A few weeks ago, a Chinese Bitcoin trader, Hui Yi, embezzled 2,000 Bitcoins, used them as collateral to take a highly leveraged (100x) short position on the price of Bitcoin.

The co-founder and CEO of a crypto market analysis platform, Hui got the timing and direction of his bet horrendously wrong.

WeChat messages indicate that on May 31, 2019 Hui had been expecting Bitcoin to fall from $8,900 to $7,000.

The above screen grab reveals Hui’s initial enthusiasm:

Hui: It’s going to be a waterfall.

Hui: Within an hour.

Hui: See $7,000 today

Tang@: Thank you! You are like a God!

OP@: It’s the first time I’ve seen Hui Yi make such a firm judgement!

Hui believed that Bitcoin was over-bought, and had met firm resistance at $8,900. But the Bitcoin price blew through the resistance line, and kept going up.

The losses were quick and savage.

Hui bailed (on the planet).

“Hui’s sudden death has roiled the crypto community in China and left its clients at loss,” stated CCN, “People are wondering why this professional and seasoned trader acted so crazy and irrational with 100x leverage.”

Hui fell victim to “Magical Thinking” which is the “the belief that one’s own thoughts, wishes, or desires can influence the external world.”

Common in very young children, psychologists claim that “Magical Thinking tends to fade as children master concepts of logic and cause and effect.”

Ten years ago, I had a misadventure in the options market, which also led to dramatic losses and suicidal thoughts. Unlike Hui, I didn’t embezzle the equity I bet with. But like Hui, I was guilty of “magical thinking”.

Here’s the background. I had just started to work in the capital markets. I’d taken the stock-brokers’ course, a “Mining-For-Investors” course, and been the Communications Director for a consortium of metal companies. I knew jack-shit.

At the same time, I sold a home in the east of Vancouver and ended up with about $650,000 in my bank account.

My teen-age sons had gone feral (I knew the first name of the intake officer at the downtown jail).

After an exhausting period of being a single father, the budding criminals who claimed to have my DNA finally went to live with their mother.

I quit my job, drove out into the country and lived in a cabin by a river. I spent the summer trout fishing and playing blues piano.

Then I started to plan my next move.

Before we get into that, there is one more nugget of personal history, pertinent to this story:

Years earlier, when I was a welder at Allied Ship Builders, one rainy Friday morning, I played hooky and took a bus to the Hastings Street race-track.

I’d never been to the racetrack before. I bet $100 on a horse with a name I liked (“Wind Spirit”). It was a photo finish. I had to pace for a few minutes while they reviewed the photo. Finally, my horse was announced as the winner. I went to the betting window with my ticket, and the woman handed me $145 (I guess I’d picked a favorite.)

What I did next was, I think, a little unusual.

I took the $145, walked out of the horse track, and never went back. In all probability, I’m the only guy you’ll ever meet who can truthfully say, “I made money betting on horses”.

In the dying evening, as I cast my pheasant-tail fly into a local lake, I thought about my “Wind Spirit” win, and I decided I would duplicate that success in the stock markets. I’d just make one perfect bet, collect my earnings and walk away.

Except I wouldn’t pick the stock at random. I’d use my newly-found market savvy to do something bold and original.

Here was my idea (I’m not dumbing it down for comedic effect). On-line retailer Amazon (AMZN.Q) was about to launch an eBook reader called “The Kindle”. Investor bull-boards were exploding with excited messages about how The Kindle was going to bulk up Amazon’s bottom line.

I had previously lived in Michigan, California and New York. Based on the endemic ignorance of Americans I met on the street, it was clear to me they did not read books. So what good is a Kindle to these folks? I was 100% sure that Kindle sales would be weak, and the AMZN stock would pull back sharply.

I didn’t drill down into the eBook industry, or look at Amazon’s over-all revenue growth, I just had this one idea. I felt in my bones it was right. And God would reward me financially for this simple insight.

Magical thinking.

I could’ve shorted the stock, but like Hui Yi I wanted to do something more aggressive, more profitable, more life-changing.

So I bought put options on Amazon stock.

A put option is an option contract giving the owner the right, but not the obligation, to sell a specified amount of an underlying security at a specified price within a specified time frame. This is the opposite of a call option, which gives the holder the right to buy an underlying security at a specified price, before the option expires.

It’s like shorting a stock, but there is a time-decay factor. The underlying stock needs to go down, and it needs to do it within the time frame you specify.

That didn’t happen.

Shortly after the launch of the Kindle, Amazon reported that “For the third week in a row, customers are purchasing well over 1 million Kindle devices per week.”

Three years later, profit from Amazon’s Kindle ecosystem was $565 million/year.

The good news?

I didn’t bet my whole $650,000 stake.

I bet $280,000 that AMZN was going to tank, and I lost about half of it in six weeks.

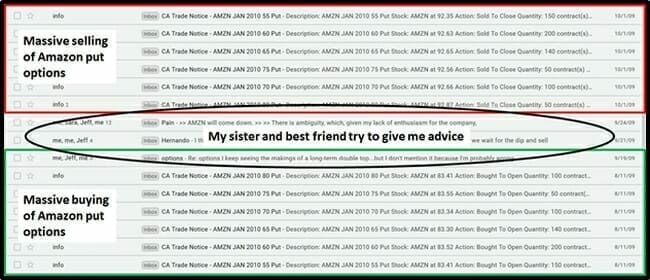

I no longer have that options trading account, but searching “put options” on my Gmail provides electronic evidence of my misadventure.

The night after I sold my final AMZN position, and tallied my losses, I pulled a shotgun out of the attic, loaded the chamber, put the muzzle in my mouth and curled a big-toe around the trigger.

Looking back, I believe this was a theatrical expression of self-disgust, rather than a serious preparation to die.

Spoiler alert: I did not blow my head off.

But the depth of my despair was so deep that even now, it’s difficult to unpack it.

I was pissed off at being poorer (that was the easiest part). I was humiliated at the wrong-headedness of my thinking. I felt guilty about how little research I had done.

But the hardest part was saying goodbye forever to magical thinking.

I don’t get to press a few buttons, beat the system, and walk away a rich man.

As an example, this is how one trade worked out.

Since then, I’ve made that money back and then some. I own stocks in cannabis companies, gold companies, a copper company and a weapon’s detection company. I also have a rental property that is slowly shedding its debt.

More good news: neither of my sons is incarcerated.

Dead thieves don’t get a lot of sympathy.

The Bitcoin community is furious at Hui Yi for gambling with 2,000 Bitcoins that he didn’t own.

I understand his desire to beat the system, to walk out of the fire unscathed, a financial super-hero.

The irony is, winning that Amazon bet wouldn’t have made me happy.

The meaning is in the struggle.

I like working.

– Lukas Kane

Leave a Reply