Gaia Grow Corp. (GAIA.V) (formerly Spirit Bear Capital) announced that effective August 1, its shares will be trading on the TSX Venture Exchange. Gaia Grow has 200.2 million shares outstanding. A July, 2019 capital raise was completed at $0.10, bringing its market cap to $20.2 million (about 124.7 million, or approximately 62%, of outstanding shares are locked up in various escrow agreements). This company comes by way of a reverse takeover (RTO). Investors should review all applicable SEDAR filings and company press releases before investing in a RTO.

I and my company, Epstein Research [ER], have no former or existing relationship with any person or company mentioned below. However, at the time this interview was posted, [ER] was negotiating to secure Gaia Grow as an advertising client. While Gaia is not an advertiser on ER as of August 1, 2019, please consider [ER] biased in favour of the company. As of August 1, Peter Epstein owned no shares, options or warrants in Gaia or its predecessor company, but he may acquire shares in the open market.

Quick, name the top 3 hemp/CBD players…

By now most investors know that there are cannabis/dispensary stocks, and hemp/CBD stocks. Cannabis stocks include Licensed Producers (LPs) like Canopy Growth and Aurora Cannabis, and Multiple State Operators (MSOs) that sell cannabis through dispensaries in the U.S. such as Curaleaf and Green Thumb Industries. A MSO is the U.S. version of a Canadian LP.

Then we have the hemp/CBD players… wait, where are my hemp and CBD names? Ahh, here we go: Charlotte’s Web, ranked 9th the top 50, and next is… silence. Unless one accepts processing companies like Medipharm, who primarily extract CBD from hemp, there’s only one large publicly-traded hemp cultivation company on the planet.

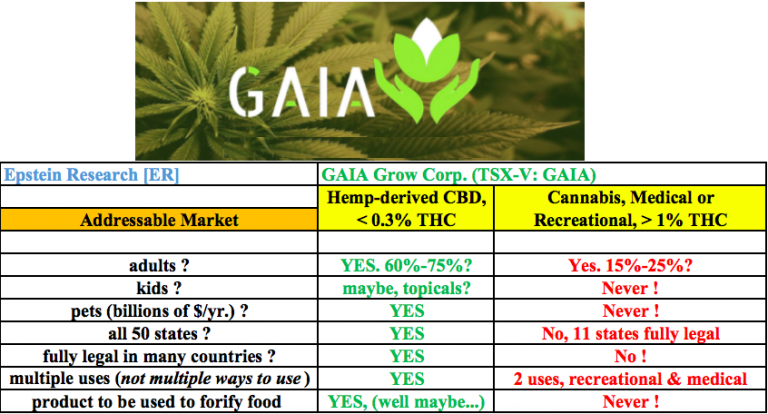

Addressable market, stupid

Cannabis companies outnumber hemp-focused names by 10 or 12 to 1, implying that demand and acceptance of cannabis by users and various legal and political entities must be very high. Yet this simply is not the case. Cannabis is still a tough sell in most of the world.

Think about the global market for CBD (containing less than 0.3% THC). What percentage of adults might use CBD in its many forms for preventative health measures, specific aliments, or health and wellness? I estimate 60% to 75% could be consuming CBD regularly or at least occasionally. By contrast, cannabis (with more than 1% THC) is used in only 2 ways: recreationally and medically.

What percentage of adults might use cannabis? I estimate just 15% to 30%. CBD is legally available in far more countries and jurisdictions than cannabis. Therefore, in my opinion, CBD demand next decade could be more than 5 times that of medical and recreational cannabis combined.

With that in mind, I interviewed Frederick Pels, CEO, Chairman and co-founder of Gaia Grow Corp. Fredrick is very active in the cannabis/hemp space in Canada. He and his partners were early champions of medical cannabis, successfully advocating for its wider use and acceptance.

His prior company, the Green Room, was a leader in medical cannabis supply, industry best practices and education. The Green Room helped form, and get passed, many of the rules and regulations that make medical cannabis safe, affordable and accessible today. Fredrick and his team made valuable connections with people and companies in agriculture, finance, legal/compliance, cannabis, hemp, extraction and related sectors. The following interview was conducted by phone and email from July 26 to July 31.

Frederick, thank you for your time. Please give readers the latest snapshot of Gaia Grow Corp.

Sure. We have a strong management team and board, supportive shareholders, deep roots in the community and tremendous contacts in agriculture, finance and banking. We have vast experience in the Canadian cannabis and hemp space dating back more than 5 years. We understand how to navigate the increasing number of rules and regulations that cannabis and hemp growers face, because in many cases we helped develop them.

Most important, although there are other hemp/cannabis assets and opportunities held by Gaia Grow, our only active operation is a 1,494-acre crop of hemp plants that are about a month old and a half-foot (15 cm) tall. Harvest is expected at the end of September or early October.

Can you tell us about James Tworek?

Yes, of course. James is a director and co-founder. He has a strong background, over 20 years’ experience, in banking and finance. He was a partner at a mortgage brokerage and then in a commercial development fund. In 2016, James worked on corporate finance contracts in the Canadian medical cannabis sector, giving him hands-on experience in early-stage development financing and capital-raising.

Those roles make him well-versed in corporate finance, mezzanine funding, equity-based lending and business start-ups. James’ experience in raising capital has brought him success in structured finance, including multiple global deals, and he has built strong business relationships with family offices, private equity and venture capital firms.

Your recent background and experience is largely in medical cannabis, yet Gaia Grow is actively pursuing hemp. Is hemp a better investment opportunity than cannabis?

First and foremost I’m an entrepreneur, a business owner, so my aim is to satisfy an under-served or unmet need. To me, hemp seems better positioned than cannabis, but Gaia Grow is looking at various cannabis situations as well. We think the opportunities for a small company to grow very rapidly are much greater in the hemp space than in cannabis.

What can you tell us about Gaia Grow’s hemp crop in southern Alberta?

Everyone is excited, seeds arrived in the second week of June and it was a very rainy spring – great conditions for seed germination. The process of fertilizing, seeding and rolling the expansive 1,494.4 acres was spread out over two weeks. Thanks to intermittent rains, we are pleased to report that the crop has started off well.

“Gaia’s 2019 crop is planted and off to a great start. We will continue to monitor progress and work with our farmers, contract harvesting, and agronomy teams to optimize timing of harvest, currently estimated to be at the end of September (or) early October. In the meantime, Gaia’s management team is working diligently to firm up contracts with off-take partners to ensure a successful sale and extraction process of the harvest.”

—Gaia President James Tworek

What are your plans for your maiden hemp crop? Is there demand for 1,500 acres of hemp?

Yes, there’s tremendous demand. We can either sell the entire crop as biomass on a per-acre basis, which would be the easy way to go, or get our biomass processed into higher-value CBD extracts. We don’t have any extraction equipment, so a third party would have to do it. If the crop develops as expected, we think we could sell it for $3,000 to $5,000 per acre.

However, if we choose a CBD extraction path, which is more complex and logistically difficult, then we could potentially generate a multiple of the revenue derived from selling the entire crop. Timing is a large part of the issue this year. Next year we fully expect to have an extraction path nailed down for one or more crops in Canada and possibly the U.S.

Is there a lot of crop risk between now and harvest?

Yes, there is certainly some degree of risk, there always is in agriculture. However, we have a well respected consulting group managing the grow. And, most of the severe weather is behind us. Frost in late September or early October is a concern, but by then the plants should be fairly robust. We looked into crop insurance, but the first few quotes we received were unattractive. Recently we starting negotiating with a party that we think we could possibly come to terms with.

Is Gaia looking to acquire any properties or assets?

Yes, absolutely. Interesting opportunities are presented to us almost daily. We see great potential to acquire assets at very attractive valuations in the industrial heartland, where communities are suffering from high unemployment and a low tax base. Having a company like Gaia Grow come into a small town would go a long way towards revitalizing the area with new jobs and investment.

Gaia Grow recently raised over $4 million in equity capital. What will the funds be used for?

Some of that money was spoken for. We planted hemp seeds on just shy of 1,500 acres over the course of about two weeks and have consulting groups managing the crop. We have operating expenses to pay. But make no mistake, we want to grow this company. Capital remaining from the $4 million raise will be added to cash flow generated from our crop.

Once we’re done with our maiden crop, April 2020 is right around the corner, time to acquire genetics and get started all over again. Hopefully on a much larger scale.

Are you in talks with potential strategic or financial partners?

Strategic? Yes, definitely. But we don’t need any financial partners at this time. A lot of eyes are on us, watching this crop, how well it goes for us. As a publicly-traded company, we will see all the deal flow we could possibly want. The ability to quickly raise capital is extremely important in the initial years of a market boom (in hemp). We are fully funded for the foreseeable future.

Why should investors consider buying shares of Gaia Grow Corp.?

We strongly believe that now is the time to be investing in the cultivation of hemp at large commercial scale. We are looking at opportunities all over North America, but first we need to deliver our first harvest in about two months. Readers should know that companies can’t just buy land and start farming the next day. It takes many months to over a year to get all the permits and approvals, complete surveys and studies, etc. If you miss a growing season, you have no choice but to wait, wait for up to a year, for the next window of opportunity.

We are not waiting! We have a crop in the ground, a fairly large crop of 1,494 acres. If all goes reasonably as planned, it will comfortably fund Gaia through to bigger and better crops next year. After that, the sky’s the limit. We could possibly become vertically integrated with CBD extraction equipment. We could potentially be growing hemp in multiple provinces of Canada and states in the U.S.

–Peter Epstein

Leave a Reply