE

If there is a constant parade of new companies looking for financing dollars and investor interest, and the kitty that finances them is not infinite, then it stands to reason some companies must perish when financings and loans and hype deals begin to get choked out.

Currently on the ‘seemingly given up’ list are one-time players like Invictus (GENE.V), which is down and has been for a long time and, frankly, nobody there seems to give a shit as long as celebrity non-endorser Gene Simmons keeps showing up once a year to sign lunchboxes. Anyone home? Any plan to make people want to buy your stock? Because silence ain’t it, chief.

InMed (IN.C) was once a pharma play in the making that insisted it was going to pound out novel applications for weed, but the stock price for the last year looks like someone tilted the prairies 100ft up on one side and they sure as hell haven’t given the market a reason to believe in them since 2017.

Wayland Group (WAYL.C) is halted in Canada because they’re doing their financials on an old Speak ‘n’ Spell apparently, and has traded so poorly in the US (where they’re not halted) that it’s down around 1/2 from what it was when the trade halt kicked in, which was down at 2/3 from where it was a year ago.

ICC International (WRLD.U), which gave WAYL a boatload of paper to buy half of ithat company’s questionable foreign assets, is now down so far (90% since November), that the deal in question is almost a freebie for them. Namaste Technologies (N.V) sacked its CEO for self-dealing, then got scared he’d sue them for saying so, and has been trying to figure out his maze of weird deals ever since, with their stock down 87% from its high last year.

On the list of plays that never had much reason to be but, hey, if you’re giving away free money’, FSD Pharma (HUGE.C) is down, but it’s always been down, but for the first few days of its existence, while internet trolls keep yelling at me for warning that would happen. Hey guys, hows that whole ‘grabbed some cheap stuff at the bottom’ routine working out for you?

Stablemate Cannara Biotech (LOVE.C) is even worse, a $100 million valuation that appears $95 million higher than it should be for what should, realistically, have just been a unit running inside HUGE.

Now the same stable has World Class Extractions (PUMP.C) out there in the world, having seemingly learned their lesson by bringing on a real team to run a real business, that being Quadron Cannatech (QCC.V), makers of the Boss cannabis extraction unit.

Vivo (VIVO.V) last talked to investors sometime around the end of the Great Depression, C21 Investments (CXXI.C) talked a good tale which saw their stock run hard on impressive revs, then stopped telling their tale as it fell back to earth, leaving the impression of dumpage and pumpage among those with a predilection for such assumptions, Livewell/Eureka 93 (ERKA.V) lost nearly all it’s value when it halted for eight months as part of a three way transaction, then rolled back 15:1 on reentry, creating a perfect storm of stock implosion, and Lifestyle Delivery Systems (LDS.C) is at its cheapest point since 2016 as it continues to miss projections, backed out of a potential acquisition when investors got antsy at the valuation, and fights off pissed off investors with bats.

If all of this sounds like the sky is falling, it isn’t. ‘The Market’ isn’t shaking out. It’s not folks disappearing for the summer. It’s nothing more than this:

JUST DON’T BE SHIT, CANNABIS COMPANIES.

Everyone mentioned above has managed to fuck things up. Some harder than others, some from more cynical origins than others, but they’ve all screwed up the opportunity thus far. Clients of ours and strangers, good companies making mistakes and bad companies taking liberties.

A sustained bull run convinces investors they’re geniuses, and company executives that they’re captains of industry, when in actual fact the deficiencies on both sides are being hidden.

BUT ALL IS NOT LOST.

If you’re an investor and you’re concerned this downturn will last forever, you need to get off the ledge right now.

Because, cycles.

Historically, September to December is always a run, if you look back at every year since 2014. January usually freezes a little, then there’s a February pop AND THEN NOTHING RISES UNTIL THE NEXT SEPTEMBER.

This is like, the law. It’s science. Of the six years since we moved from BC (Before Cannabis) to AD (After Dope), the trends have moved from small sample size to statistically relevant.

Check out the stock price on Canopy over the years. Even back in 2014, where the increase were measured in cents and not dollars, you can see where things got cray, and where things slipped, and where they got cray again.

2019 the numbers got bigger and the highs stuck around longer, and the lows were more pronounced, but it happened like it always does.

And every year the downturn comes from questions regarding legitimacy of the big players, after a three month spike.

- 2014: License system announced, companies rise on likelihood they’ll get one… Almost nobody gets one, down they go

- 2015: Licenses kick in, stocks go up on expectation again. Mettrum and Organigram get caught with pesticides, down it all goes

- 2016: Companies announce they’re multiplying their grow facility size by multiples, 300k sq ft to 1m sq ft to 4m sq ft – stocks go up. Companies borrow a bunch to pay for those grows which take longer than expected to kick in, stocks go down

- 2017: Aurora and Canopy go on a buying spree, stocks go up on speculation others will be next. Market figures they’re overpaying for things that don’t make money, stocks come back down.

- 2018: International assets OMG, up we go! The assets are fake OMG, down we go!

Today, we have a new problem and it’s a killer because this one is not about perception, it’s about hard numbers.

LPs be running out of money.

Late last year, traditional financing began to dry up a little. This year, a lot of financiers are underwater on their investments and a lot of institutional money went to the big boys in the space who, it turns out, were skeezy and/or bad financial guardians and won’t be getting anymore cheap money.

Traditionally, weedcos go to big brokerages and banks to get the money they need from one or two guys. But those guys are gun shy now, so the company will then turn to retail investors to make up the difference. Sadly, you guys don’t have the capital you once did, so then they go to the debenture crowd, borrowing money against their own stock. When those debentures come due, some hard decisions have to be made.

But that’s not the bottom of the money pit. If the debenture crowd know there’s blood in the water, they’ll offer a loan with a twist – commonly known as death spiral financing, or a bottomless convert, where the debenture converts no matter where the stock price is on the down side, which gives the lender every incentive to short the stock they know is hanging tough and facing tough times. The lender then makes money as the company goes into its death throes, and then convert their loan cheaply, thereby getting a stack more stock than they otherwise would have (which they use to cover the short and make mad profit).

If the borrower is lucky, they can pull out of their descent with some shrewd deals and maybe alternate borrowing sources. But, mostly, they get completely screwed.

Which means the shareholders get completely screwed.

[contextly_sidebar id=”UxYEKMdEBK7pHGqdb2pcNJsTsWymwHbb”]Companies like MMCap and Alpha Blue Ocean do those deals which the receiving companies announce with glee as a ‘big financing’, hoping retail investors will see the deal as being defacto due diligence and a sign that big things are coming. But they’re not, they’re just keeping the lights on borrowing money to cover old debts by taking out new debts.

Ask Wayland and ICC about that.

Right now, the stocks that are being punished are – for the most part – companies that have warranted a good ass kicking for a while. That might be no reassurance to you, if you’re looking at daily red numbers in your portfolio, but the lesson here is to actually do due diligence, because the Greater Fool may be you.

If you’re chasing based on sentiment while the rest of the crowd has learned what a balance sheet is, you’re at a disadvantage. If you’re believing what a CEO told you and not reading filing documents and MD&A documents and balance sheets, you’re the mark at the table.

The market is fine. In fact, if you’d listened for the last six months and gone cash heavy, as I did and as I’ve been preaching since last December, what you’re experiencing now wouldn’t be regret at all.

No, what you’d be experiencing now would be an urge to go shopping.

I’m going to show you something considered ultra rare in the weed world. I want you to sit down for this. Maybe take a deep breath because you won’t know how to respond and it may trigger you in ways unknown.

Here it is… a weed stock that isn’t down.

So that’s the chart for Rubicon Organics (ROMJ.C) and it shows that most rare of creatures; a cannabis share price that, for the past year, hasn’t been nutty.

If you just got dizzy, if you’re seeing stars right now, it’s not a diabetic shock and you’re not having a stroke. That’s actually a North American weed company that is not down 75%.

AMAZING, RIGHT?

Here’s another which, though it had a drop late last year, has been smooth sailing since. Not up, but also not down. CRAZY!

Fincanna (CALI.C):

Admittedly, nobody has 3x’ed their money on Fincanna yet, but they also aren’t on Facebook investor groups sharing stories about the $120k they’re down since they started buying weed stocks.

Here’s another chart, this one for a company that some online frolks have been calling worthless, a pump and dump, a scam, while others are seeing huge potential and actual realized returns on their investment while the rest of the market is eating street ass.

Take a bow, Heritage Cannabis (CANN.C).

We’ve been talking up CANN since late last year when, if you timed it right, you could have purchased stock in the company for $0.15.

ENJOY YOUR THREE BAGGER WHILE THE ‘MARKET IS DOWN’, CANN FANS!

Cara Therapeutics (CARA.Q) is also defying sector gravity, running hard on their pharmaceutical push:

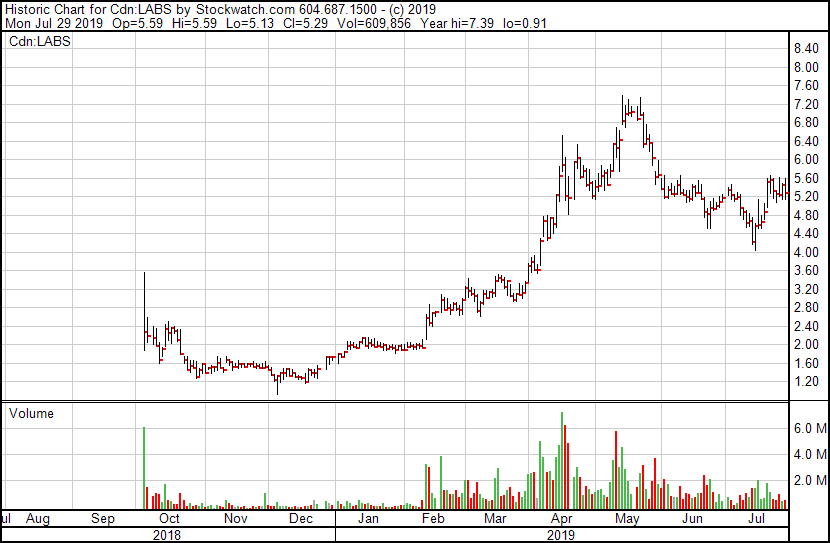

And Medipharm Labs (LABS.T) is holding the high ground.

Neptune Wellness (NEPT.T), which grows in Quebec and has a hemp deal out of North Carolina, isn’t standing for your ‘woe is me’ routine:

Vegas dispensary resort operator Planet 13 Holdings (PLTH.C) is showing how to make money over the counter, US MSO slump be damned.

Tinley Beverage (TNY.C) has been a dark horse for a while, choosing to develop its products without overhype rather than to play the market promises and craziness routine.

The chart is fine, lots of ups and downs, but this is the image that’ll sell you:

View this post on Instagram

Two epic #THC drinkables. #StoneDaisy #HighHorse #Cannabis #Tonic #420 #Health #NoAlcohol

In dispensaries now. As promised.

Bottled at their own plant. As promised.

More coming.

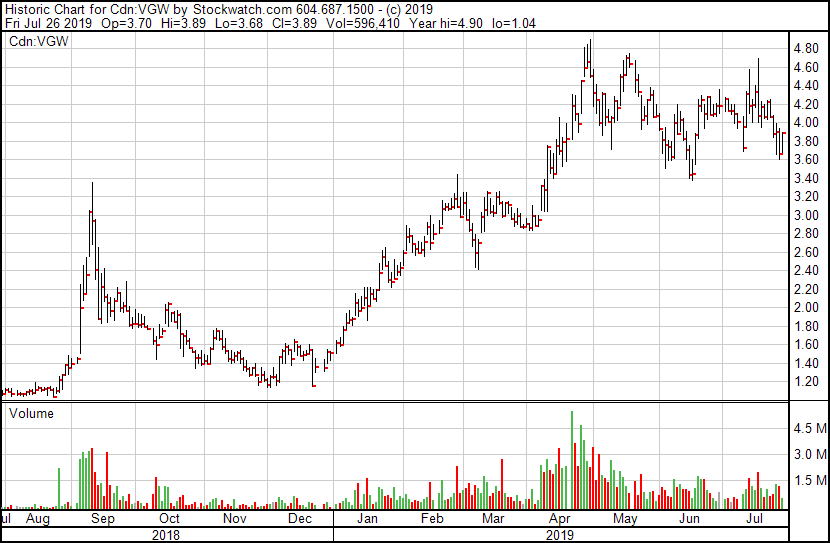

Meanwhile, Valens Groworks (VGW.V) just keeps hitting deep triples… wut?

Tell me again how ‘the market’ is getting crushed.

Right now, the companies I mentioned above can bask in the sunlight emanating from their backsides but they may not be where you want to park your cash, despite their good runs. The last great pound out of weed stocks, from early 2018, saw some lower-valued companies excel while the big guys were getting slaughtered. At that time, Invictus, DOJA, and Abcann were called by us as three companies that hadn’t had the same outrageous climbs as most and might beat the sector drop because of that.

They did exactly that, doubling handily in the weeks after.

But they did eventually join the fall-off.

Instead, keep your cash dry, watch everything fall, keep an eye on revenues and (dare I say it) profits (look up the term some time, it’s a nice piece of history) and be cashed up when some of these over sold beasts with good fundamentals are ready to flip around.

[contextly_sidebar id=”wtHFwx0L4GRApZcI5b1dpMhmnkVT2pnm”]

— Chris Parry

FULL DISCLOSURE: Supreme, 1933, Tinley, Heritage Cannabis are Equity.Guru marketing clients. Others, including iAnthus, Rubicon, Vivo, and more, are former clients who may be again and who the author may hold stock in.

Leave a Reply